KSPI, RAVE and TEQ added to the SCRai

Performance update, announcements, and upcoming write-ups.

To read our full disclaimer, click here.

The reality of concentrated investing is simple: you find far more exceptional opportunities than any single portfolio can hold.

The Schwar Capital Research Asymmetry Index (SCRai) captures these opportunities.

Each one reflects what I view as an asymmetric setup - though not necessarily suitable for my current portfolio at this moment.

Performance:

The SCRai is down 4.18% since inception, compared with the S&P 500’s 3.63% decline.

Since last week’s post, LMN has climbed around 10%, while UBER has fallen about 8.5%, making them the clear standouts of the week.

But, we’re not reading much into these performance figures yet.

Until the index reaches its target size of around 50 names and has a few months under its belt, tracking performance will be difficult.

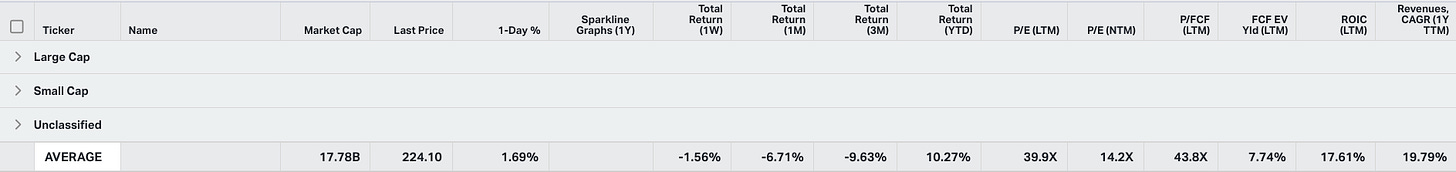

What might be more useful right now is looking at the average statistics of the companies in the Index.

As you can see, positions have been hit hard recently.

Yet the fundamentals suggest they may be undervalued: forward PEs are compressing significantly as earnings growth accelerates, with returns on invested capital over 15% on average and 20% revenue growth over the trailing twelve months.

These are averages, naturally. Individual companies may skew the figures.

But the premise holds: quality businesses, growing earnings and revenue at a strong clip, recently hammered.

All of which, we think, creates an asymmetric setup.

Updates:

We have added three positions to the index this week:

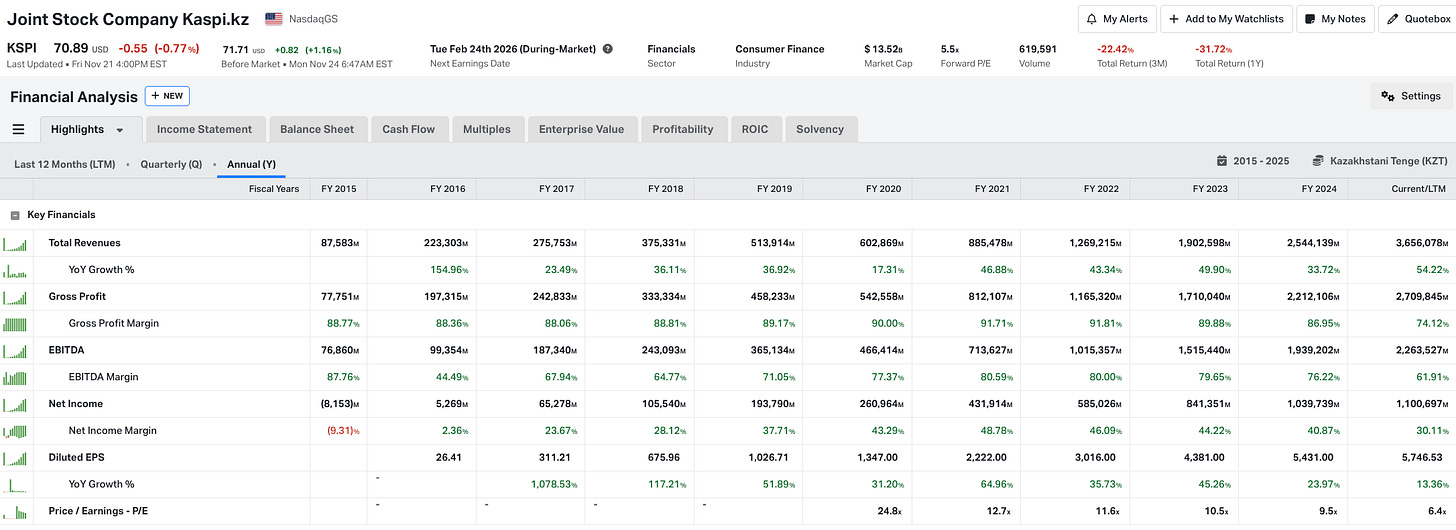

KSPI

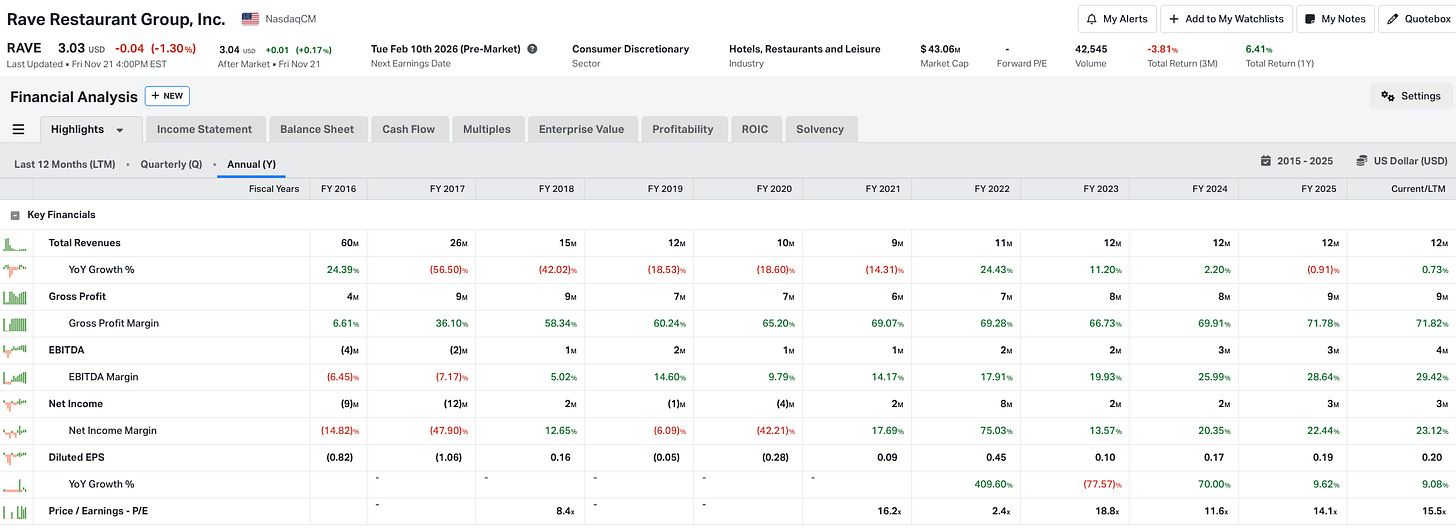

RAVE

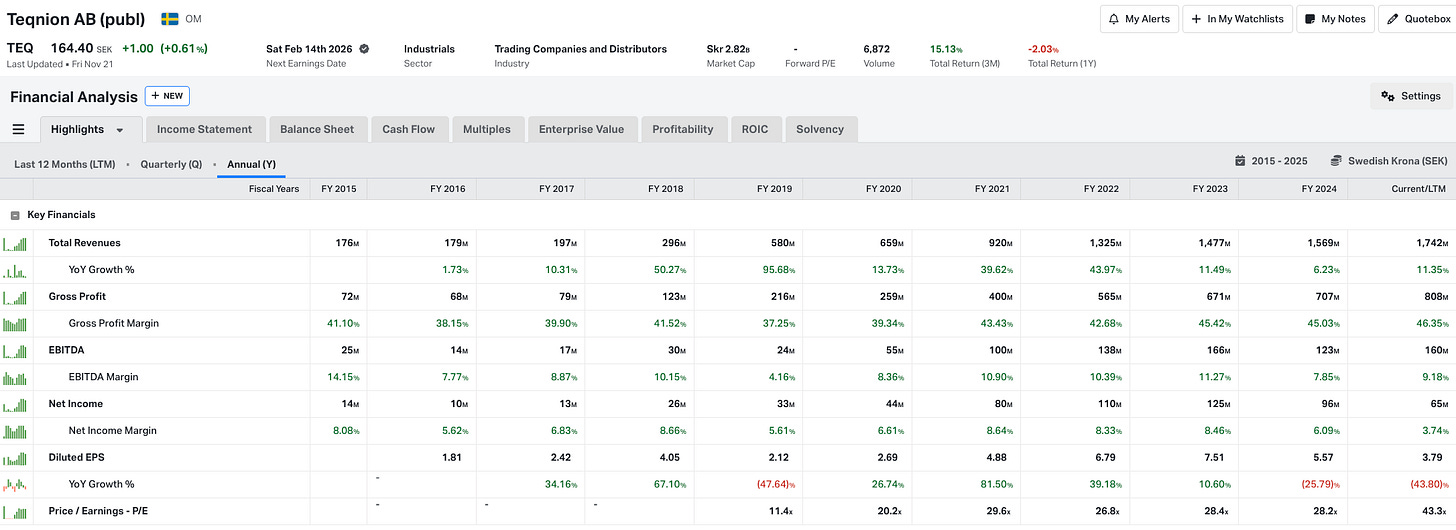

TEQ.ST

Coming this Week:

Wednesday: What The Godfather can teach us about investing; timeless lessons from strategy, discipline, and power.

Friday: A full investment thesis on Hagerty - now up 19% since we added it to the index.