NEW FORMAT: On Timeless Wisdom, Market Illusions, and the Art of Resilience

The Schwar Report - Week 20

In a market environment where everything seems to change at a rapid pace, ancient wisdom offers us an anchor. This week, we explore how timeless principles of resilience and clear thinking apply to modern investment challenges.

📚 Three Worthwhile Reads

1. Letters to Lucilius by Seneca

Why it matters: Seneca's teachings on resilience and wisdom resonate powerfully with today's investment challenges.

Key insight: "No one can lead a happy life who thinks only of himself and turns everything to his own advantage" – particularly relevant in an era where many confuse the pursuit of wealth with the pursuit of wisdom.

From my desk: His insights into handling uncertainty and maintaining clear judgment amid chaos are exactly what modern investors need.

2. Take My Money and Lie to Me by

Why it matters: A masterful examination of how private market valuations can create dangerous illusions of stability.

Key insight: The volatility you can't see is still there – smoothed returns often mask underlying risks.

From my desk: Just as Seneca warned against false comforts, we must be wary of artificial stability in our portfolios.

3. 2024 Year-End Portfolio Review by

Why it matters: A transparent look at how batting averages and position sizing drive long-term returns.

Key insight: Superior returns come from the combination of good stock selection and thoughtful position sizing.

From my desk: The path to outperformance isn't just about picking winners but about having the conviction to size them appropriately.

💭 Two Quotes Worth Considering

1. On True Knowledge:

"What really ruins our character is the fact that none of us looks back over his life. We think about what we are going to do, and only rarely of that, and fail to think about what we have done." — Seneca

Why it matters: In investing, understanding our past decisions and their outcomes is crucial for improving our process.

2. On Market Reality:

"The volatility you can't see is still there." — Cliff Asness

Real-world application: A modern echo of Seneca's warnings about false security – just because we can't see risk doesn't mean it isn't present.

🤔 One Question to Consider

How do you distinguish between genuine stability and comforting illusions in your portfolio?

Context: Given both ancient wisdom and modern market realities, it's worth examining what truly makes an investment approach resilient.

Now you’ve done the poll, why don’t you like this post as well? It helps know you enjoy this content. Thanks!

My thoughts: True resilience comes not from avoiding volatility but from understanding and preparing for it – a lesson as relevant in Seneca's time as it is today.

🎯 Quick Updates

What's New

Latest Analysis:

ICYMI:

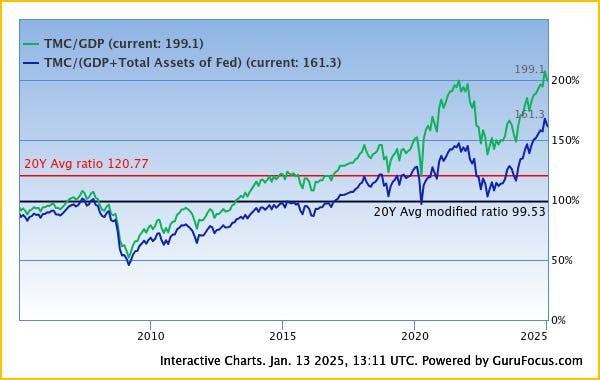

Visual of the Week

Companies on My Radar

Greggs (GRG): Shares at 6-month lows, potentially presenting an attractive entry point after recent earnings report.

Currently Reading

"Alchemy" by Rory Sutherland – Fascinating insights into psychological value and decision-making that complement our investment approach.

Until next Monday,

Schwar Capital

P.S. If you found value in these ideas, consider sharing this newsletter with other thoughtful investors. The best asymmetric opportunity might be the compound effect of growing this community together.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

![[FREE] Nintendo Investment Thesis Statement](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd50c679e-65ee-4b19-aa36-a922c5fbade2_4200x3000.png)