Why I'm More Confident in Today's Portfolio Despite Underperformance

Portfolio Update #21 📊

To read our full disclaimer, click here.

The portfolio has endured a challenging few months, bringing year-to-date returns to just 0.5%.

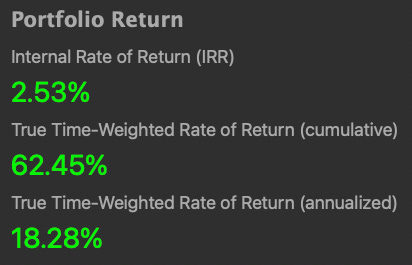

Our time-weighted rate of return still stands at 18.28% annualised, however.

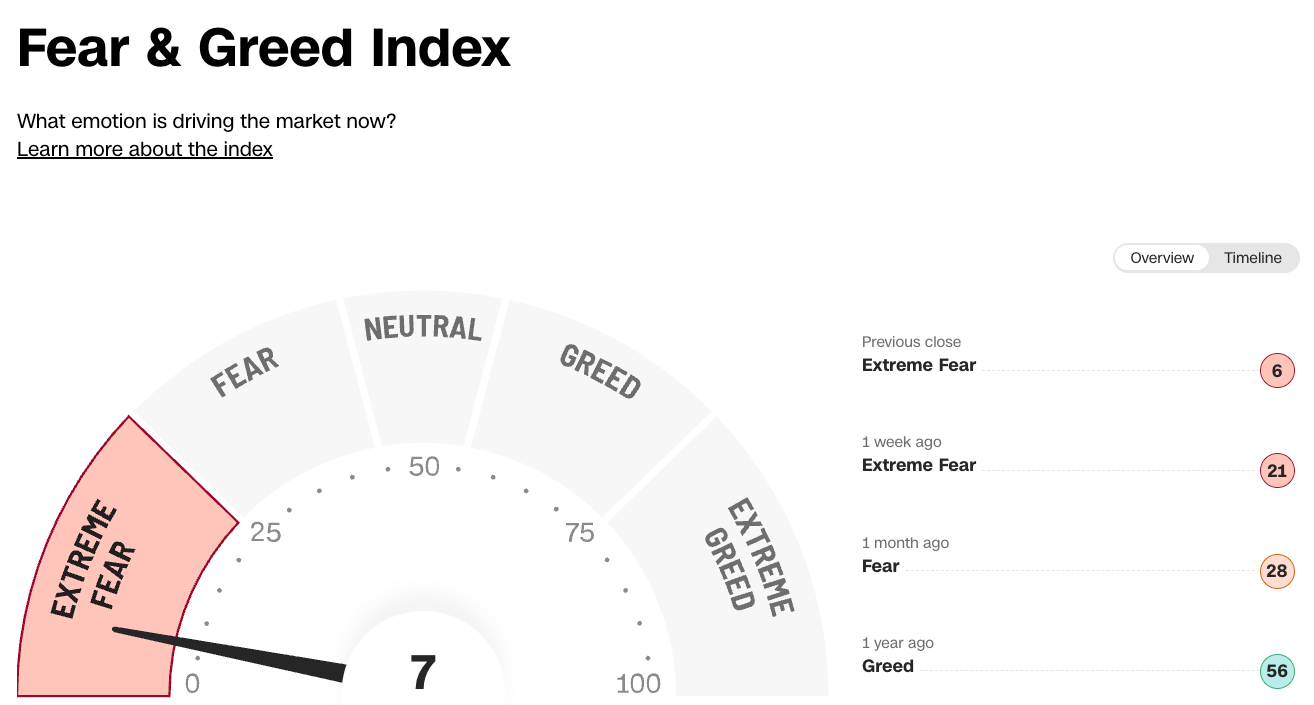

It’s been a couple of weeks since our last update on February 14th. Back then, we sat at a fear index level of 7.

We’re now at levels that haven’t been seen since April.

Despite the underperformance this year, I remain pleased with our portfolio holdings.

Let me explain why.

When markets turn, especially in microcaps, it’s easy to lose sight of fundamentals. But fundamentals are precisely what matter most in downturns like these.

Six months ago, though the portfolio was higher, I wasn’t as confident in the holdings.

Today, I have far greater peace of mind.

The quality is better.

The conviction is higher.

The margin of safety is wider.

We’ve moved away from concentration in large-cap names - big tech and other US stocks - toward what I believe are higher-quality, higher-conviction ideas trading at more compelling valuations.

Full holdings appear at the end of this post.

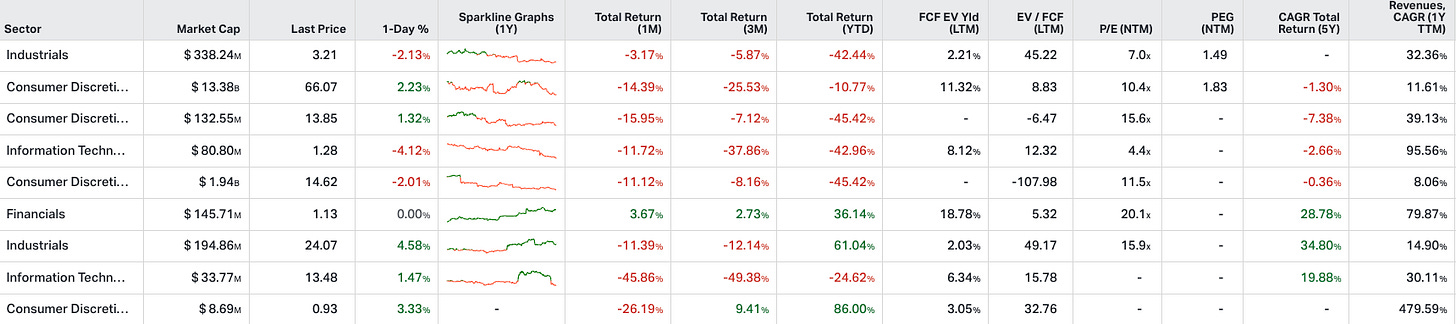

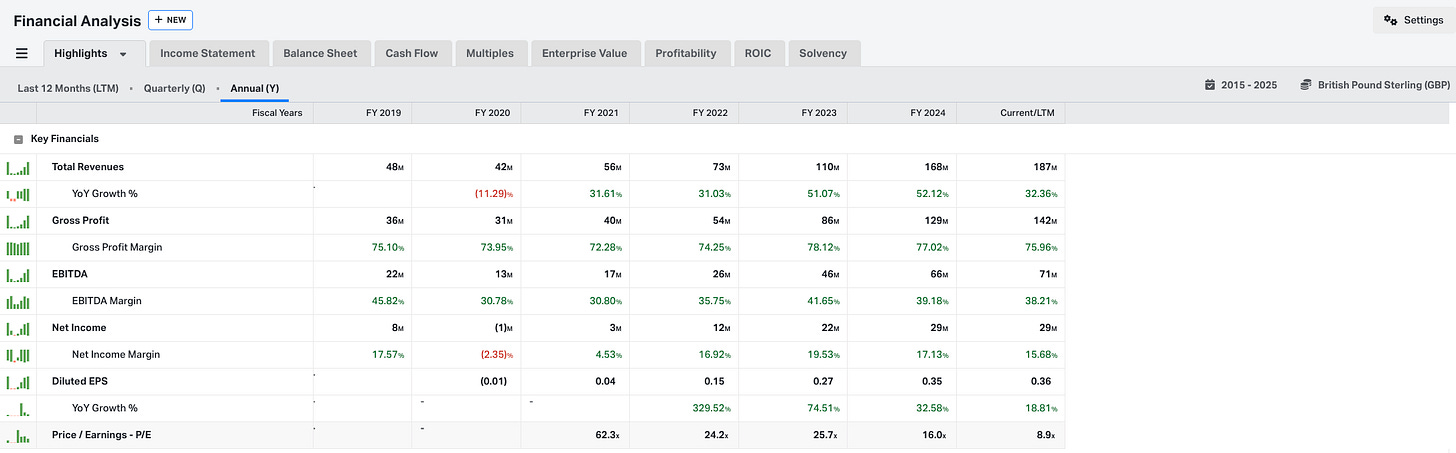

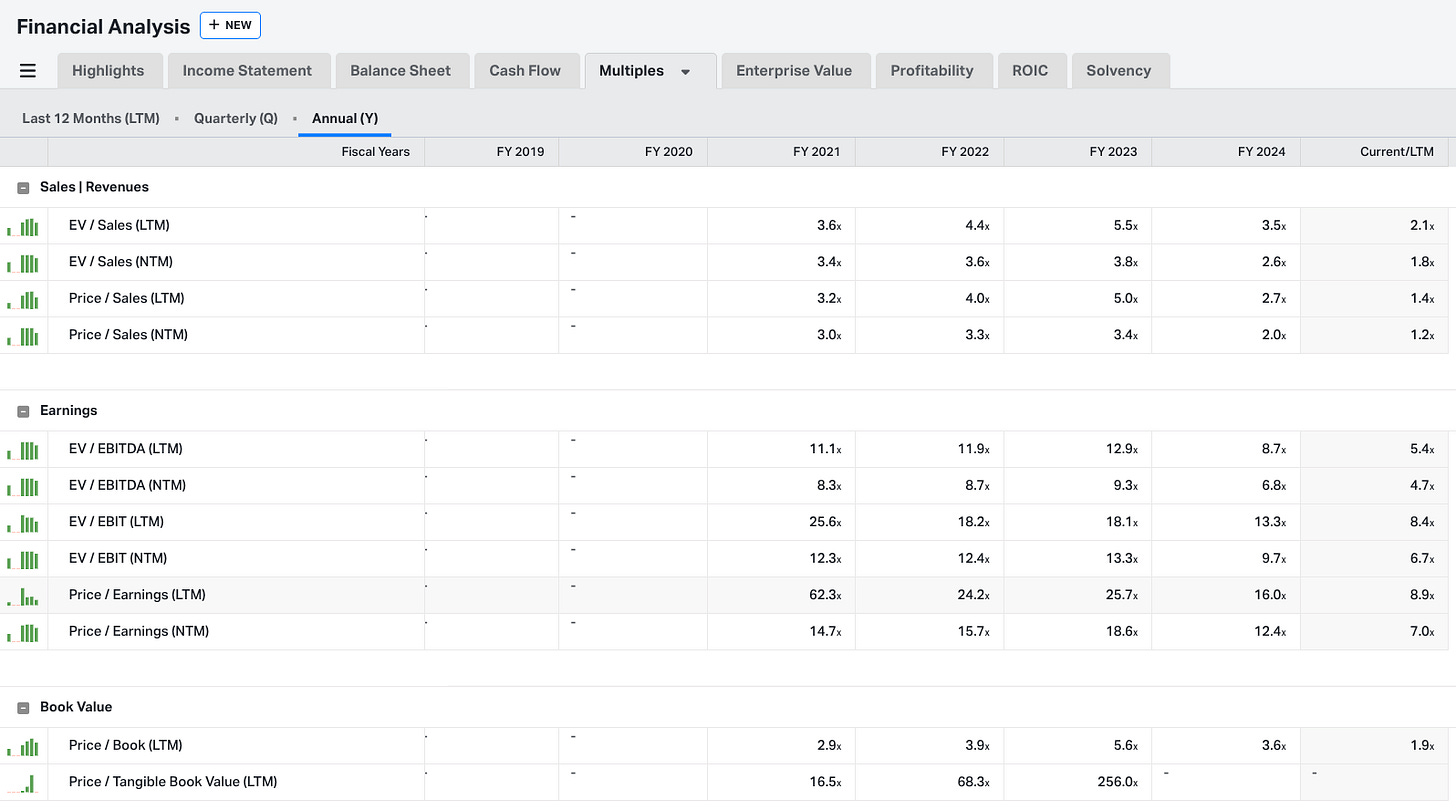

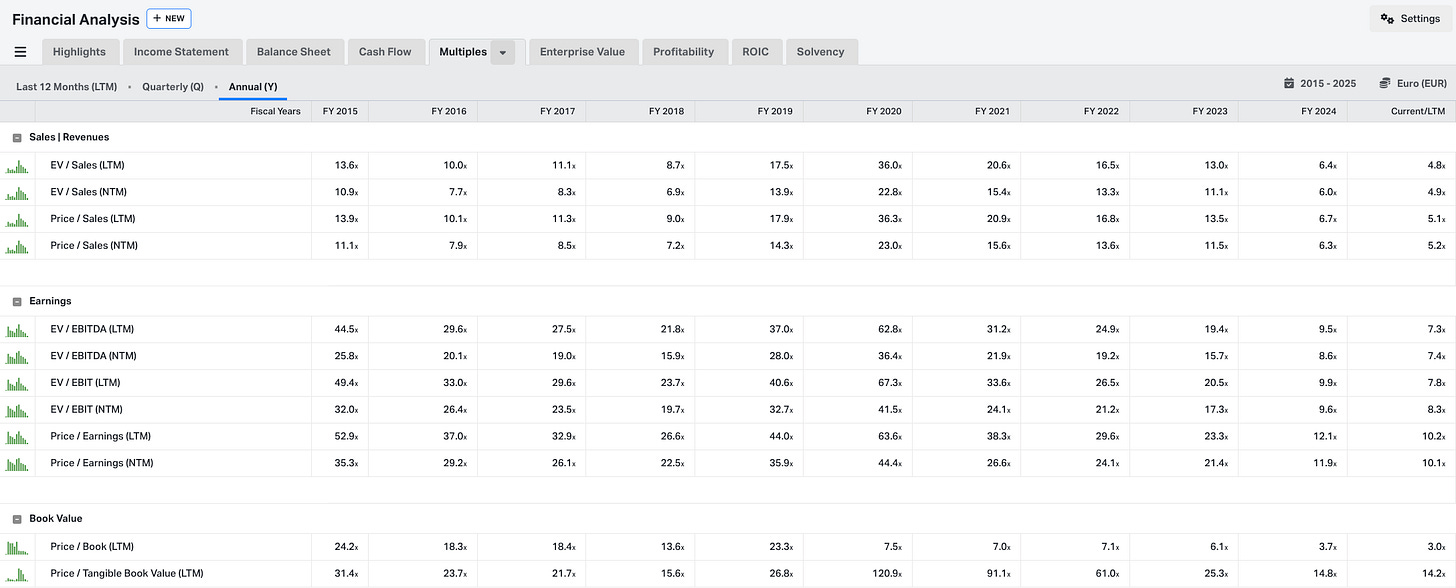

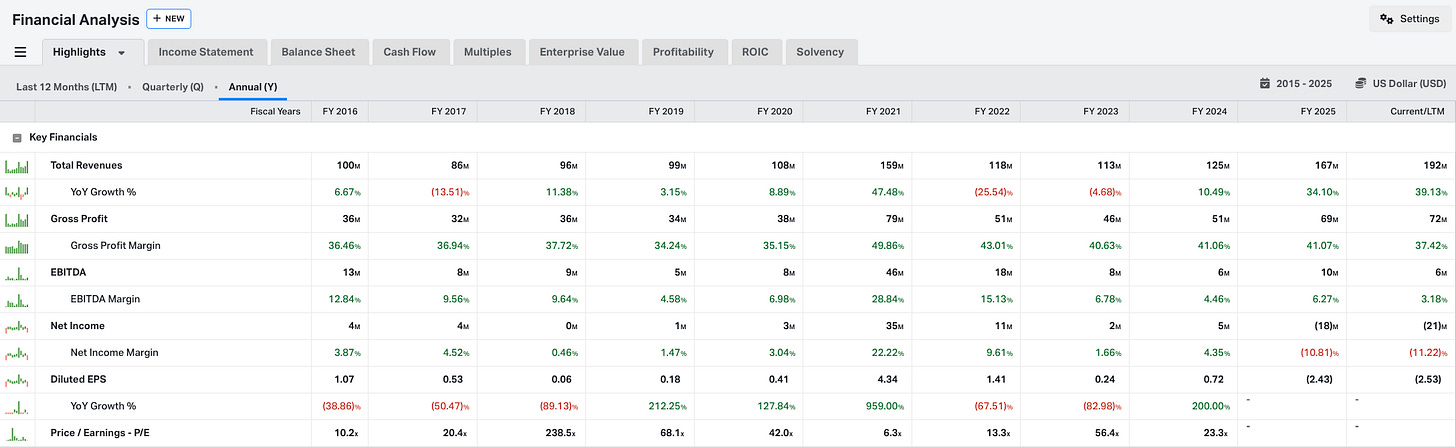

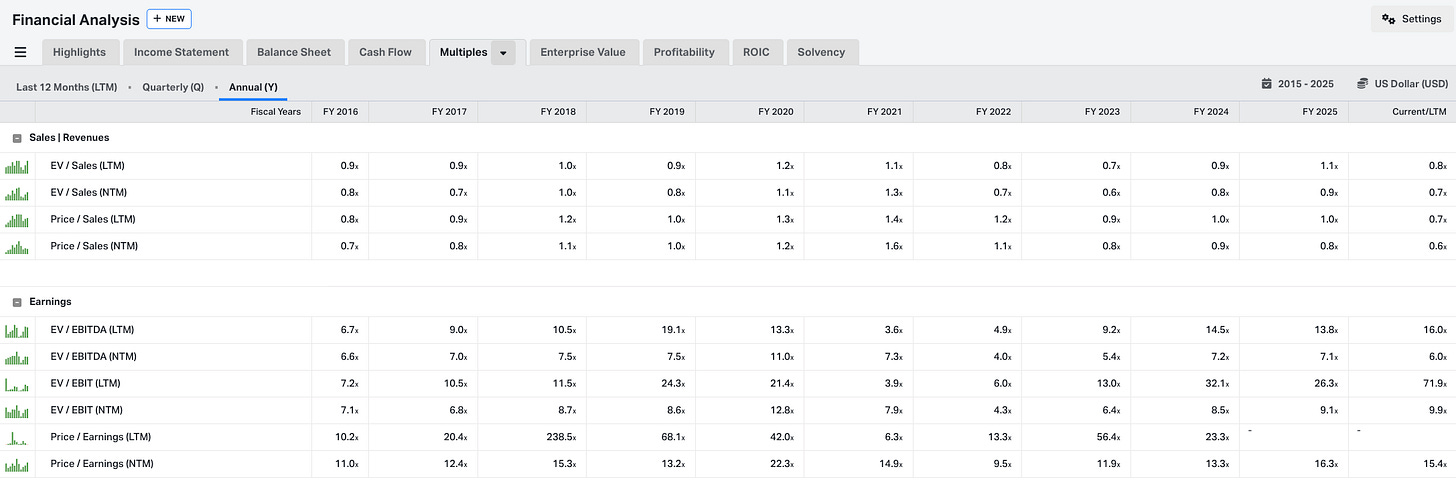

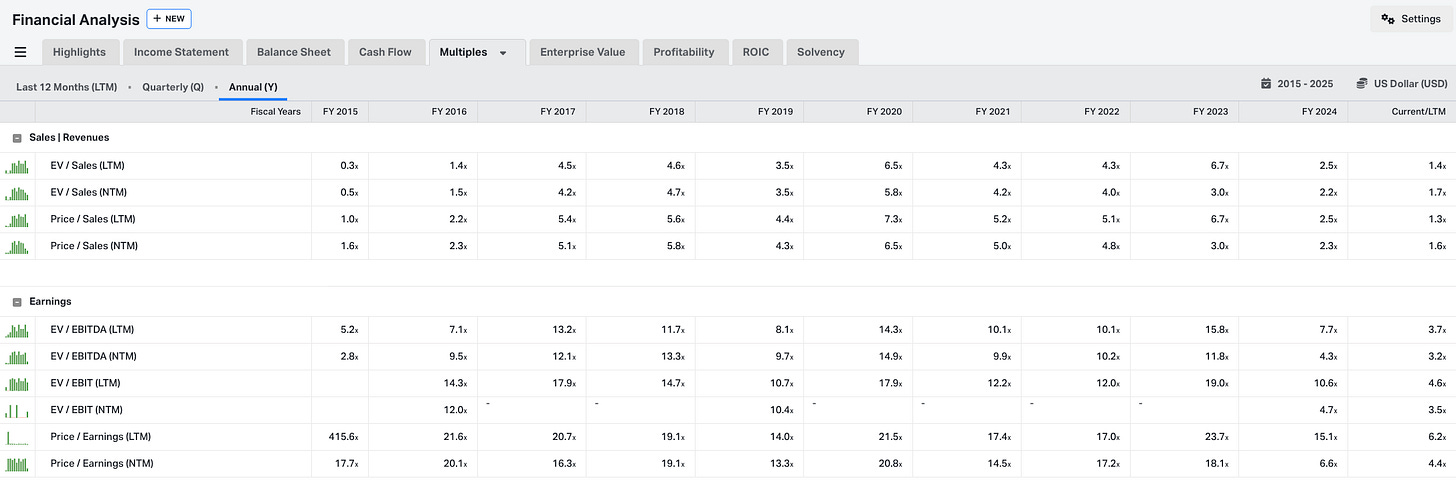

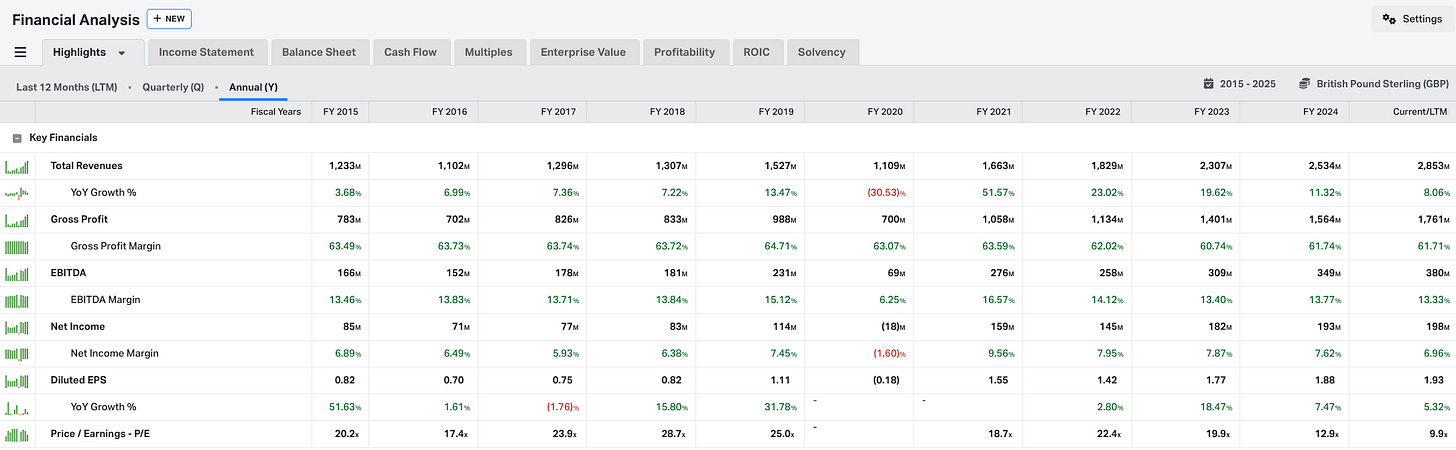

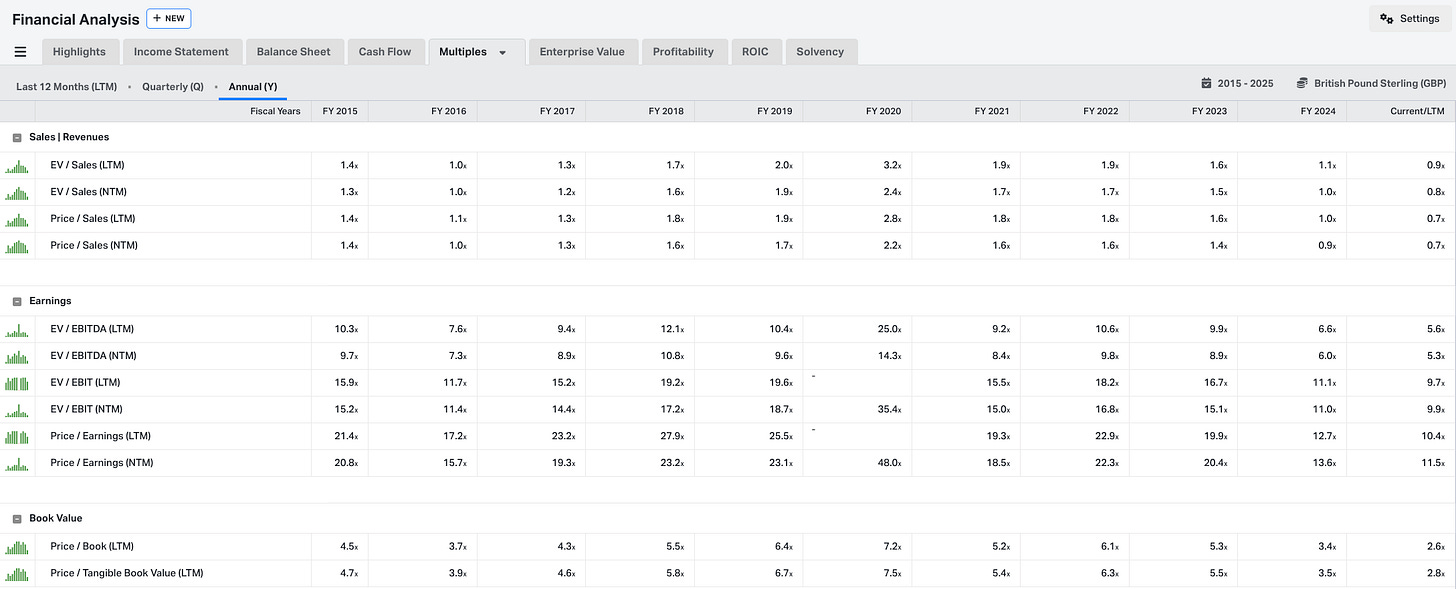

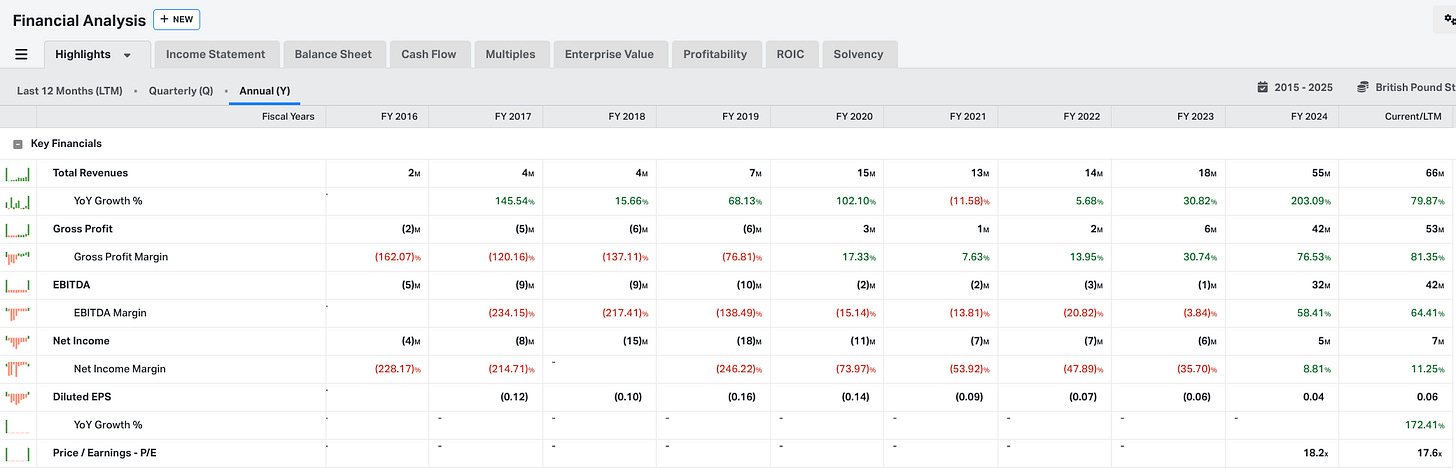

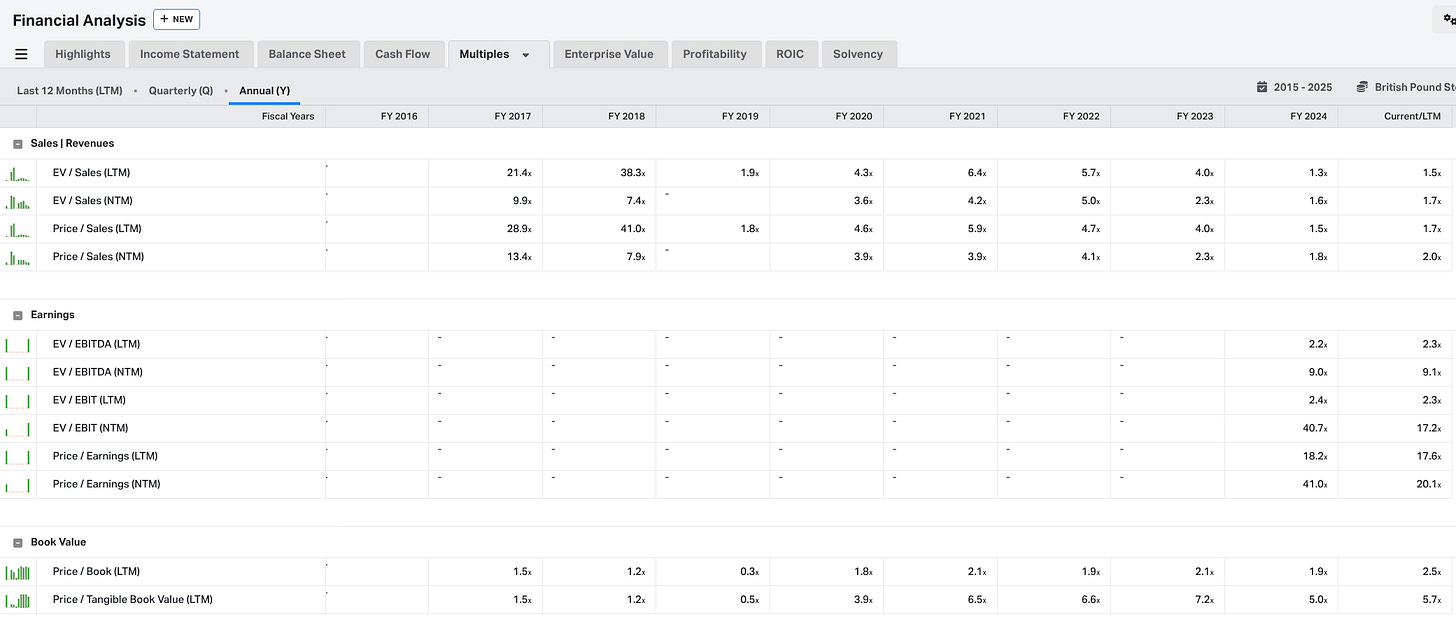

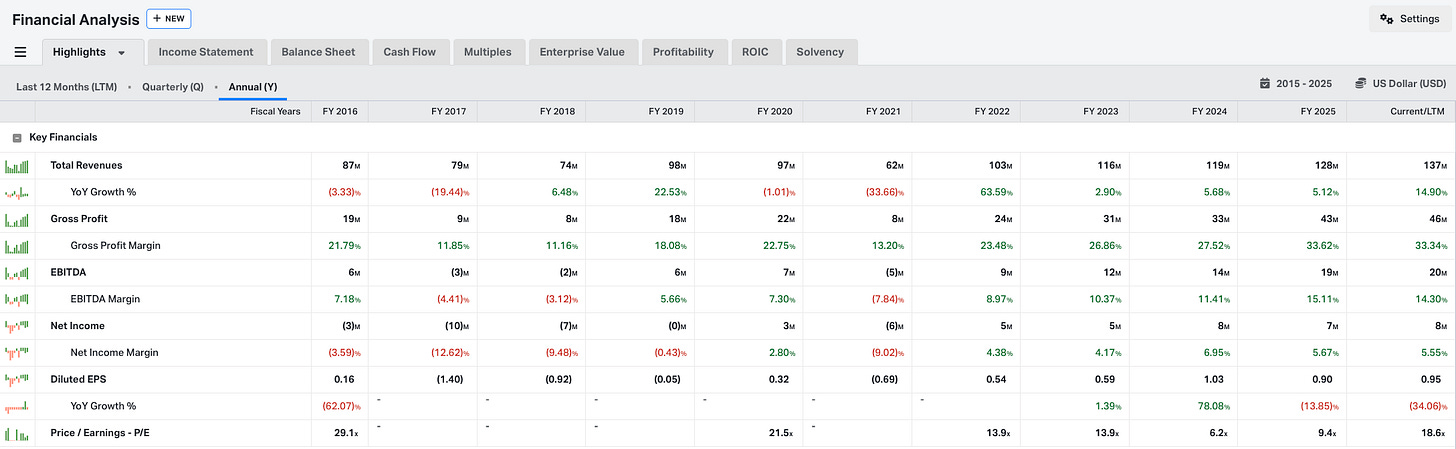

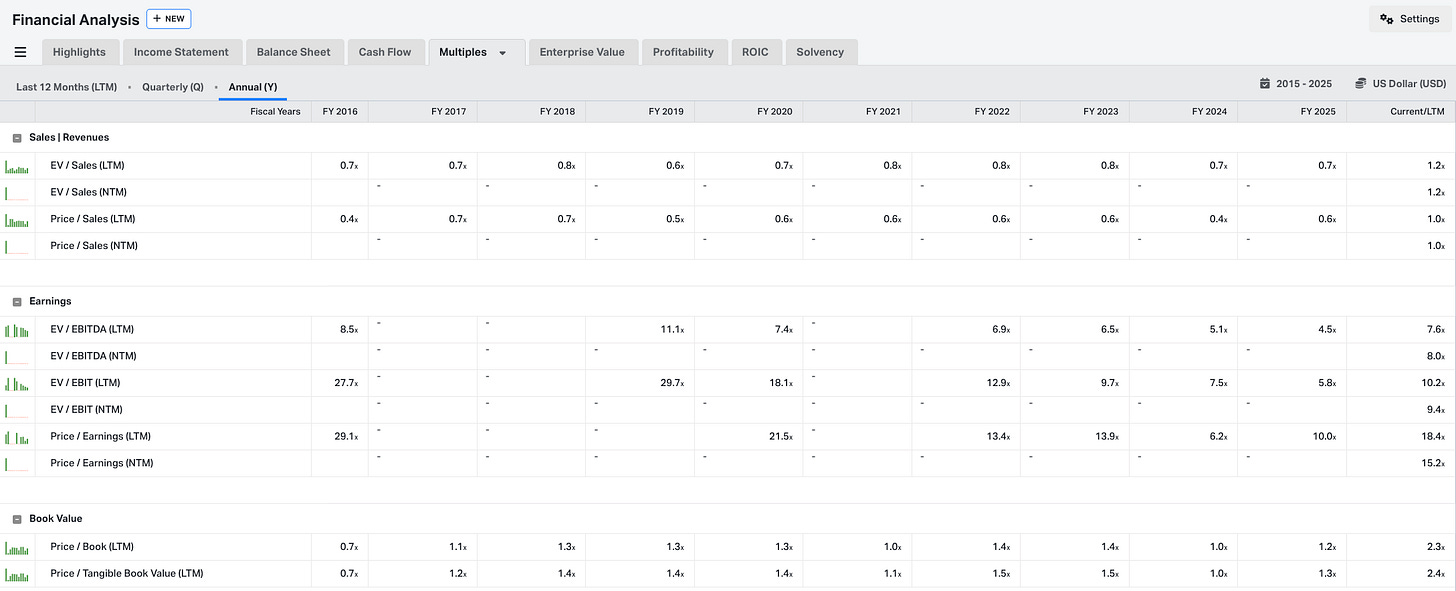

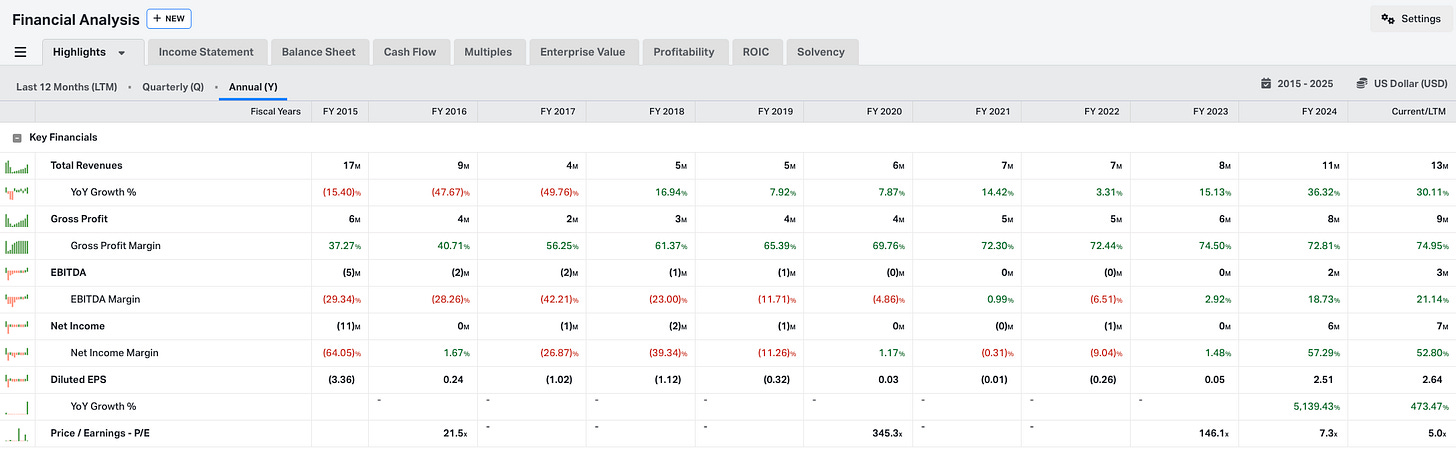

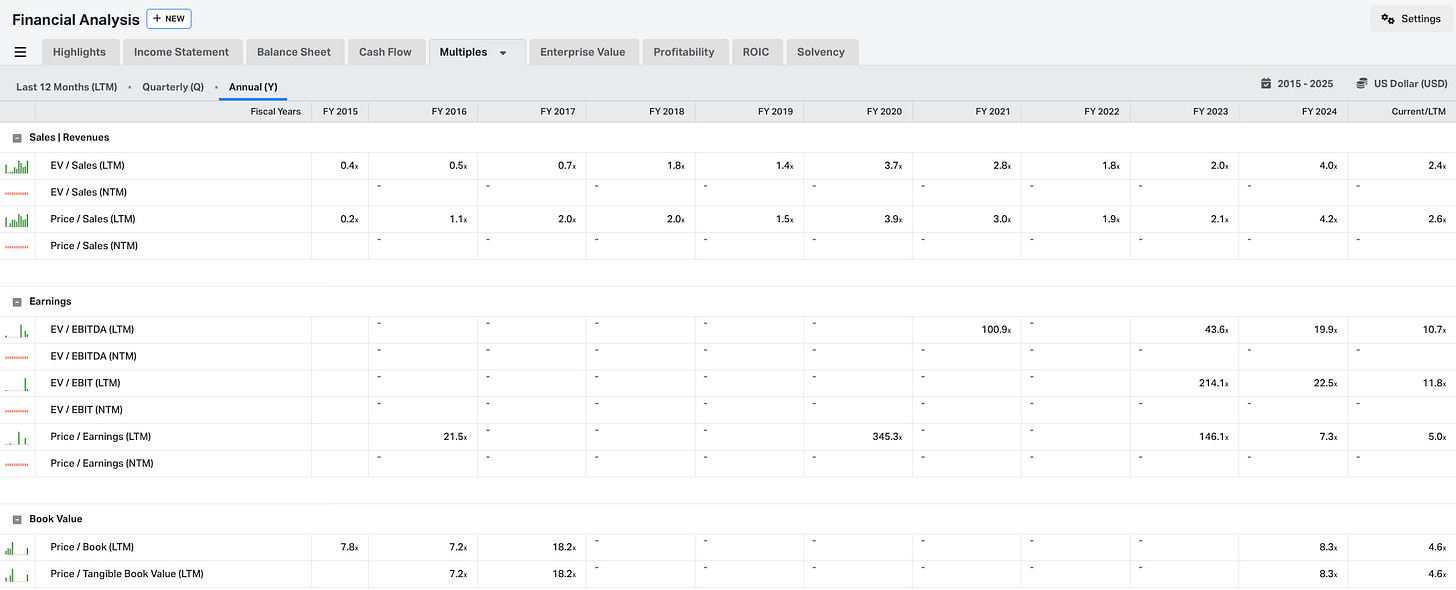

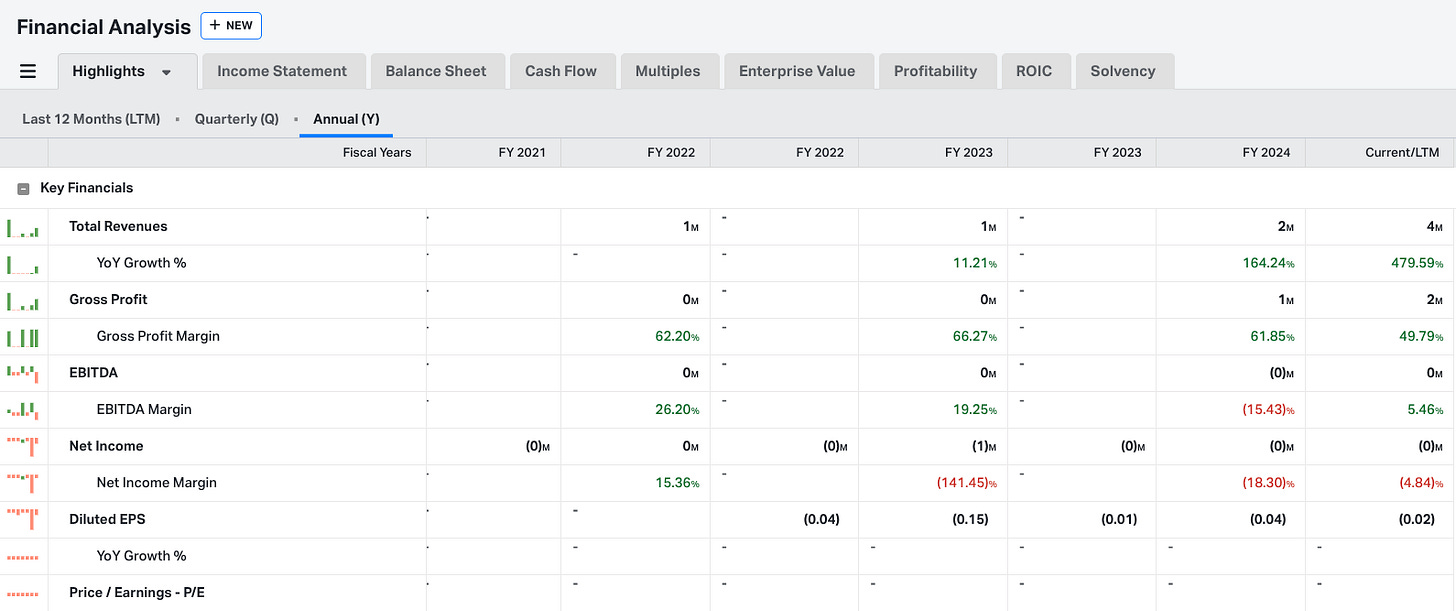

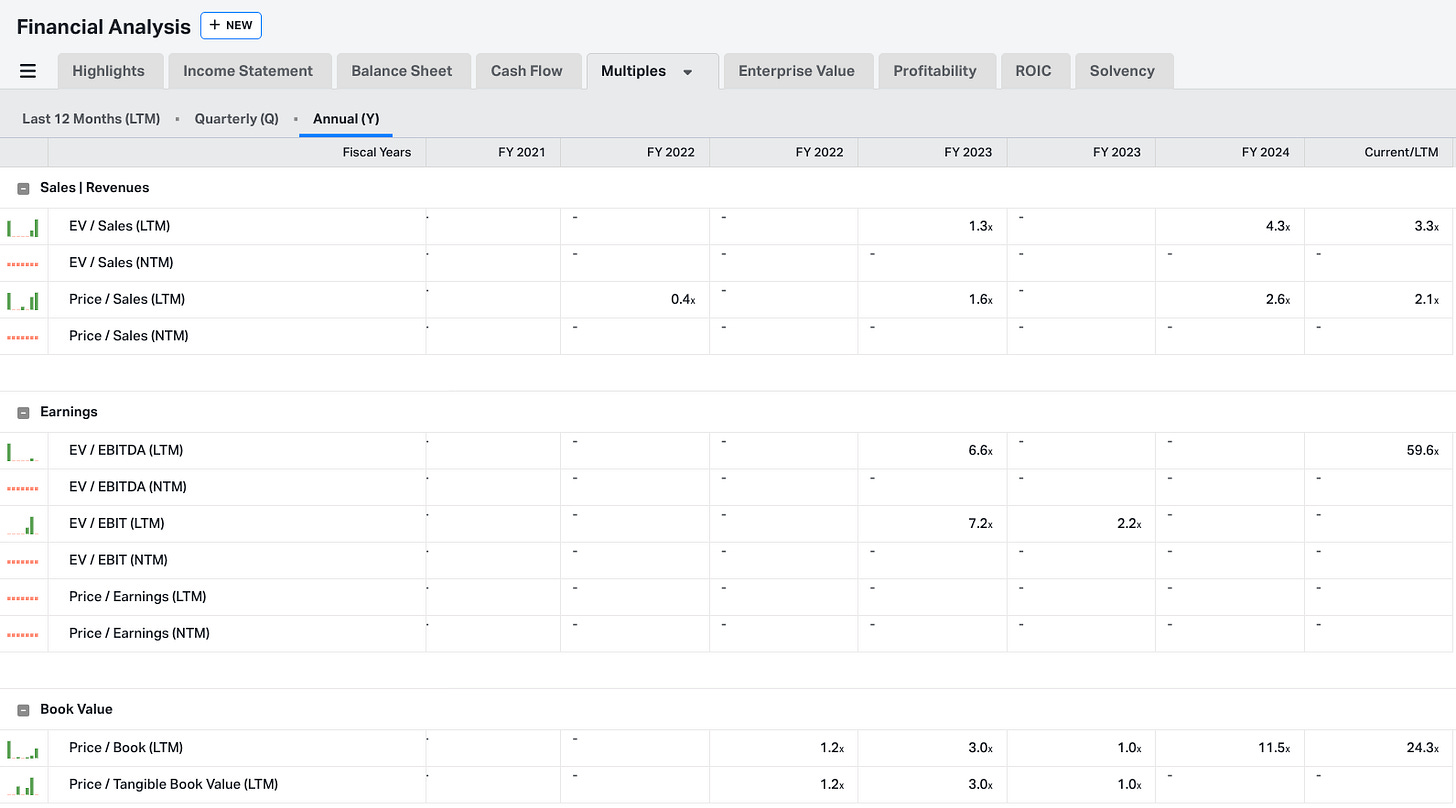

Below are the financial highlights for all companies, presented in order of position size:

Overview

Position 1

Position 2

Position 3

Position 4

Position 5

Position 6

Position 7

Positon 8

Poistion 9

View the full portfolio…