The Hidden Power of Doing Nothing (and Being Ready for Everything)

Why Buffett is Hoarding So Much Cash

To read our full disclaimer, click here.

Cash isn't just an asset.

It's optionality.

And optionality might be the most undervalued concept in investing.

Let me explain…

Most people think about investing backwards.

They see cash as dead money.

Empty space.

Wasted potential.

But Nassim Taleb understood something different:

"The inability to predict outliers implies the inability to predict the course of history."

Translation?

You can't time the market.

But you can stay ready for it.

That's what optionality gives you.

What Is Optionality?

Simple definition:

Having the right, but not the obligation, to act.

Think of it like this.

You're at a restaurant.

The waiter asks if you want dessert.

You say, "Maybe - let me see how I feel after the main course."

That's optionality.

You've kept your decision open until you have more information.

In investing, optionality works the same way. It's about positioning yourself to benefit from uncertainty rather than being crushed by it.

The best investors don't predict the future.

They prepare for it.

Warren Buffett keeps billions in cash not because he's pessimistic. But because he knows opportunity requires readiness.

Cash combined with courage in a crisis is priceless.

The key word?

Combined.

Cash without courage is just fear. Courage without cash is just hope.

You need both.

The Asymmetric Nature of Options

Here's where it gets interesting.

Not all options are created equal.

Watching Netflix for hours gives you options (what to watch next), but no upside.

Buying a beaten-down quality stock gives you asymmetric optionality.

Limited downside. Unlimited upside.

That's the kind of option you want to collect.

Take March 2020.

Everything was falling apart. Panic everywhere. Most investors were frozen.

But those with optionality? They were shopping.

Quality companies at once-in-a-decade prices. The downside was maybe another 20-30% drop. The upside was multiples over the following years.

That's asymmetric optionality in action.

Three Ways to Build Optionality

1. The Barbell Strategy

Taleb's favourite approach: 90% in safe, boring assets. 10% in high-risk, high-reward bets.

Most of your money stays protected. But you're positioned for the extraordinary.

This isn't about being conservative.

It's about being antifragile.

When markets crash, your safe assets preserve capital. When they soar, your risk assets capture the upside.

You win either way.

2. Quality at Reasonable Prices

Charlie Munger called it "sit on your arse investing."

Buy wonderful businesses when they're reasonably priced.

Then wait.

These companies give you optionality through time.

Each year they compound, they create more options for reinvestment, acquisition, or distribution.

The downside is limited by the quality of the business.

The upside is unlimited by the power of compounding.

3. Keep Powder Dry

The hardest part of optionality? Waiting.

Every day you hold cash, you feel like you're missing out. Every week your fully invested friends might outperform you.

But optionality isn't about maximising returns in good times.

It's about positioning for great times.

As Howard Marks writes: "Being too far ahead of your time is indistinguishable from being wrong."

Stay patient. Stay ready.

The Hidden Cost of Being Fully Invested

Here's what most investors don't realise.

When you're 100% invested, you've given up all your options.

You can only benefit if everything you already own goes up.

You can't take advantage of new opportunities. You can't pivot when the world changes.

You've traded optionality for certainty.

And in an uncertain world, that's usually a losing trade.

Think about the greatest investment opportunities of the last decade.

Who benefited most?

Those who were ready.

Not those who predicted these events (impossible). But those who had maintained optionality to act when they occurred.

Bottom Line

Optionality isn't about being indecisive.

It's about being strategically flexible.

It's about collecting the right kinds of options - those with limited downside and unlimited upside.

And it's about having the patience to wait for the right moment to exercise them.

In a world obsessed with prediction, optionality offers something better: preparation.

The future will surprise us. Markets will do unexpected things. Opportunities will arise from nowhere.

The question isn't whether this will happen.

It's whether you'll be ready when it does.

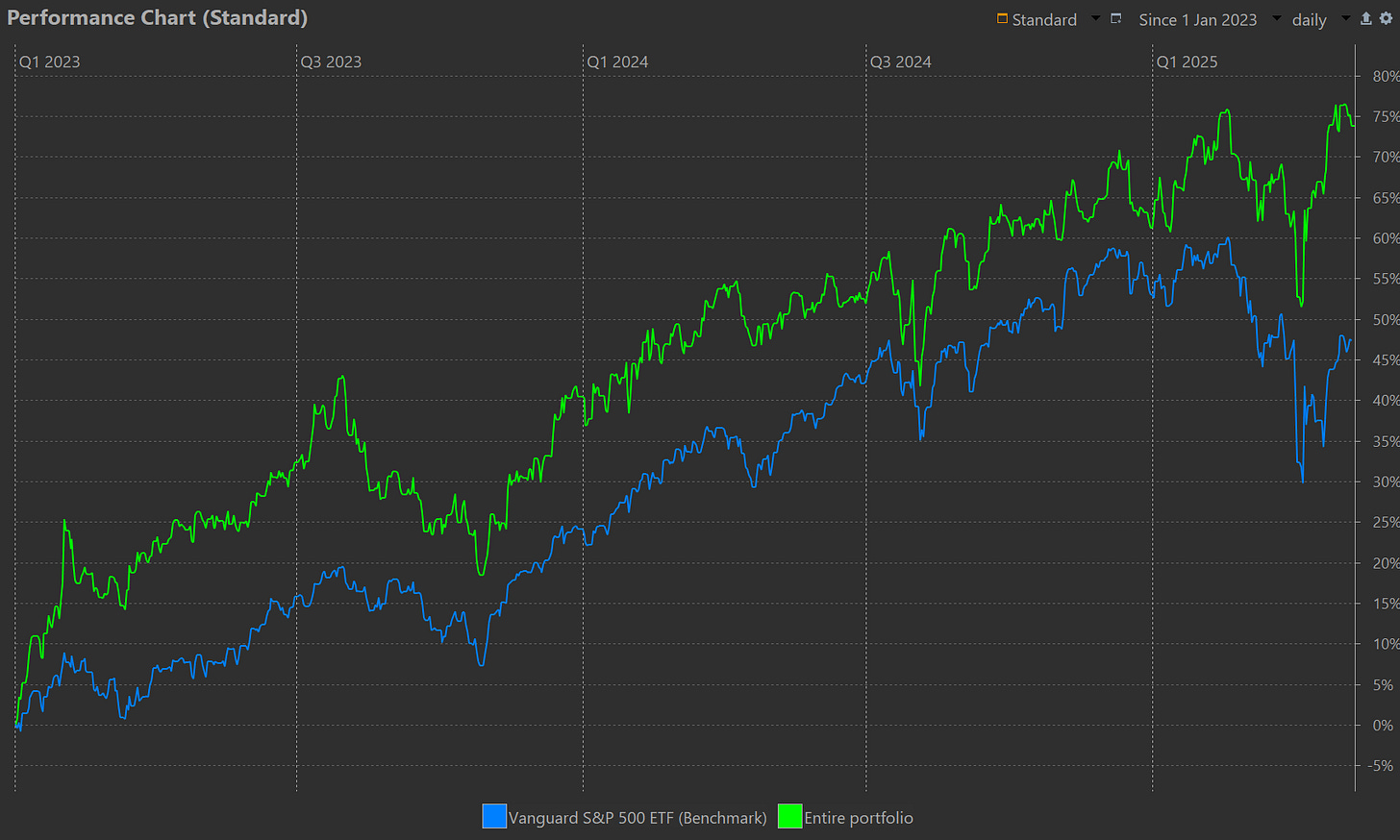

We believe that a big reason that Schwar Capital has returned 26.55% annualised TWRR since inception is because of our emphasis on optionality. This approach has helped us identify opportunities others miss and avoid pitfalls that trap conventional thinkers.

If you like the way we think and want to see how we invest, subscribe here and become a paid subscriber to see our full portfolio, complete with our reasoning behind each position.

That's your opportunity.

Until next week,

Dom

Founder & Chief Investment Officer

Schwar Capital

📌 PS - If you found this post valuable, please consider sharing it with someone who might benefit from thinking differently about cash and opportunity. 🙏

Thanks for reading Schwar Capital! Subscribe for more content like this.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.