The Lollapalooza Effect: Why Multiple Factors Create Investment Opportunities Others Miss

When several forces align, the result isn't addition - it's multiplication

To read our full disclaimer, click here.

Most investors hunt for single catalysts.

One reason to buy.

One compelling metric.

One compelling story.

They're missing the real prize.

The truly exceptional returns come when multiple forces align simultaneously. When psychological biases, business fundamentals, and market dynamics all point in the same direction.

Here's what most people don't understand: These forces don't just add up.

They multiply.

The Lollapalooza Effect.

A term coined by Charlie Munger, borrowing from the famous music festival where multiple bands create an experience far greater than any single performance.

In investing, it describes what happens when several psychological and business forces combine.

The result?

Explosive.

The Anatomy of Multiplication

Picture this scenario:

A quality company trades at 12x earnings (undervalued). Management announces a share buyback programme (reducing supply). A competitor exits the market (increasing pricing power). Short sellers get squeezed (forced buying). Institutional investors start taking notice (momentum builds).

Any one of these factors might move the stock 10-15%.

All five together?

We're talking about a different game entirely.

As Munger observed:

"The most important thing to keep in mind is the idea from chemistry that in some systems, a small amount of catalyst can have an enormous effect on the outcome."

That catalyst isn't always obvious. It's the combination that matters.

Why Others Miss It

Most investors think linearly.

They see Factor A and predict Outcome A. They see Factor B and predict Outcome B.

Wrong approach.

The magic happens at the intersection. When social proof meets scarcity. When fear meets forced selling. When quality meets deep value.

Nassim Taleb calls this "convexity"—situations where small changes produce disproportionately large results.

Here's the uncomfortable truth: Recognising Lollapalooza opportunities requires more work.

You can't just run a screen for low P/E ratios. You can't just follow insider buying. You need to understand how multiple forces interact.

Most investors aren't willing to do that work.

That's your edge.

The Three Layers

Great Lollapalooza opportunities typically have three layers:

1. Business Reality

Something fundamental is changing. Market share is shifting. Costs are falling. Moats are widening.

2. Market Psychology

Fear, greed, or misunderstanding creates a gap between perception and reality.

3. Technical Forces

Share buybacks, short covering, index inclusion, or institutional flows amplify the move.

A Real Example

Consider Warren Buffett's Bank of America investment in 2011.

Business Reality: Post-crisis, fundamentally strong bank trading below book value.

Market Psychology: Everyone feared banking. Regulatory uncertainty everywhere. "Never again" mentality.

Technical Forces: Forced selling by institutions. Massive short interest. Capital requirements creating artificial selling pressure.

Result? Berkshire's $5 billion preferred stock investment eventually generated over $35 billion in value.

That's Lollapalooza.

How to Spot Them

The best opportunities often emerge during periods of maximum discomfort.

When headlines scream danger. When "experts" recommend avoiding entire sectors. When your neighbours think you've lost your mind.

Ask yourself:

Are multiple negative factors already priced in?

What happens when even one of these factors reverses?

Could several reverse simultaneously?

The market occasionally creates situations where everything that can go wrong already has.

Those are the moments to pay attention.

The Patience Premium

Here's what separates professionals from amateurs: timing.

Recognising a potential Lollapalooza situation is step one. Having the patience to wait for all factors to align is step two.

Sometimes that takes months. Sometimes years.

Most investors can't wait. They need action. They need movement. They need something happening.

That impatience is precisely what creates your opportunity.

Your job is to position yourself before the weighing begins.

Bottom Line

The Lollapalooza Effect isn't about finding more factors.

It's about finding the right factors.

It's about understanding how business fundamentals, market psychology, and technical forces interact - and positioning yourself before they converge.

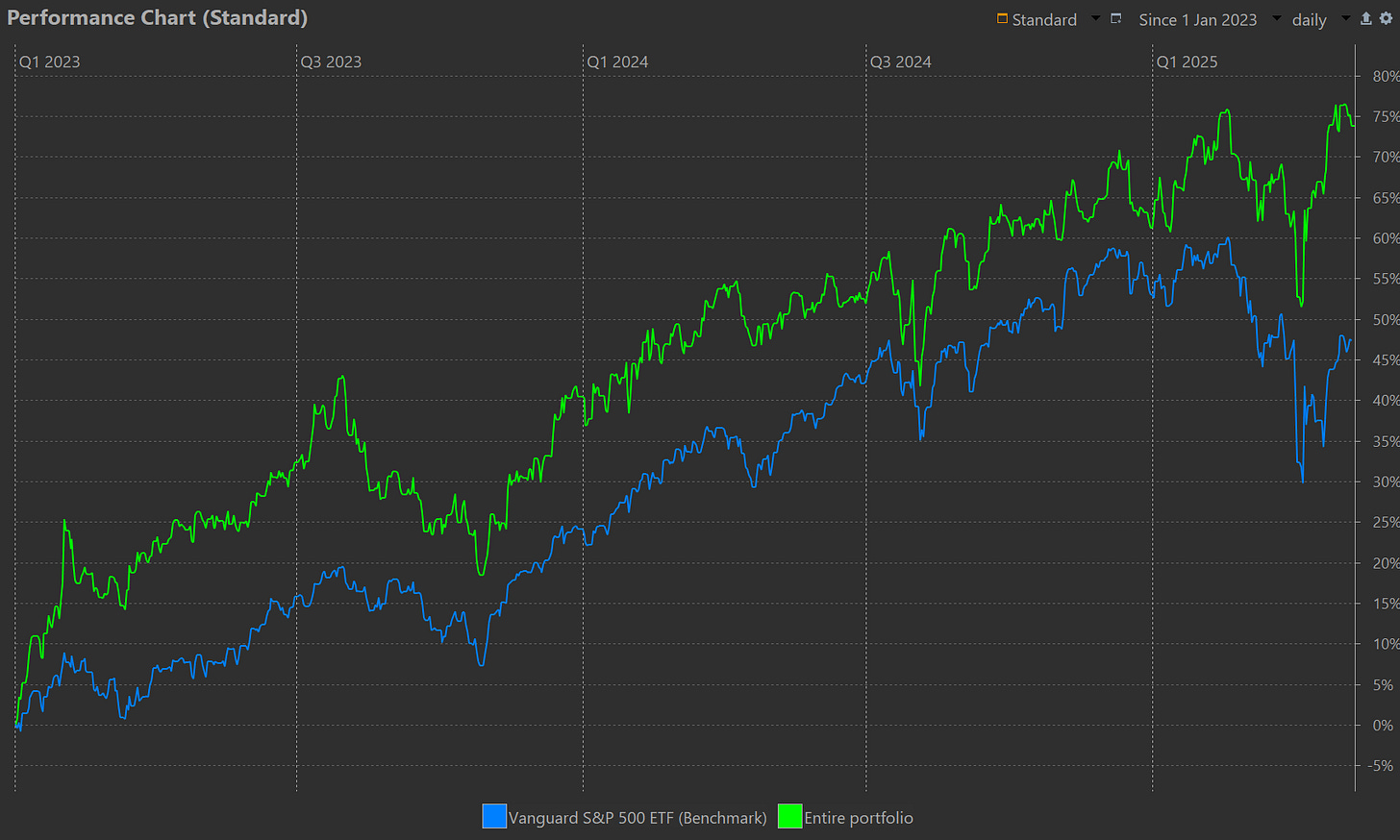

We believe that a significant reason Schwar Capital has delivered exceptional returns since inception is because of our focus on identifying these multiplicative moments.

This approach has helped us spot opportunities others miss and capitalise on convergence that conventional thinking overlooks.

If you like the way we think and want to see how we invest, subscribe here and become a paid subscriber to see our full portfolio, complete with our reasoning behind each position.

That's your opportunity.

Until next week,

Dom

Founder & Chief Investment Officer

Schwar Capital

📌 PS - If you found this post valuable, please consider sharing it with someone who might benefit from thinking differently about cash and opportunity. 🙏

Thanks for reading Schwar Capital! Subscribe for more content like this.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

I prefer the Lollapalooza Moat. I believe I have found it in TGLS in the early stage and am happy about that.