Why I've Sold 2 Positions and Gone 30% Into This One Stock

Portfolio Update #17 📊

To read our full disclaimer, click here.

Portfolio Strategy and Update

We're trying a new format this week, something we hope brings more value to subscribers.

Beyond the usual portfolio moves, we want to share more of our thinking, more of the process. Below is a censored version with certain names hidden. Subscribers get the full, uncensored version further down.

Even without naming every holding, there should be plenty here to chew on.

Let's dive in.

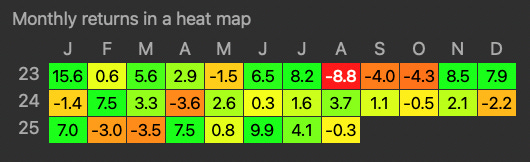

The portfolio is up 23.6% in 2025 so far. The market, meanwhile, has returned 6%.

It's been a busy few months, and this week is no different.

As we've written recently, much of our capital was tied up in Alpha Group International.

This was a coin flip: either a buyout or we'd hold a long-term compounder.

The coin landed on buyout.

We made 30% in 25 days.

A small arbitrage opportunity remains as the market waits for the deal to close. We decided to exit completely.

Why?

First, small arbitrages appear asymmetric in the wrong way: little upside, meaningful downside if the deal breaks.

Second, if the deal closes, it won't be until later this year. We'd rather not have capital sitting idle when it could be working elsewhere.

Which brings us to today.

We initiated a new position with the proceeds: [Company A].

Full thesis coming next week, but here's the elevator pitch: A company we believe could compound revenues at 20% annually for the next decade, trading at 8x earnings with 25% ROIC and what we view as excellent management. We think the market has this one completely wrong. Multiple catalysts could potentially send the stock higher in the second half.

This might be the most asymmetric investment I've ever found.

And I mean that.

More asymmetric than when I bought Meta at $95.

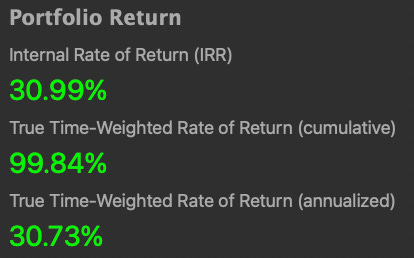

Speaking of which, we sold Meta and Nintendo today: 656% and 67% gains, respectively. IRRs of 108% and 45%. Solid investments both.

Why sell?

Opportunity cost and lack of asymmetry. [Company A] seems simply that compelling.

Opportunities like this don't come often.

We had to rotate capital.

We've also been adding to our [Company B] position, roughly doubling it.

It seems borderline ridiculous that such a quality company trades at these levels. We think it's oversold.

With all this capital shuffling, we're currently 21% cash.

We've written before about the value of cash in a portfolio. It'll be a few more months before we have predictable cash inflows, so until then we want to maintain a 10-20% buffer.

We value the optionality highly.

One name we're eyeing: [Company C], a special situation with what we see as 50-100% potential upside that could play out over the next few months.

We'll keep you posted if we move.

Overall, we're pleased with the portfolio.

Our efforts to diversify geographically and by currency have paid off, helping us separate from benchmark returns.

Earnings updates for portfolio companies will be out shortly on Schwar's Radars.

Hope you enjoyed this new format.

Have a great weekend.

Dom

Schwar Capital

Statement of Assets

Become a paid subscriber here to see our full portfolio, complete with our personal reasoning behind each position and the uncensored version of the post above.