NU +74% Net Income + Our Serial Acquirer Deploys 95% of FCF on M&A

Breaking down two critical earnings reports that tell very different stories

We're sharing part of this analysis for free to demonstrate the value you can expect as a paid Schwar Capital subscriber.

Two very different earnings stories just crossed our desk. One shows explosive growth, while the other demonstrates strategic patience during a cyclical trough. Let's dive into what these results mean for our portfolio.

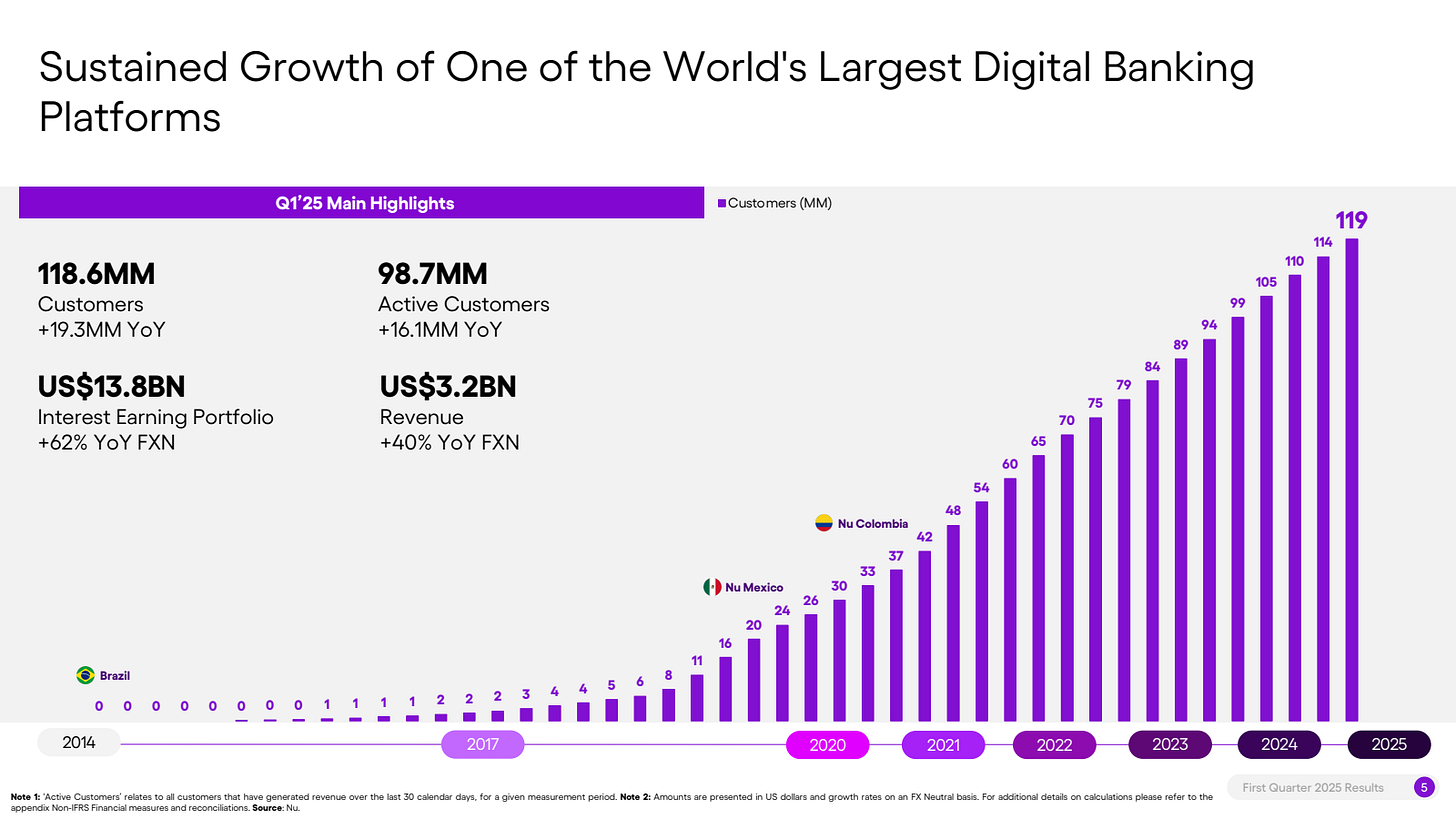

NuBank (NU)

NuBank's Q1 2025 results showcase why this company has become one of the most compelling growth stories in global fintech. Despite some margin pressure and credit challenges, the underlying growth trajectory remains extraordinary.

You can see our full investment thesis here:

The Headline Numbers: Scale Meets Execution

Customer base hit 118.6 million with 4.3 million net additions in Q1

Revenue surged 40% YoY (FX-neutral) to $3.2 billion

Monthly active users reached 98.7 million with 83% activity rate

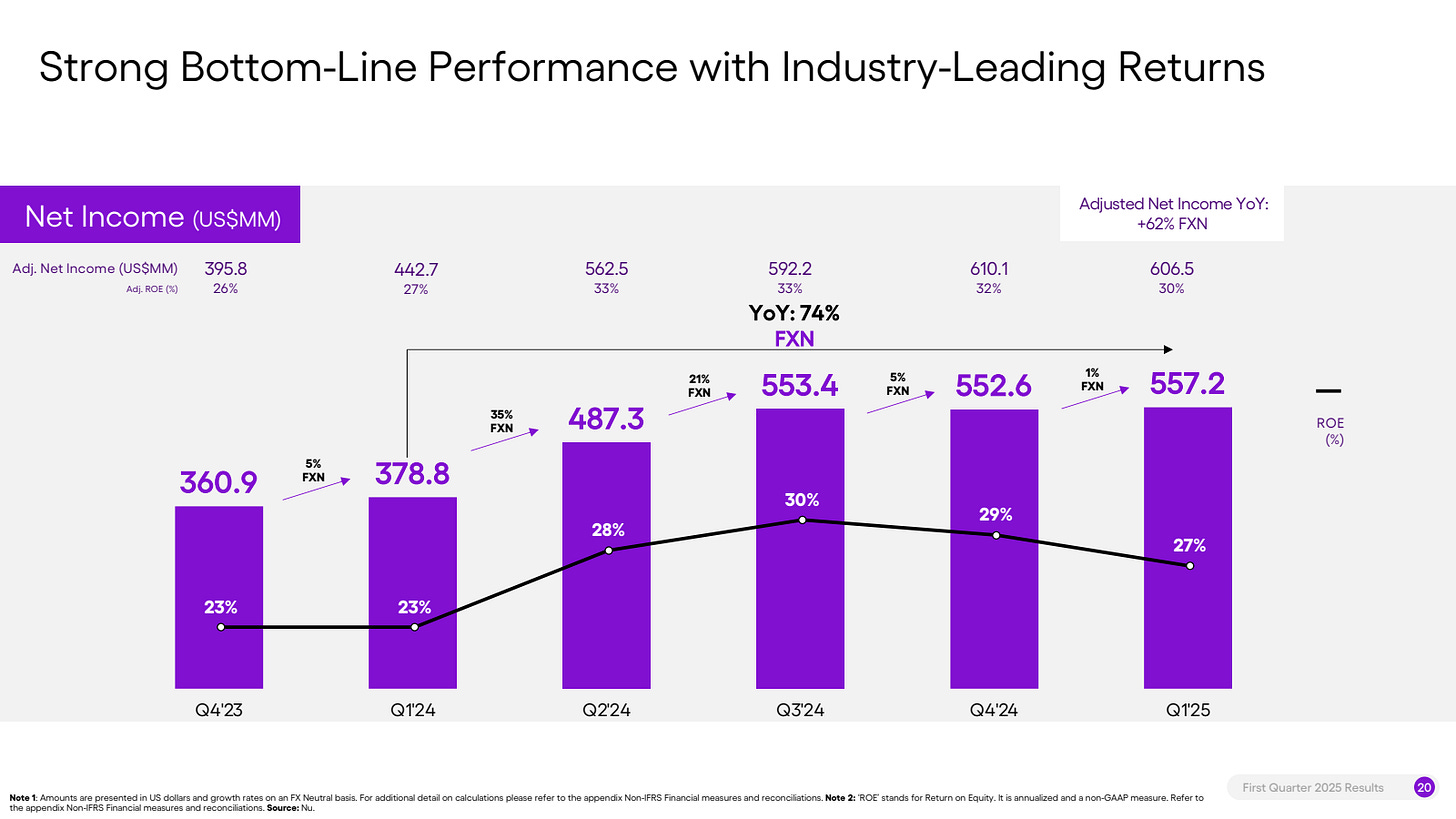

Net income jumped 74% YoY (FX-neutral) to $557.2 million

Cash position strengthened by $834.8 million to $10.28 billion

Revenue increased 14% YoY (17% constant currency) to $11.5 billion

Income from operations reached $1.2 billion, up $1.1 billion YoY

Free cash flow soared 66% YoY to $2.3 billion (annualizing to $9.2B)

You can see shorter earning summaries that cover all the stocks in our watchlist by Subscribing here to Schwar’s Radar

The Good, The Bad, The Strategic

What's Working:

Monthly ARPAC increased to $11.2 from $9.6 YoY - higher revenue per customer

Cost to serve dropped to $0.7 from $0.8 YoY - improving efficiency at scale

Efficiency ratio improved to 24.7% - massive 740 bps improvement YoY

Strong asset quality in core segments with stable delinquency rates in key portfolios

Product diversification accelerating with successful new financial product launches

What's Challenging:

Net Interest Margin (NIM) compression from higher funding costs and competitive pressure

Increased credit loss provisions reflecting tougher macro environment

Rising operating expenses from technology investments and expansion

Regulatory headwinds affecting some product profitability

Why The Negatives Don't Derail The Story

While NIM compression and higher credit provisions grabbed headlines, they're largely the natural result of Nu's massive scale and market maturation. Here's why we're not concerned:

NIM pressure is industry-wide as Brazilian fintech matures - Nu's scale advantages should help it weather better than competitors

Credit provisions are proactive rather than reactive - management is getting ahead of potential issues

Operating expense increases are investments in technology and expansion that should drive future profitability

Regulatory challenges create moats - established players like Nu benefit from compliance infrastructure that startups can't match

The Bottom Line on Nu

At 118.6 million customers generating improving unit economics, NuBank has achieved the scale that creates defensive advantages. The combination of market leadership in Brazil plus early-mover advantage in Mexico and Colombia creates a powerful platform for sustained growth.

Yes, margins are under pressure. Yes, credit costs are rising. But these are growing pains for a company transforming Latin American banking, not structural problems.

The cash fortress of $10.28 billion provides tremendous strategic flexibility, while the 44% loan-to-deposit ratio shows conservative risk management despite aggressive growth.

We are happy to maintain holding NU and we will be adding to our position if the price falls under $10.5.

Limited Time Offer: 20% Off New Subscriptions

Curious about our largest position and what we think of their recent earnings? Subscribe now to unlock all premium member benefits and complementary access to Schwar’s Radar.