Why I Study Failed Hedge Funds More Than Successful Ones

The uncomfortable truth about learning that most investors ignore

To read our full disclaimer, click here.

Most investors study success stories.

They read about Warren Buffett's latest moves, analyse Renaissance Technologies' returns, and obsess over Pershing Square's quarterly letters.

I do the opposite.

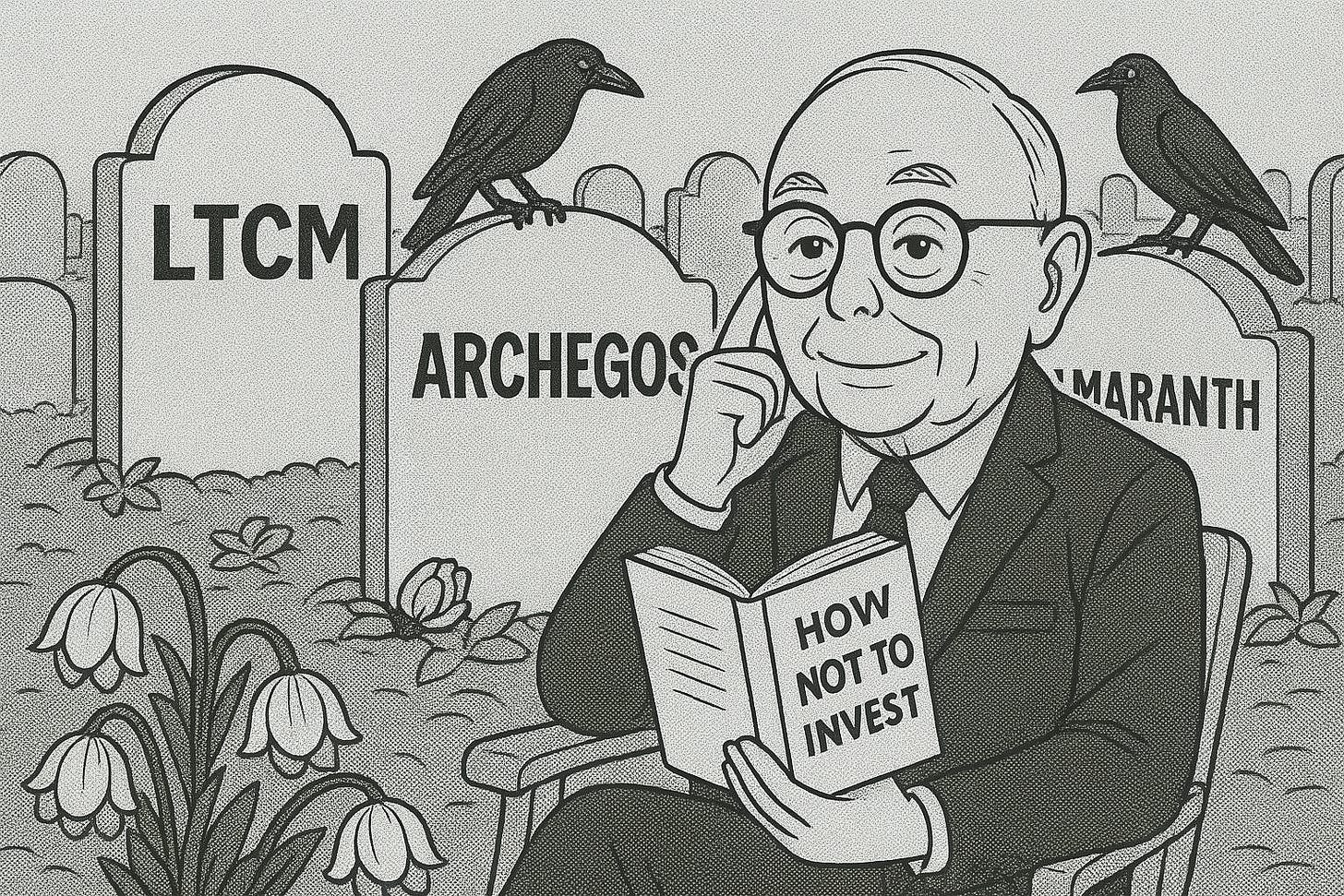

While others chase the glamorous winners, I spend my time in the graveyard of spectacular failures.

Because here's what I've learned after years of studying both:

Success stories teach you what worked in specific circumstances.

Failure stories teach you what kills.

And in investing, avoiding death is far more valuable than chasing returns.

The Graveyard Teaches Better Lessons

Charlie Munger understood this perfectly.

His famous "invert, always invert" wasn't just clever wordplay, it was a fundamental approach to learning.

Instead of asking "How do I get rich?" he asked "How do I avoid going broke?"

The hedge fund graveyard is littered with brilliant minds who forgot this distinction.

Take Long-Term Capital Management.

Nobel Prize winners.

Rocket scientists.

Mathematical geniuses who could price derivatives with stunning precision.

They had a 99.9% confidence interval in their models.

Whoops.

LTCM collapsed because they forgot that markets don't read textbooks.

Their models assumed normal distributions in a world where black swans swim regularly.

What Dead Funds Teach Us

Here's what failed hedge funds have taught me about investing:

Leverage kills everything eventually. Even if you're right 95% of the time, that 5% will destroy you if you're borrowing too much money.

Correlation goes to one in a crisis. Your "diversified" portfolio of tech stocks isn't diversified when the entire sector implodes simultaneously.

Liquidity is an illusion. You can sell anything in good times. In bad times, good luck finding a bid.

Size becomes a disadvantage. The bigger you get, the harder it becomes to find opportunities that actually move the needle.

Everyone's a genius in a bull market. Real skill only reveals itself when things go wrong.

💡 Finding this valuable? A quick like and restack really helps our page and other investors to discover these insights!

The Amaranth Lesson

Amaranth Advisors managed $9.2 billion in 2006.

By September 2006, they had lost $6.6 billion in natural gas trades.

In one week.

The fund's collapse wasn't due to stupidity.

Their energy trader Brian Hunter was genuinely talented.

The problem was concentration.

Hunter's natural gas positions represented nearly half the fund's capital.

When natural gas prices moved against them, there was nowhere to hide.

The lesson?

Diversification isn't about owning different stocks.

It's about ensuring that no single bet can kill you.

Why Success Stories Mislead

Successful investors are terrible teachers for one simple reason: survivorship bias.

For every George Soros who "broke the Bank of England," there are hundreds of currency speculators who went broke attempting similar trades.

We only hear about Soros because he survived to tell the tale.

Failed hedge funds, on the other hand, provide unfiltered data.

No spin.

No selective storytelling.

Just raw, honest failure that shows you exactly what went wrong.

And that's invaluable.

The Inversion Advantage

When I analyse potential investments, I don't start by asking "How much can I make?"

I start with: "How can this kill me?"

What if the thesis is completely wrong?

What if management is lying?

What if competition destroys margins?

What if regulatory changes wipe out the business model?

What if I'm overleveraged when markets crash?

This inversion process has saved me from countless mistakes.

While others were chasing the latest hot growth stock, I was asking what could go wrong.

Boring? Perhaps.

Profitable? Absolutely.

Building Your Own Graveyard Studies

Here's how you can apply this approach:

Study position sizing failures. Look at funds that got too concentrated in single bets.

Analyse leverage disasters. Understand how borrowed money amplifies both gains and losses.

Research liquidity crunches. See what happens when everyone heads for the exit simultaneously.

Examine overconfidence patterns. Notice how past success often breeds future recklessness.

Track correlation breakdowns. Study how "diversified" portfolios become correlated during crises.

The beauty of studying failures is that the data is free.

Failed hedge funds become case studies.

Their mistakes become public record.

Their pain becomes your education.

👍 If this changed how you think about finding investments, a quick like and restack really helps us carry on making content for you!

The Uncomfortable Truth

Most investors hate studying failures because it's depressing.

It's more fun to read about 10-baggers than total losses.

Success stories are inspiring.

Failure stories are uncomfortable.

But here's what I've learned: Getting rich slowly is boring, but staying rich requires something even more tedious, understanding exactly what can kill you.

That's why while others chase the next hot investment strategy, I spend my time in the graveyard, studying beautiful disasters.

Because the dead don't lie.

Speaking of learning from failures...

There's one opportunity we've just discovered that perfectly embodies this "study the graveyard" philosophy.

While most fintech companies over the past decade chased growth at any cost, leveraged up, and eventually imploded, this management team took the opposite approach.

They watched the spectacular failures in their sector and built their business to be the anti-fragile alternative.

No debt. High margins. Real cash generation.

Even better?

There's a buyout offer on the table right now, expected to finalize in the next few weeks.

Heads you win: If the deal goes through, it's a clean 10-20% return in weeks.

Tails you win more: If it falls through, you're left holding one of the best-run companies in fintech at a significant discount.

This is the kind of asymmetric opportunity that emerges when you focus on what doesn't kill you, rather than what might make you rich quickly.

Want the full details?

Our Schwar Capital subscribers get access to our complete investment thesis on the company, including our fair value estimate, the acquisition mechanics, and why we think this business could double even without the deal.

Until next week,

Dom

Founder & Chief Investment Officer

Schwar Capital

📌 PS - If you found this post valuable, please consider sharing it with someone who might benefit from thinking differently about cash and opportunity. 🙏

Thanks for reading Schwar Capital! Subscribe for more content like this.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions. To read our full disclaimer, click here.

Great article Dom!

Any resources to study failures? You mention LTC, that book was already on my want to read list.