Why 99% of Stock Screeners Are Worthless (Here's What Actually Works)

The uncomfortable truth about finding great investments - and why Charlie Munger never needed a single screener

To read our full disclaimer, click here.

Last week, I watched an investor show me his "foolproof" stock screener.

Forty-seven different criteria. Revenue growth, margins, debt ratios, price-to-everything ratios. The works.

"It filters 8,000 stocks down to just 12 winners," he said proudly.

I nodded politely. But inside, I was thinking about something Charlie Munger once said:

"I've never used a stock screener in my life, and I've done just fine."

Here's the uncomfortable truth most investors refuse to accept: Your screener isn't finding great businesses.

It's finding great spreadsheets.

And there's a massive difference.

The Screener Trap That Kills Returns

Walk into any investment firm, and you'll see the same scene. Analysts hunched over Bloomberg terminals, running endless screens.

P/E under 15. ROE above 20. Debt-to-equity below 0.3.

Click, filter, sort, repeat.

The problem?

Great businesses don't fit neat little boxes.

Take Amazon in 2001. Negative earnings. Screener result: REJECTED.

Netflix in 2007? Sky-high P/E ratio. Screener result: REJECTED.

Every single one became a life-changing investment.

But your screener would have filtered them out faster than you can say "value trap."

What Screeners Actually Screen For

Here's what your fancy screener is really doing: Finding yesterday's winners trading at today's reasonable prices.

It's like using a rearview mirror to drive forward.

Technically possible, but probably not ending well.

Most screeners reward:

Mature businesses with consistent metrics

Boring industries with predictable patterns

Yesterday's growth stories now trading cheaply

What they miss:

Businesses in transition (the biggest opportunities)

Management quality (the most important factor)

Competitive dynamics (what actually drives returns)

Reinvestment opportunities (what creates compounding)

Your screener can't tell the difference.

It sees numbers, not narratives.

💡 Finding this valuable? A quick like and restack really helps our page and other investors to discover these insights!

The Munger Method: How to Actually Find Winners

Charlie Munger built a fortune without ever running a single screen.

His secret?

He studied businesses like a detective studies crime scenes.

Here's his actual process:

Step 1: Start With Industries You Understand

"Stay within your circle of competence, but work to expand it."

Forget the screener. Start with businesses you actually understand. Can you explain how they make money to a 10-year-old? If not, move on.

Step 2: Look for Pricing Power

"The ability to raise prices without losing customers is the single most important business trait."

No screener measures this. You have to dig into annual reports, study customer behavior, understand switching costs.

Step 3: Assess Management Quality

"We buy businesses, not stocks. And businesses are run by people."

Screeners can't read between the lines of shareholder letters. They can't detect whether management thinks like owners or operators.

Step 4: Understand the Moat

"What we're looking for is a competitive advantage that's durable."

This requires thinking, not filtering. Network effects, switching costs, regulatory barriers - none of these show up in your P/E ratio.

The Real Secret: Quality Over Quantity

Here's where most investors go wrong: They think more options equal better results.

Wrong.

The best investors I know follow fewer than 50 companies. Deeply. They read every annual report, know every competitor, understand every trend.

Chris Mayer, one of the sharpest minds in investing, puts it this way: "I'd rather know everything about 10 businesses than something about 100."

The math is simple:

Screener approach: 1% knowledge about 1,000 stocks

Munger approach: 90% knowledge about 10 stocks

Which investor do you think finds the better opportunities?

What Actually Works: The Anti-Screener Approach

Step 1: Pick 3-5 Industries You Understand

Start narrow. Really narrow. Payment processing. Software. Insurance. Whatever you genuinely understand.

Step 2: Find Every Public Company in Those Industries

Not through a screener. Through industry reports, trade publications, competitor analysis. Know the ecosystem.

Step 3: Read Everything

Annual reports. Quarterly calls. Industry publications. Become the expert your screener pretends to be.

Step 4: Wait for Opportunity Most of the time, do nothing.

When Mr. Market offers you a great business at a fair price, then you act.

Step 5: Concentrate Own your best ideas.

As Munger says: "Diversification is protection against ignorance. It makes little sense for those who know what they're doing."

The Uncomfortable Truth About "Efficiency"

"But this takes forever!" you're thinking. "My screener gives me results in seconds!"

Exactly.

And that's the problem.

If finding great investments were that easy, everyone would be rich.

The fact that it's hard work is precisely what creates the opportunity.

Your screener is competing with thousands of other screeners running the same filters.

You're all fighting over the same "cheap" stocks.

The anti-screener approach?

You're competing with your own curiosity, patience, and understanding.

Much better odds.

As Seth Klarman notes:

"The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions."

Screeners can't read human nature.

Only humans can.

👍 If this changed how you think about finding investments, a quick like and restack really helps us carry on making content for you!

Why This Matters More Than Ever

Here's the irony: As more investors rely on screeners and algorithms, the advantage of thinking independently grows larger.

Everyone's using the same tools, applying the same filters, finding the same "opportunities."

It's like everyone showing up to a gold rush with identical maps.

Meanwhile, the patient investors - the ones reading annual reports, understanding businesses, thinking for themselves - they're finding the real gold.

The choice is yours:

Join the crowd with your fancy screener

Or think like Munger and build real understanding

One approach is fast and feels sophisticated.

The other actually works.

The Bottom Line

Stock screeners aren't worthless because they're poorly designed. They're worthless because they're solving the wrong problem.

They're trying to turn investing into a spreadsheet exercise when it's actually a business analysis challenge.

Great investors don't find great investments. They understand great businesses deeply enough to recognize opportunity when Mr. Market offers it.

Your screener will never tell you that.

But your patience, curiosity, and willingness to think independently? That's where the real edge lies.

Speaking of thinking independently...

At Schwar Capital, we've built our entire investment process around the principles discussed above.

No screeners.

No shortcuts.

Just deep, patient analysis of exceptional businesses.

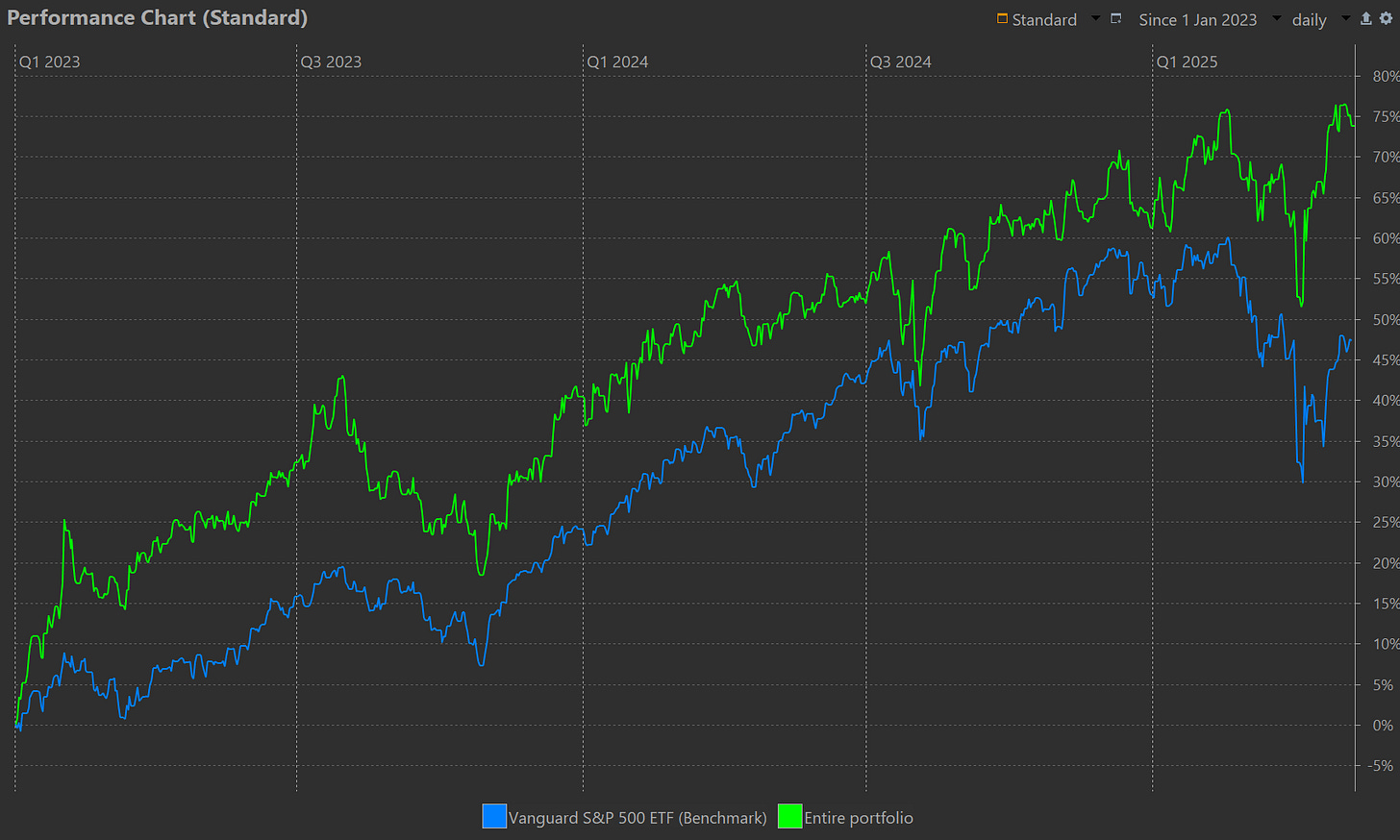

The result?

An annualized TWR of 28.17% since inception.

If you like the way we think and want to see how we invest, subscribe here and become a paid subscriber to see our full portfolio, complete with our reasoning behind each position.

You can get a 20% lifetime discount here if you are interested.

Until next week,

Dom

Founder & Chief Investment Officer

Schwar Capital

📌 PS - If you found this post valuable, please consider sharing it with someone who might benefit from thinking differently about cash and opportunity. 🙏

Thanks for reading Schwar Capital! Subscribe for more content like this.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

Really good post! To be honest, using screeners I’ve never found opportunities that I had not heard about before from publications, podcasts, etc.

Interesting. I use screens a lot but not in the way you are describing people use it. I have a simple set up to identify certain valuation metrics. The actual investment decisions is made after extensive reading of financial reports though. Screens are used to see what is moving and why.