Ever wonder why having more choices often makes decisions harder, not easier? Or why smart people can completely change their minds about everything they thought they knew? Or what invisible forces shape the decisions we think we're making rationally? This week, we're diving into the fascinating world of choices, transformations, and the hidden forces that shape our financial futures.

📚 Three Worthwhile Reads

1. “The Purgatory of Endless Possibility” by

Why it matters: A profound look at how keeping all options open can paradoxically trap us in decision paralysis.

Key insight: While you can be anything, you can't be everything - and that's okay.

From my desk: This perfectly captures why some investors never fully commit to a strategy, always chasing the next "better" opportunity.

2. “Was John Maynard Keynes A Value Investor?” by

Why it matters: Even the world's top economist eventually abandoned macro trading for value investing.

Key insight: Keynes' journey from macro trading to value investing shows that simpler, long-term approaches often win.

From my desk: Sometimes the best investment strategy isn't the most intellectually stimulating one - it's the one you can stick with.

3. "Influence: The Psychology of Persuasion" by Robert Cialdini

Why it matters: Understanding how influence works is your best defence against making emotional investment decisions.

Key insight: Most of our decisions are driven by automatic triggers - knowing them helps us spot when they're being used against us.

From my desk: The section on scarcity particularly resonates with how FOMO drives market bubbles. Next time you feel urgency in an investment decision, ask yourself: Is this real scarcity or manufactured pressure?

💭 Two Quotes Worth Considering

1. On Decision Making:

"The more choices you have, the harder it gets to choose, and the less satisfied you become with your choice." — Barry Schwartz

Why it matters: In investing, having too many options can lead to analysis paralysis or constant second-guessing. Sometimes, limiting our universe of potential investments actually improves our decision-making.

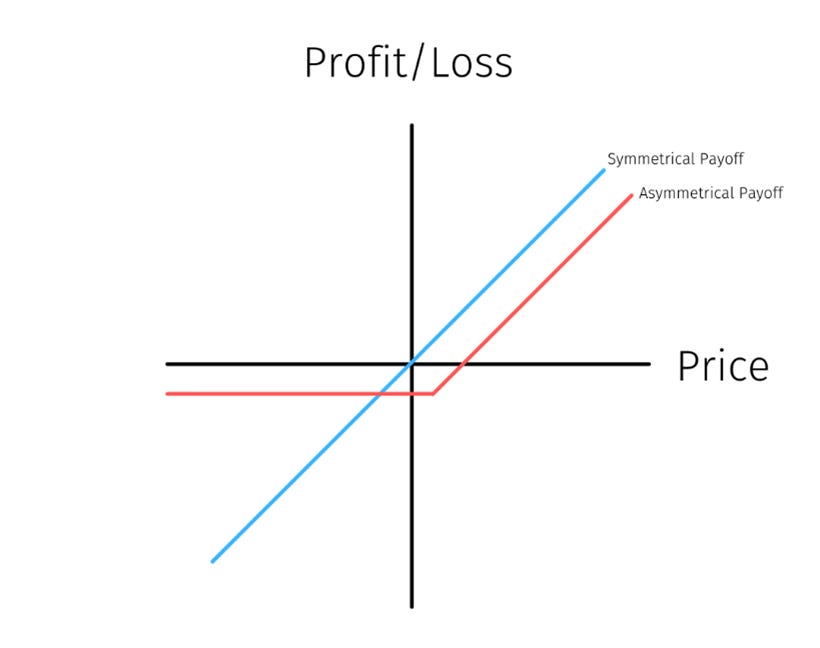

2. On Intelligent Risk-Taking:

"Successful investing is about managing risk, not avoiding it." — Benjamin Graham

Real-world application: Most failed investors I've met weren't ruined by taking too much risk - they were ruined by taking the wrong kinds of risks. Graham knew that great investing isn't about finding "safe" investments, but about understanding the risks you're taking.

🤔 One Question to Consider

How do you balance keeping your options open with making committed decisions in your portfolio?

Context: In a world of endless investment opportunities, success often comes from narrowing our focus rather than expanding it.

Now you’ve done the poll, why don’t you like this post as well? It helps know you enjoy this content. Thanks!

My thoughts: The best investors I know aren't the ones who keep every option open - they're the ones who develop deep expertise in specific areas and stick to their circle of competence.

🎯 Quick Updates

What's New

Latest Portfolio Update:

ICYMI:

Visual of the Week

Companies on My Radar

Greggs (GRG): Finishing up our investment thesis statement- dropping this Friday.

Currently Reading

"Influence" by Robert Cialdini - Reading this classic on the psychology of persuasion and decision-making.

Dom

Founder & Chief Investment Officer

Schwar Capital

P.S. If you found value in these ideas, consider sharing this newsletter with other thoughtful investors. The best asymmetric opportunity might be the compound effect of growing this community together.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.