Why The World's Best Investors Read Outside Their Field

The Latticework Theory

To read our full disclaimer, click here.

Ever wonder why Charlie Munger reads biology textbooks? Or why Ray Dalio studies history obsessively?

It's not random.

And it's certainly not a waste of time.

They understand something most investors miss entirely: The best investment ideas often come from completely different domains.

I've been reflecting on this concept lately. While everyone else dives deeper into financial statements and quarterly reports, the masters are building something far more valuable.

A latticework of mental models.

Most investors only have one lens. The truly exceptional have dozens.

Think about it.

When all you have is finance knowledge, everything looks like a financial problem.

Your thinking becomes predictable, limited – and worst of all – the same as everyone else's.

That's not how you gain an edge.

As Munger famously said:

"You've got to have models in your head. And you've got to array your experience—both vicarious and direct—on this latticework of models."

But what does this actually mean in practice?

The Mental Models That Matter

The world's best investors aren't just finance experts. They're continuous learners who deliberately study across disciplines:

Psychology: Understanding cognitive biases isn't optional—it's essential. Markets aren't rational because humans aren't rational. The investor who understands psychological pitfalls has an immediate advantage.

Biology: Evolution and adaptation don't just apply to species. Companies and industries evolve too. Competitive advantages emerge, adapt, or die following surprisingly similar patterns.

Physics: The concept of inertia explains why established companies struggle to change direction. Energy cannot be created or destroyed—and neither can entrenched corporate culture.

History: Market cycles repeat because human behaviour repeats. The details change, but the patterns remain. As Mark Twain supposedly remarked, "History doesn't repeat itself, but it often rhymes."

Mathematics: Understanding probability isn't just helpful—it's the foundation of intelligent decision-making under uncertainty.

The beauty of this approach?

While everyone else fights for the same information, you're connecting dots they don't even see.

The Compounding Knowledge Effect

Here's what makes latticework thinking so powerful: knowledge compounds.

When you understand multiple disciplines, you don't just add them together—you multiply their effectiveness.

Each new mental model doesn't just give you one more tool.

It enhances every tool you already have.

In a world where everyone has access to the same financial data, same news, same analysts' reports, and same valuation methods—your unique perspective becomes your greatest asset.

Your edge doesn't just come from working harder than the next investor. It comes from thinking differently.

How to Build Your Latticework

So how do you actually implement this approach?

Read widely, but not randomly

Choose foundational texts across key disciplines. Don't just dabble—study the core principles until they become intuitive.Look for connections

The real magic happens when you connect concepts across fields. What does network theory tell you about social media stocks? How does game theory inform your understanding of industry competition?Apply ruthlessly

Theory without application is mental entertainment. Force yourself to explicitly apply cross-disciplinary thinking to your investments.Build slowly but steadily

This isn't a weekend project. The latticework develops over decades, not days. As Munger notes, "It's like compound interest. You have to start early."

The paradox here is striking: to become a better investor, sometimes you need to stop studying investing.

Seth Klarman understood this when he said:

"Value investing is at its core the marriage of a contrarian streak and a calculator."

The calculator is finance.

The contrarian streak comes from everywhere else.

When Latticework Thinking Pays Off

The moments when this approach pays the greatest dividends?

During extremes.

When markets panic, your understanding of psychology keeps you rational.

When innovations disrupt industries, your knowledge of technological adoption curves proves invaluable.

When geopolitical events shake markets, your grasp of history provides context.

While others react, you respond. There's a crucial difference.

Consider how Howard Marks approaches market cycles.

His understanding isn't purely financial—it's psychological, historical, and mathematical.

That's what makes his perspective so valuable.

The Bottom Line

Investment success isn't just about having better information.

It's about having better frameworks for processing information.

In a world drowning in data but starved for wisdom, the latticework of mental models isn't just helpful.

It's essential.

The greatest investors aren't necessarily the smartest.

They're the ones who can draw from the widest range of mental models when facing complex problems.

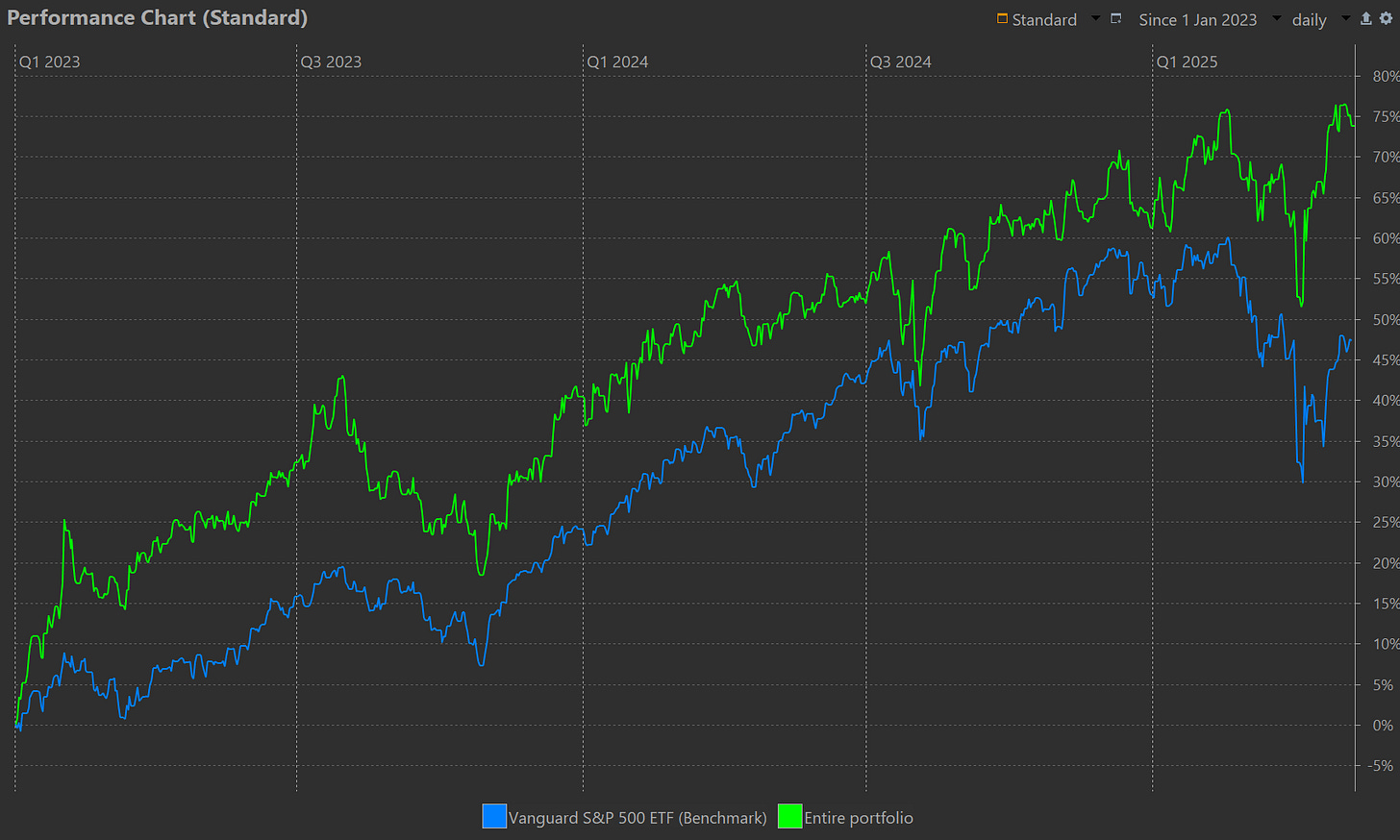

We believe that a big reason that Schwar Capital has returned 26.55% annualised TWRR since inception is because of our wide-ranging mental models. This approach has helped us identify opportunities others miss and avoid pitfalls that trap conventional thinkers.

If you like the way we think and want to see how we invest, subscribe here and become a paid subscriber to see our full portfolio, complete with our reasoning behind each position.

Until next week,

Dom

Schwar Capital

📌 PS - If you found this post valuable, please consider sharing it with other investors. Your share helps us keep writing content that helps investors build and compound their wealth. 🙏

Thanks for reading Schwar Capital! Subscribe for more content like this.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions. To read our full disclaimer, click here.