Ever wonder why certainty in markets is an illusion, yet we cling to predictions anyway? How understanding Mr. Market's mood swings can lead to better decisions? Or what it takes to develop the uncommon sense needed to think clearly when others panic? This week, we explore how embracing uncertainty, understanding market psychology, and cultivating rational thinking creates enduring investment success.

📚 Three Worthwhile Reads

1. "The End of Certainty" by Ilya Prigogine

Why it matters: A Nobel laureate's profound exploration of how uncertainty and irreversibility are fundamental features of both nature and markets.

Key insight: Complex systems like markets can't be reduced to simple deterministic models - embracing uncertainty is key to understanding them.

From my desk: Prigogine's insights about irreversibility and time's arrow have deeply influenced how I think about market cycles and decision-making.

2. "Mr. Market Miscalculates" by Howard Marks

Why it matters: A timely analysis of market psychology and price movements centred on Graham's famous metaphor.

Key insight: As Marks notes from recent markets, the ability to stay rational while others panic creates persistent opportunities.

From my desk: His insights on market volatility and psychological swings have been especially relevant lately.

3. "The Uncommon Sense of Charlie Munger" by

Why it matters: Great reflections on Munger's approach to rational decision-making and temperament.

Key insight: Munger's emphasis on destroying your best-loved ideas forces constant re-evaluation.

From my desk: Learning to detach from our own ideas might be the hardest yet most valuable investing skill.

💭 Two Quotes Worth Considering

1. On Market Psychology:

"The market fluctuates at the whim of its most volatile participants: those who are willing to buy at a big premium when news is good and sell at a big discount when news is bad." — Howard Marks

Why it matters: Understanding these patterns lets us stay rational when others panic, creating opportunities.

2. On Patient Investing:

"Part of the Berkshire secret is that when there's nothing to do, Warren is very good at doing nothing." — Charlie Munger

Real-world application: The discipline to wait for genuine opportunities often matters just as much as analytical skill.

🤔 One Question to Consider

What's your process for distinguishing between patience and paralysis in investing?

Context: Given today's market environment, it's worth examining how we make decisions under uncertainty.

Now you’ve done the poll, why don’t you like this post as well? It helps know you enjoy this content. Thanks!

My thoughts: The best investors combine systematic analysis with the emotional discipline to act decisively when opportunities arise - and the patience to wait when they don't.

🎯 Quick Updates

What's New

Latest Portfolio Update:

ICYMI:

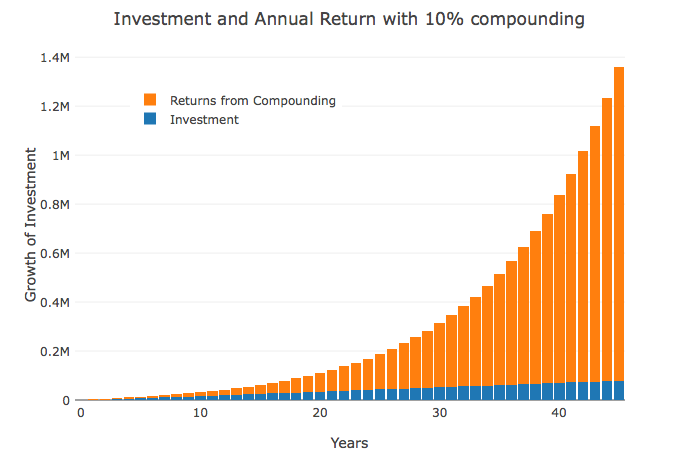

Visual of the Week

Companies on My Radar

PayPal (PYPL), Nintendo (NTDOY), Alphabet (GOOGL) and Uber (UBER) are all reporting earnings this week so there should be a lot to cover!

Currently Reading

"Influence" by Robert Cialdini - Reading this classic on the psychology of persuasion and decision-making.

Dom

Founder & Chief Investment Officer

Schwar Capital

P.S. If you found value in these ideas, consider sharing this newsletter with other thoughtful investors. The best asymmetric opportunity might be the compound effect of growing this community together.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.