Ever wonder why only 4% of stocks account for all market gains, yet we chase the next big winner anyway? How comparing ourselves to other investors often leads us astray? Or what timeless poems can teach us about keeping our heads in turbulent markets? This week, we explore how hard statistics, the folly of comparison, and literary wisdom combine to make us better investors.

📚 Three Worthwhile Reads

1. "The Odds Are Against You" by

Why it matters: A sobering exploration of market uncertainty, revealing that just 4% of public companies account for the market's net gains since 1926.

Key insight: Most publicly listed companies barely outperform Treasury bills over time, highlighting how uncertain future returns truly are.

From my desk: Understanding these odds changes how we think about diversification and the true nature of market uncertainty.

2. "Why Are You Looking at Everyone Else?" by

Why it matters: A masterful examination of investing psychology and the dangers of comparison-driven decision making

Key insight: Our psychological need to measure ourselves against others often leads to poor investment choices and unnecessary risks.

From my desk: The piece shows how our own psychology can be our worst enemy in market decisions.

3. "The Poem That Changed Charlie Munger's Life" by

Why it matters: An exploration of how rational thinking principles, illustrated through poetry, can guide better investment decisions.

Key insight: Munger's interpretation of Kipling's "If" provides a framework for maintaining rational thought during market extremes.

From my desk: The intersection of literary wisdom and investment principles offers a unique lens for developing systematic thinking.

💭 Two Quotes Worth Considering

1. On Market Psychology:

"The difference between successful and unsuccessful investing is not intelligence or access to information. The difference is emotional discipline and keeping your nerve when everyone else is losing theirs." — Bill Miller

Why it matters: Miller's observation cuts to the heart of why even brilliant investors can fail. While everyone focuses on building better analytical frameworks, the greatest edge often comes from maintaining emotional stability when facing uncertainty. This explains why some of the smartest people still make terrible investors.

2. On Patient Investing:

"In expert tennis, 80% of the points are won; in amateur tennis, 80% of the points are lost. The same is true for investing: Amateurs lose money; experts win money." — Erik Falkenstein

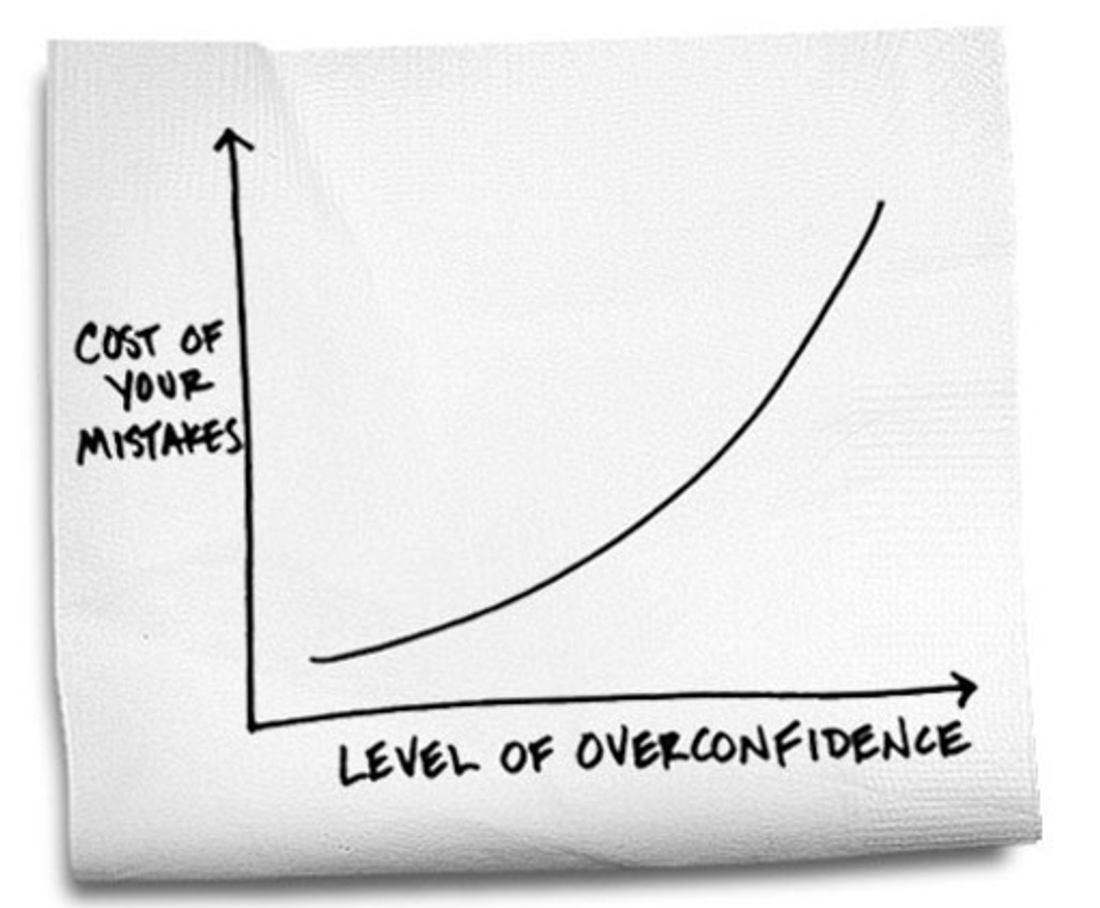

Real-world application: This elegant metaphor reveals why most investors fail - they focus on making brilliant plays rather than avoiding unforced errors. Investment success often comes not from spectacular wins but from consistently avoiding major mistakes.

🤔 One Question to Consider

How do you distinguish between learning from others' success and being distracted by their results?

Context: In an age of instant information and constant performance comparisons, maintaining your own investment philosophy while staying open to learning has never been more challenging.

Now you’ve done the poll, why don’t you like this post as well? It helps know you enjoy this content. Thanks!

My thoughts: The key lies in studying others' decision-making processes rather than their outcomes. When we focus on understanding why successful investors made certain choices rather than simply what they bought or sold, we gain transferable wisdom rather than non-repeatable results.

🎯 Quick Updates

What's New

Latest Investment Thesis:

ICYMI:

Visual of the Week

Currently Reading

"Influence" by Robert Cialdini - Reading this classic on the psychology of persuasion and decision-making.

Dom

Founder & Chief Investment Officer

Schwar Capital

P.S. If you found value in these ideas, consider sharing this newsletter with other thoughtful investors. The best asymmetric opportunity might be the compound effect of growing this community together.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

![[FREE] Evolution AB Investment Thesis Statement](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ffe6f2653-d8c2-4933-8205-1b48c6ac0c0a_700x700.png)

On the comparison point: it's why I stopped looking at index performance and adopted a conservative but achievable total return target for myself https://open.substack.com/pub/christianvalueinvestor/p/on-fomo-and-the-grounding-power-of

Thanks Dom! Food for thought!