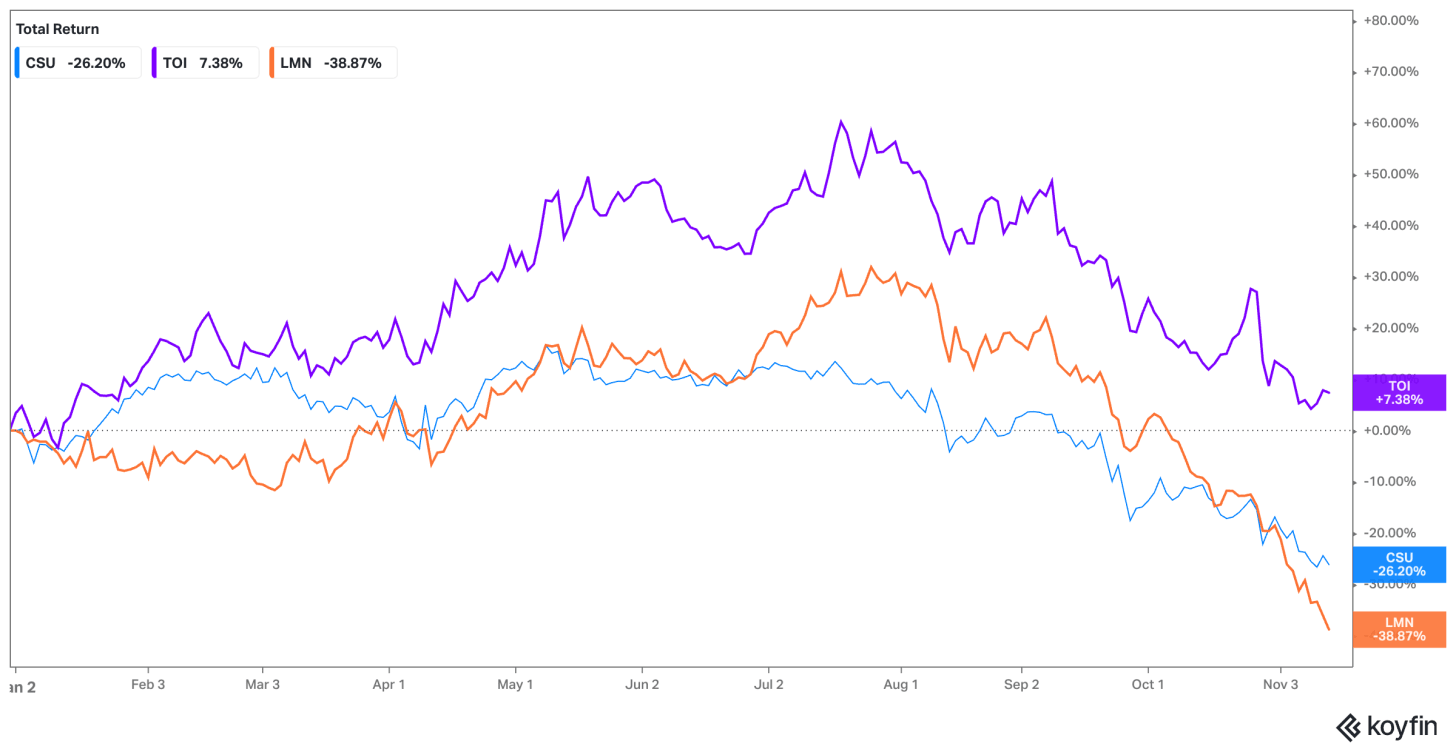

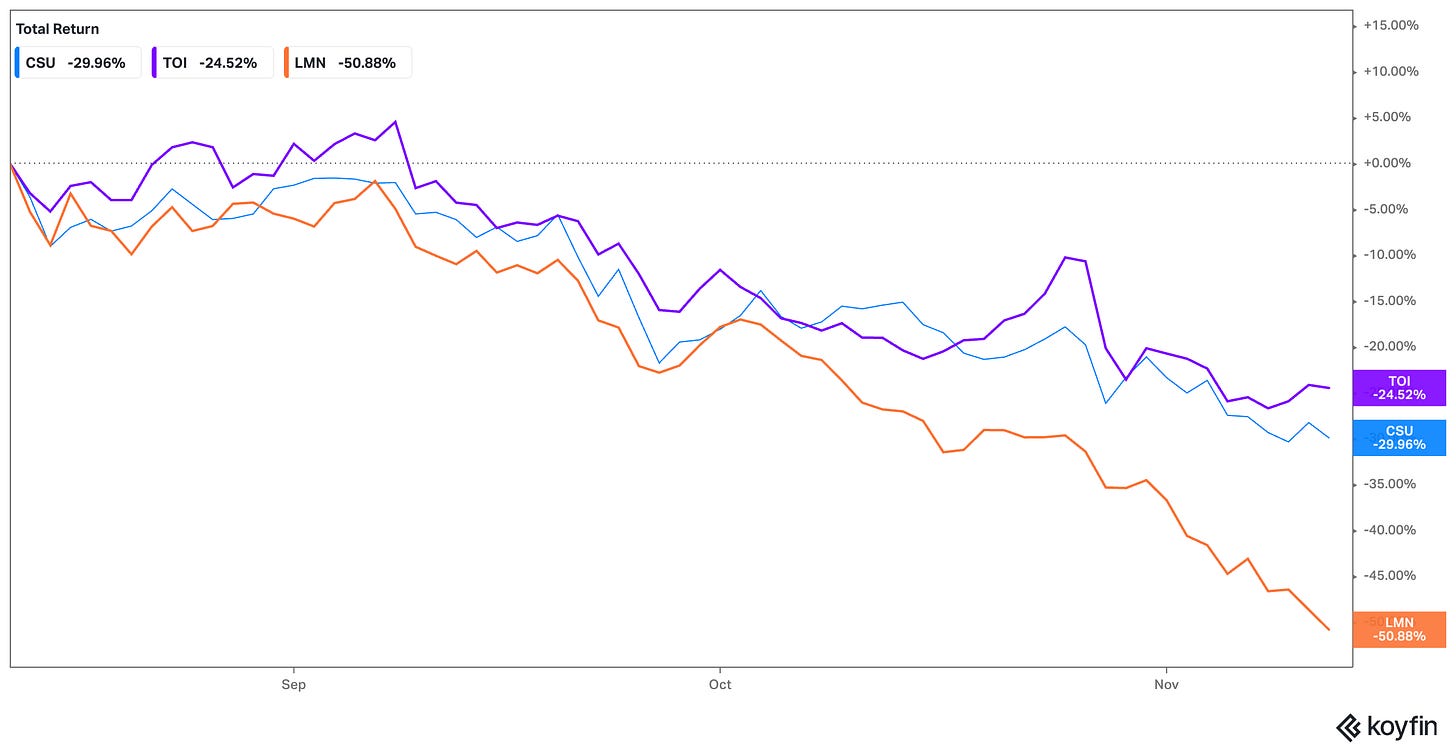

What's Going on With CSU, TOI and LMN

Three Serial Acquirers Down 25%, 30%, and 51%

To read our full disclaimer, click here.

Something unusual happened to three of the market’s best-performing compounders this year.

The last three months have been even worse.

P/E multiples have collapsed across the board.

Two things happened that spooked investors: Mark Leonard stepped down as CEO of Constellation, and AI panic hit vertical market software companies.

I think both fears are overblown.

Here’s why these might be some of the most interesting investments in the market right now...

Constellation Software built something remarkable over the past three decades.

The company pioneered a decentralized model of acquiring small vertical market software businesses - mission-critical systems that run specific industries. Dental practice management software. Marina management systems. Forestry optimization tools. Homebuilders’ estimating platforms.

These aren’t sexy businesses.

But they’re sticky.

Switching costs are brutal.

The software becomes embedded in daily operations.

Customers pay recurring fees year after year.

Constellation’s playbook: Buy profitable software companies at reasonable multiples, let them run independently, give them access to capital for their own acquisitions, and watch cash compound.

The model worked. Spectacularly.

Two spinoffs followed the same blueprint:

Topicus (TOI) - The European version, focused on Dutch and broader European vertical market software.

Lumine Group (LMN) - The communications and media software specialist.

All three companies share the same DNA: decentralized operations, acquisition-driven growth, strong free cash flow generation, and long-term thinking.

So what happened?

The Mark Leonard Question

On September 25, 2025, Mark Leonard stepped down as President of Constellation Software for health reasons, effective immediately.

After 30 years building one of the great compounding machines in market history, the announcement came as a shock. The stock dropped 10% on the news and fell to its lowest point of the year within days.

The market reacted as if the business model itself had broken. Founder risk, they said.

I think this misreads the situation.

Mark Miller, the new President, spent over 30 years at Constellation. He previously led Volaris Group, one of Constellation’s major operating divisions.

More importantly, Leonard built a decentralized structure specifically so the business didn’t depend on him.

The portfolio companies operate independently.

Capital allocation happens at multiple levels.

The machine runs itself.

Look at the evidence: Topicus and Lumine were spun off and barely had day-to-day involvement from Leonard.

Both continued compounding.

Both maintained the acquisition discipline.

Both generated strong returns.

That’s the whole point of the decentralized model.

The AI Disruption Thesis

The second fear gripping these stocks: AI will disrupt vertical market software.

The narrative goes something like this - if coding can be automated, why would companies need specialized software when they can just build their own with AI agents?

I think this fundamentally misunderstands what made these businesses valuable in the first place.

Understanding the Business Model

Before addressing the AI question, it’s worth understanding what these companies actually do.

They don’t sell generic software. They acquire deeply embedded systems in specialized niches. These are mission-critical tools that run specific industries and integrate with dozens of other systems.

The value isn’t in the code itself. It’s in:

Domain expertise accumulated over decades - Understanding the workflows, regulations, and pain points of forestry companies or marina operators isn’t something coding skills alone can replicate.

Switching costs from integration complexity - These systems connect to payment processors, accounting software, inventory management, regulatory reporting, and industry-specific hardware. Ripping out an entrenched system creates massive disruption.

Data accumulated in proprietary formats - Customer records, historical transactions, compliance documentation, and operational data locked in system-specific structures make migration expensive and risky.

Training and workflow dependency - Staff learn these systems. Processes get built around them. The software becomes the way things get done, not just a tool.

Regulatory compliance embedded in the code - Industry-specific reporting, audit trails, and compliance features take years to build properly.

Just because someone can “vibe code” a tool doesn’t mean they can replicate 20 years of domain knowledge, customer data, integrations, and regulatory compliance requirements.

The moat wasn’t ever about coding difficulty. It was about being indispensable to operations.

AI might make building new software easier.

But it doesn’t solve the problem of convincing a dental practice to rip out their patient management system, migrate 15 years of records, retrain staff, rebuild integrations, and risk compliance issues just to save a few thousand dollars a year.

The switching costs remain.

The value proposition remains.

The business model remains intact in my opinion.

What Recent Earnings Actually Show

Let’s look at what the businesses actually delivered.

Constellation Software Q3 2025:

The good:

Revenue strength - Total Q3 revenue rose 16% year-over-year to $2.95 billion, showing robust top-line momentum.

Profitability surge - Net income jumped 28% to $210 million, with earnings per share increasing from $7.74 to $9.89.

Healthy cash generation - Operating cash flow surged 33% to $685 million, while free cash flow rose 46% to $529 million.

Balance sheet improvement - Cash balances expanded to $2.77 billion, up from $2.07 billion at year-end 2024.

Shareholder returns - A $1.00 dividend per share was declared for payment in early 2026.

The bad:

Limited organic growth - Only 5% organic growth (3% after FX), suggesting that acquisitions - not core expansion - drove most of the gains.

Nine-month earnings dip - For the first three quarters of 2025, net income decreased from $446 million to $402 million year-over-year, showing some margin pressure.

Higher leverage - Debt rose from $3.84 billion to $4.42 billion, increasing financial obligations.

The interesting:

Acquisition drive - The company completed $415 million worth of acquisitions in Q3 alone, underscoring a strategic focus on M&A-led growth.

Shift in capital allocation - Management emphasized using free cash flow primarily for acquisitions over dividends or buybacks, reinforcing a long-term reinvestment stance.

Cash flow margins - FCFA2S margin reached roughly 18%, and operating cash margin was around 23%, reflecting strong underlying efficiency despite mixed organic growth figures.

Overall, this was a solid and strategically positive quarter. Profit and cash generation were strong, though sustainable organic growth remains an area to watch.

Topicus Q3 2025:

The good:

Strong top-line growth - Revenue rose 24% year-over-year to €387.9 million, driven by a mix of acquisitions and 3% organic growth.

Healthy cash generation - Operating cash flow improved 53% to €48.4 million, while free cash flow available to shareholders more than doubled to €22.3 million (+114% YoY).

Solid recurring base - Maintenance and other recurring revenue reached €277.6 million, making up nearly 72% of total revenue, underscoring strong business stability.

The bad:

Swing to heavy loss - The company reported a net loss of €120.9 million, compared to profit of €38.0 million a year earlier. This was mainly due to a €221.7 million expense linked to revaluing the Asseco investment under equity accounting.

Reduced equity cushion - Retained earnings declined to €260.4 million from €266.3 million at year-end 2024, reflecting the quarterly loss.

Increased financial leverage - Short- and long-term debt levels expanded sharply, with the revolving credit and term loans rising to €742.4 million versus €275 million in 2024 - a noticeable jump in balance sheet gearing.

The interesting:

Derivative gains - Despite the Asseco-related accounting hit, Topicus booked €60.7 million in income from mark-to-market adjustments on derivatives tied to that deal.

Massive balance sheet shift - The investment in Asseco Poland became a prominent asset - recognized at €195.5 million on the balance sheet by Q3.

Comprehensive income contrast - While the company posted a net loss, total comprehensive income was positive €170.3 million for the first nine months, thanks to €179.7 million in other comprehensive income, mainly from fair value gains on equity investments.

Overall, Topicus delivered resilient underlying growth and strong cash flows, but extraordinary accounting impacts around the Asseco investment dominated headline profitability for Q3 2025.

Lumine Group Q3 2025:

The good:

Operating income acceleration - Q3 operating income increased 7% to $65.1 million, while nine-month operating income surged 32% to $187.3 million.

Net income turnaround - Q3 net income rose 36% to $24.8 million. For the nine months, net income reached $69.2 million, reversing a $288.3 million net loss in the prior year.

Exceptional cash flow growth - Q3 cash flows from operations jumped 143% to $46.5 million, and free cash flow available to shareholders surged 297% to $42.5 million. Nine-month figures showed similar strength: operating cash flow up 167% and free cash flow up 272%.

Strong balance sheet position - Cash balance reached $232.5 million at September 30, 2025, up from $210.9 million at year-end 2024, alongside significant reduction in bank indebtedness.

The bad:

Revenue slightly missed estimates - Q3 revenue of $187 million came in 2% below expectations.

Organic growth challenges - Revenue growth mainly driven by new acquisitions, with organic growth flat or slightly negative after currency adjustments.

The interesting:

Preferred securities conversion impact - The dramatic swing from net loss to profitability primarily resulted from the mandatory conversion of preferred and special securities in March 2024, eliminating related expenses.

Continued acquisition focus - Growth attributed to strengthening activities of recent acquisitions in the communications and media software sector, with free cash flow earmarked for reinvestment in acquisitions meeting the company’s hurdle rate.

Overall, Lumine delivered strong operational performance with exceptional cash flow generation, though growth remains heavily acquisition-dependent rather than organic.

What I Think Happens Next

These results weren’t exceptional. But they weren’t disasters either.

The common thread across all three: organic growth is weak.

CSU managed just 3% after currency adjustments. Topicus hit 3%. Lumine was flat to negative. Growth is coming almost entirely from acquisitions, not from the existing base expanding.

That’s a legitimate concern.

It suggests the underlying software businesses aren’t growing much on their own. Maybe customers are cautious. Maybe AI fears are affecting buying decisions. Maybe it’s just a tough environment for enterprise software spending.

But here’s what matters: the businesses continue generating substantial cash, deploying that cash into acquisitions at disciplined returns, and maintaining the fundamental model that’s worked for decades.

The market has hammered these stocks like the business model is broken.

The earnings don’t justify that selloff at all in my opinion.

The Risks

AI disruption could materialize - If customers actually do rip out embedded systems and rebuild with AI tools, the thesis breaks. I think switching costs prevent this, but I could be wrong.

Organic growth remains weak - All three companies rely heavily on acquisitions for growth. If organic growth stays flat or negative, it suggests underlying business quality issues.

Acquisition discipline could deteriorate - Paying higher multiples, making poor capital allocation decisions, or running out of quality targets would destroy value over time.

Multiple compression could continue - If markets stay pessimistic on software businesses generally, multiples might stay depressed regardless of fundamentals.

The Bottom Line

The Constellation Software family has been hammered. The asymmetry analysis reveals which selloffs created opportunity in my opinion.

I think all represent asymmetric investments and therefore qualify for the SCRai - the Schwar Capital Research Asymmetry Index.

Hope this post was interesting.

Dom

Schwar Capital

📌 PS - If you found this post valuable, please consider sharing it with someone who might benefit from thinking differently about cash and opportunity. 🙏

Thanks for reading Schwar Capital! Subscribe for more content like this.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions. To read our full disclaimer, click here.

Topicus is about 80 eur (130 CAD). So the return will be similar as CSU.

Not to mention you have to adjust starting Topicus EPS for the impact of Asseco one time transaction costs and equity method accounting impact.