Welcome to this week's edition of Reflections. Today, we explore how AI is revolutionising investing for smaller players, giving individuals tools once exclusive to large institutions. While Wall Street firms have historically dominated the landscape with their deep pockets and access to expensive data, new AI-powered tools are levelling the playing field.

“Artificial intelligence is not a substitute for human intelligence; it is a tool to amplify human creativity and ingenuity.” – Fei-Fei Li

The Rise of AI in Investing

Institutional investors used to hold all the cards. With vast budgets and access to cutting-edge tools, they could dominate markets while smaller investors struggled to keep up. Information was fragmented, slow to access, and often hidden deep in quarterly reports or obscure filings.

But AI has changed everything.

For the first time, individual investors can access insights that rival those of Wall Street—without spending thousands. Metrics, trends, and company analyses that once required weeks of manual work are now available in seconds.

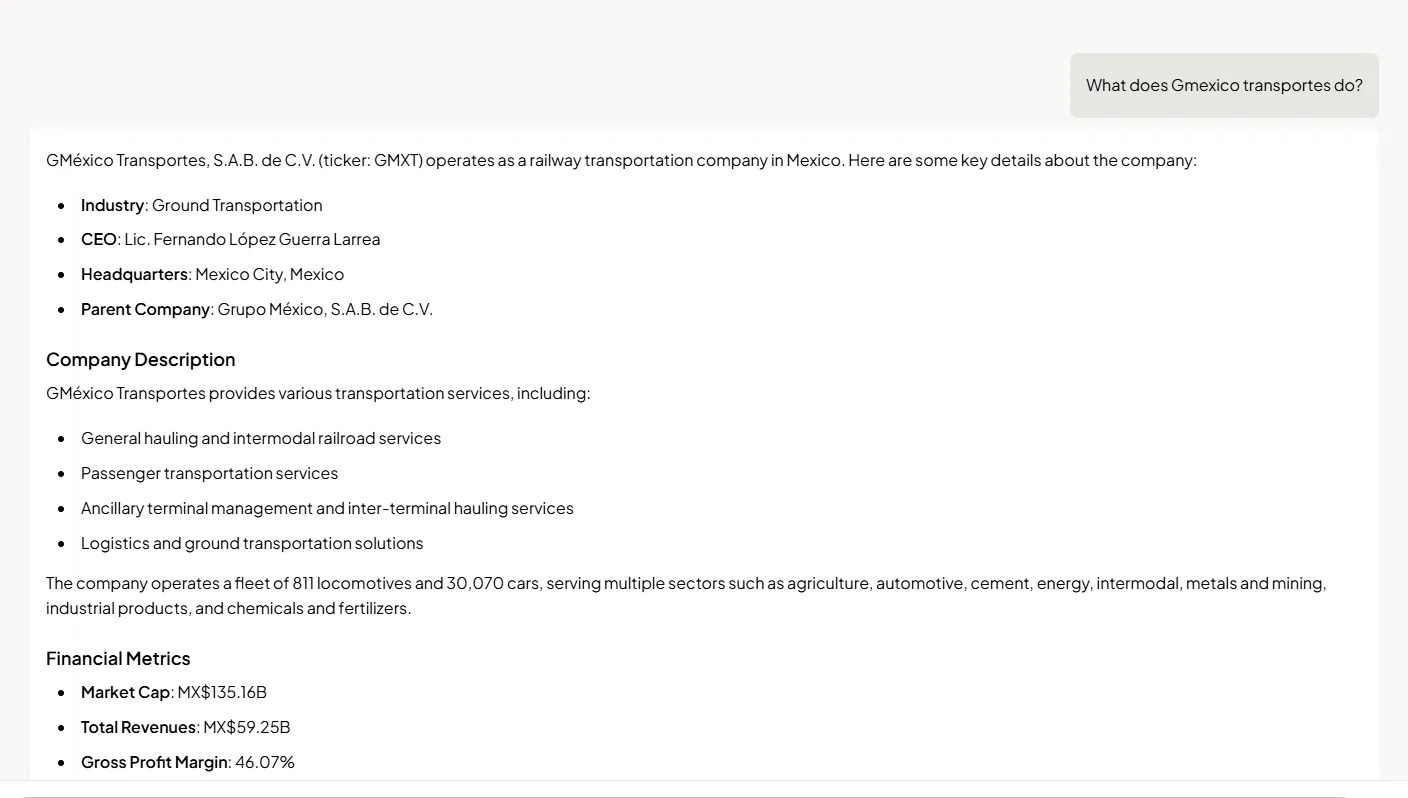

AI tools like Finchat not only save time, but also help uncover opportunities that might otherwise remain hidden. They act like a personal research assistant, sifting through enormous volumes of data and presenting the most relevant insights in a digestible way. Whether it’s tracking performance metrics, building a watchlist, or digging into industry comparisons, these tools help you invest smarter.

AI tools level the field not by eliminating research, but by making better research faster and easier.

More Time, Better Decisions

Investing well requires time—something most small investors lack.

AI simplifies this by automating routine tasks and cutting through unnecessary noise. Imagine needing subscriber growth figures or specific revenue breakdowns. Instead of digging through reports for hours, tools like Finchat deliver key data instantly.

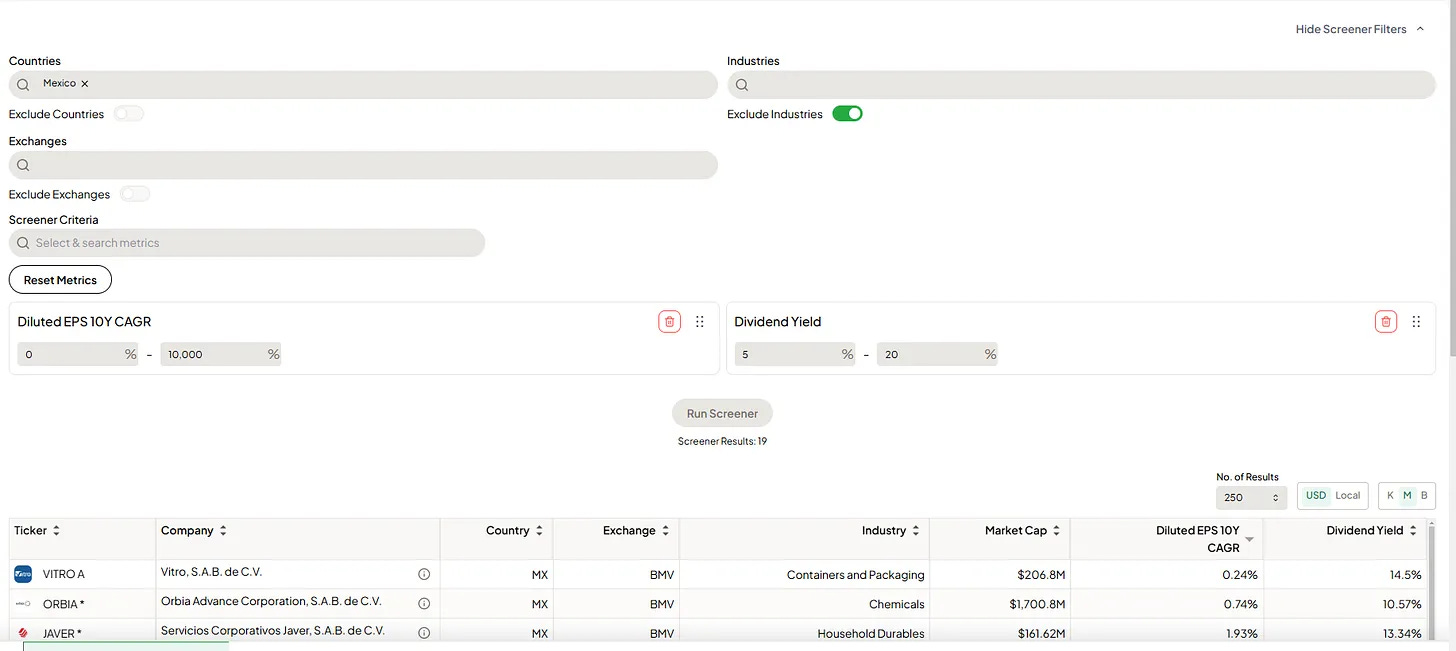

Stock screeners, too, have become far more advanced. Instead of spitting out generic lists, today’s AI-powered versions allow you to target exactly what you’re looking for—whether it’s dividend yields in Mexico, revenue growth in Europe, or earnings stability across decades. The result? You spend less time filtering and more time focusing on opportunities that matter.

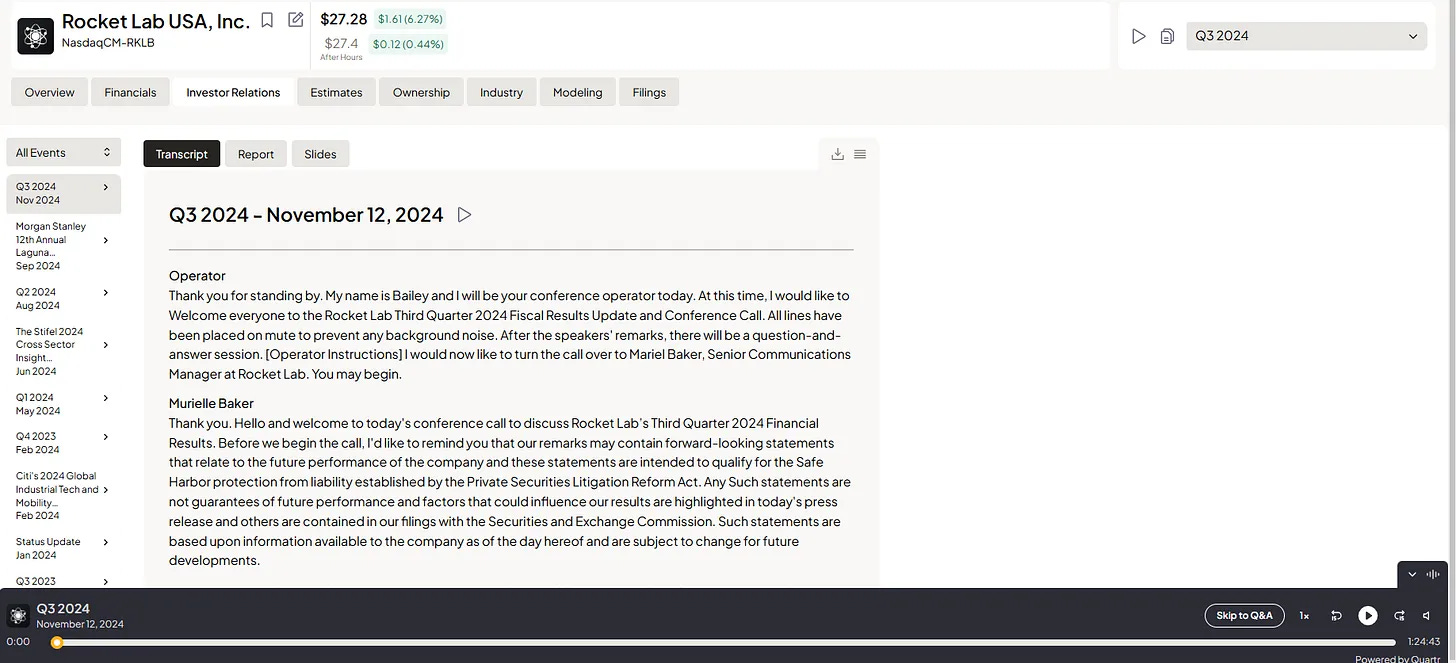

Even conference call transcripts and regulatory filings are now neatly aggregated. You no longer need to juggle multiple websites just to get the full picture of a company. AI ensures you have everything you need at your fingertips.

In investing, time spent thinking matters far more than time spent searching.

Why Finchat Stands Out

We’ve explored many tools, and Finchat consistently stands out for its depth and simplicity. Whether you’re building a watchlist or finding your next position, it combines features that make research intuitive and effective:

KPI Insights: From subscriber data to segment revenue, access metrics you won’t find on standard platforms.

Smart Screeners: Hyper-specific filters let you find opportunities tailored to your goals.

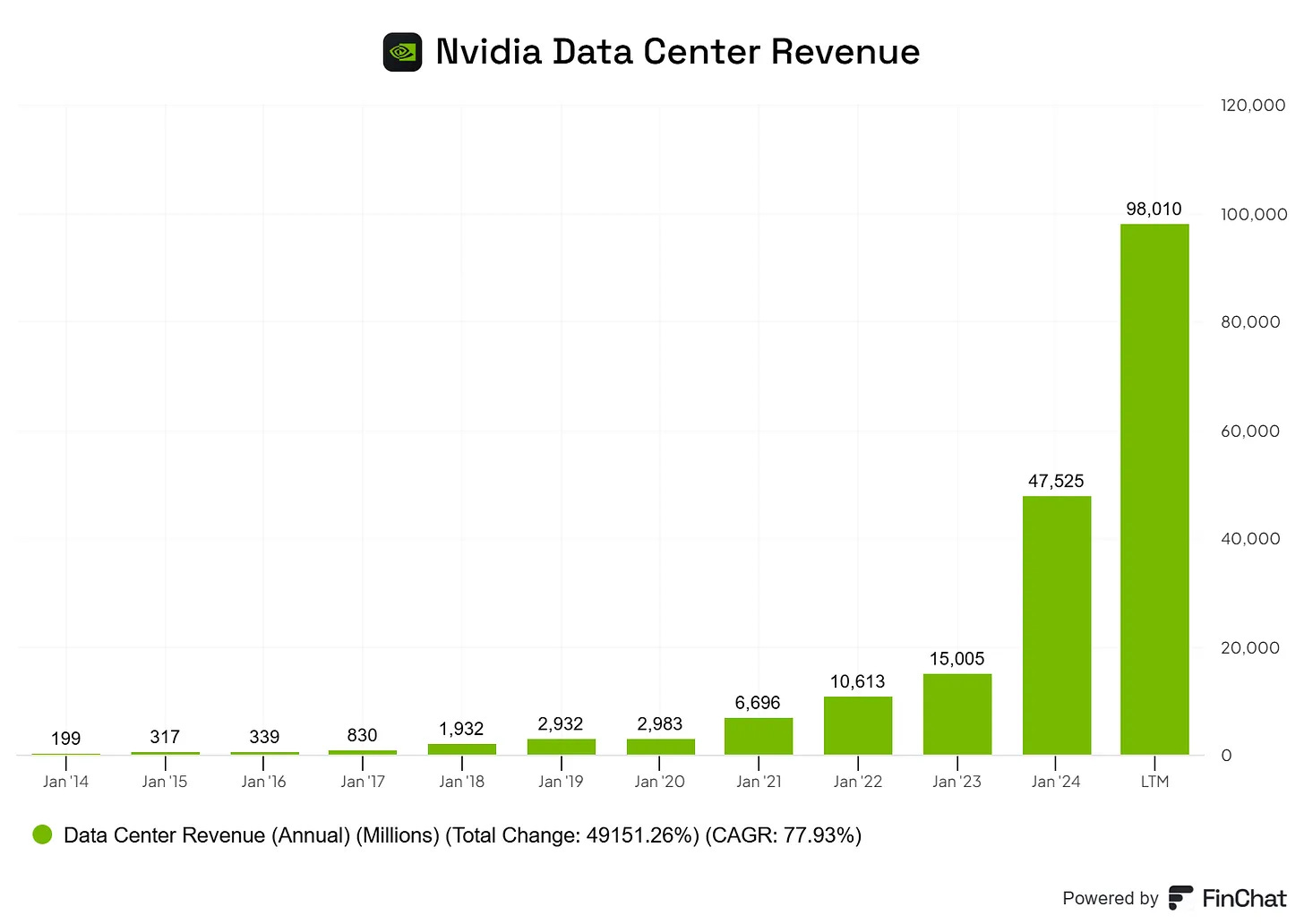

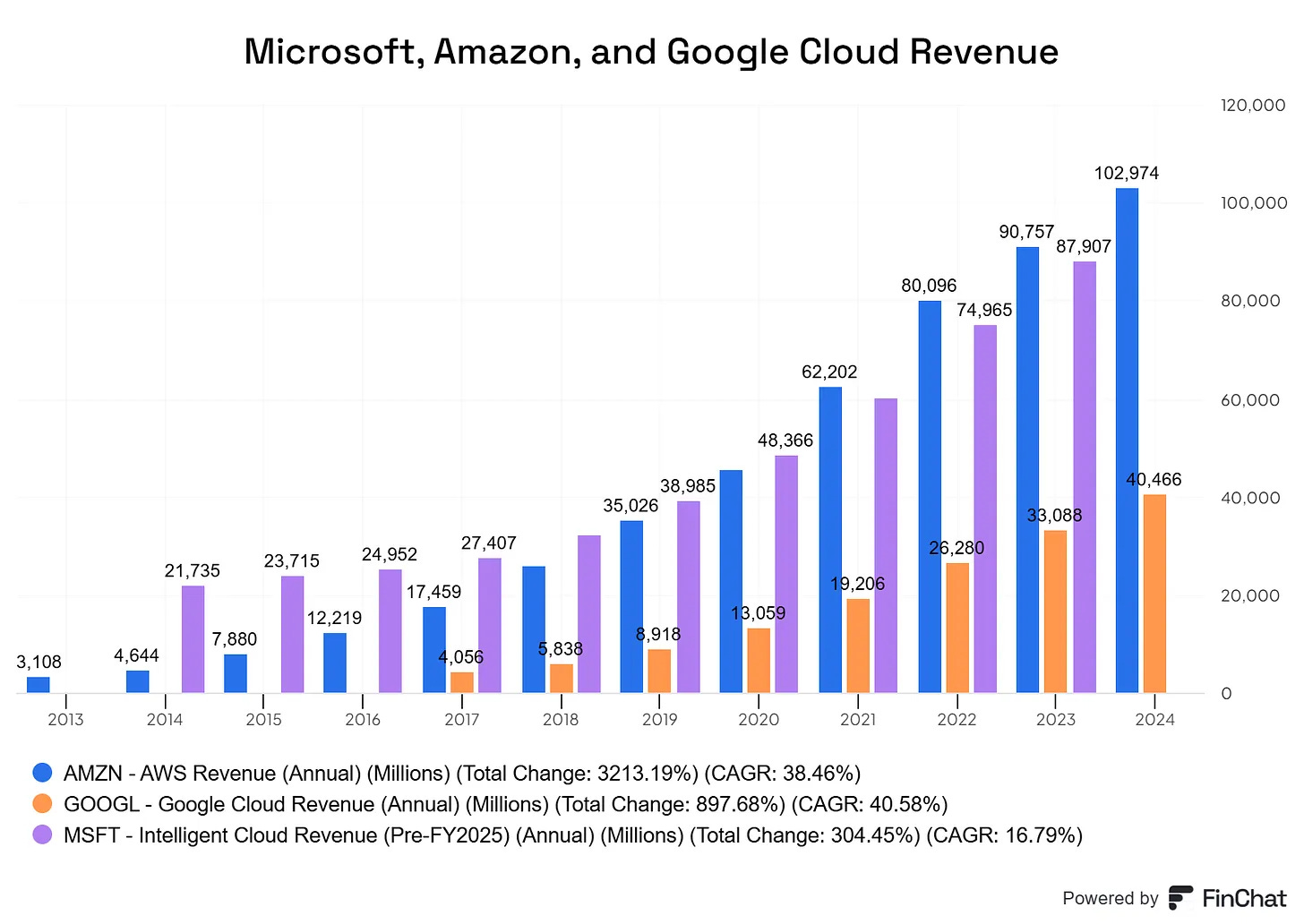

Advanced Charting: Visualise and compare company metrics over decades to identify trends and outliers.

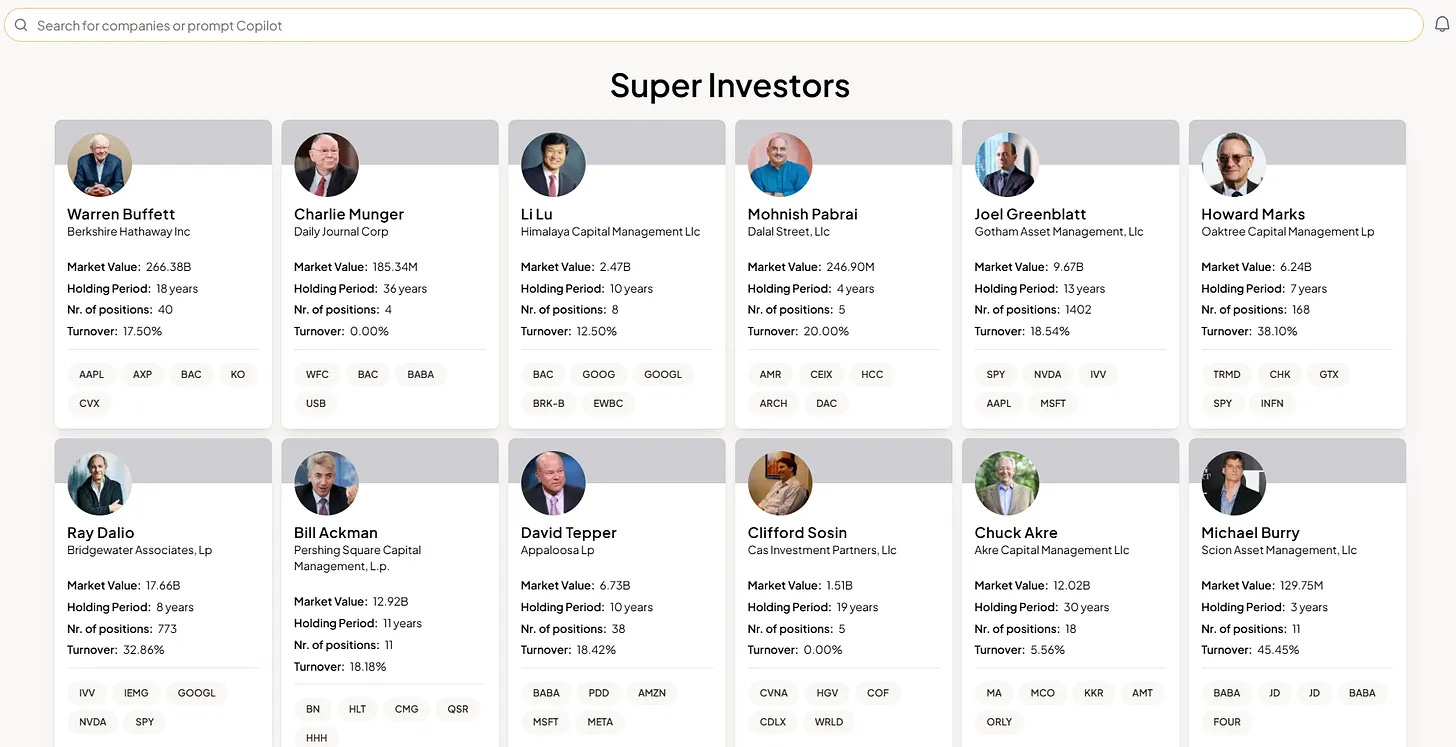

Ownership Trends: Explore what the top investors are buying and selling.

Investor Relations & Filings: Access conference call transcripts, ownership data, and regulatory filings all in one place.

AI Copilot: Ask deep questions about any company or sector and receive detailed, AI-driven answers.

The Edge AI Provides

For smaller investors, the power of AI isn’t just in the speed or breadth of information it offers—it’s in the ability to make better decisions. By levelling the playing field, AI-driven tools like Finchat give you access to the same quality of data that institutional investors rely on.

If you’re serious about improving your investing process, these tools are no longer optional. They’re essential.

We’re excited to announce that Schwar Capital has partnered with Finchat to bring our readers an exclusive 15% discount on their platform for a limited time.

If you’ve ever wanted to experience the benefits of AI-driven research, now is the time to try it out!

We hope you enjoyed this post. If you found it valuable, feel free to share it, and stay tuned for our next edition!

Enjoy the rest of your week.

The S.C. Team

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions. We receive affiliate commissions when you subscribe to Finchat using our link.

I would also add Quartr for all investor relations material, and access to recordings

This convinced me to try out the the paid version