I'm Adding to 4 of My Holdings

Portfolio Update #20 📊

To read our full disclaimer, click here.

As always the uncensored version of this post can be found at the end.

The portfolio has had a rough couple of months.

I think this underperformance has been amplified by my shift toward smaller companies and therefore more volatility.

That said, I’m not investing for short-term results.

I haven’t been happier with the composition of my portfolio in years. I think all of my positions offer exceptional value right now, especially when compared to the US market and the larger names currently discussed across Substack.

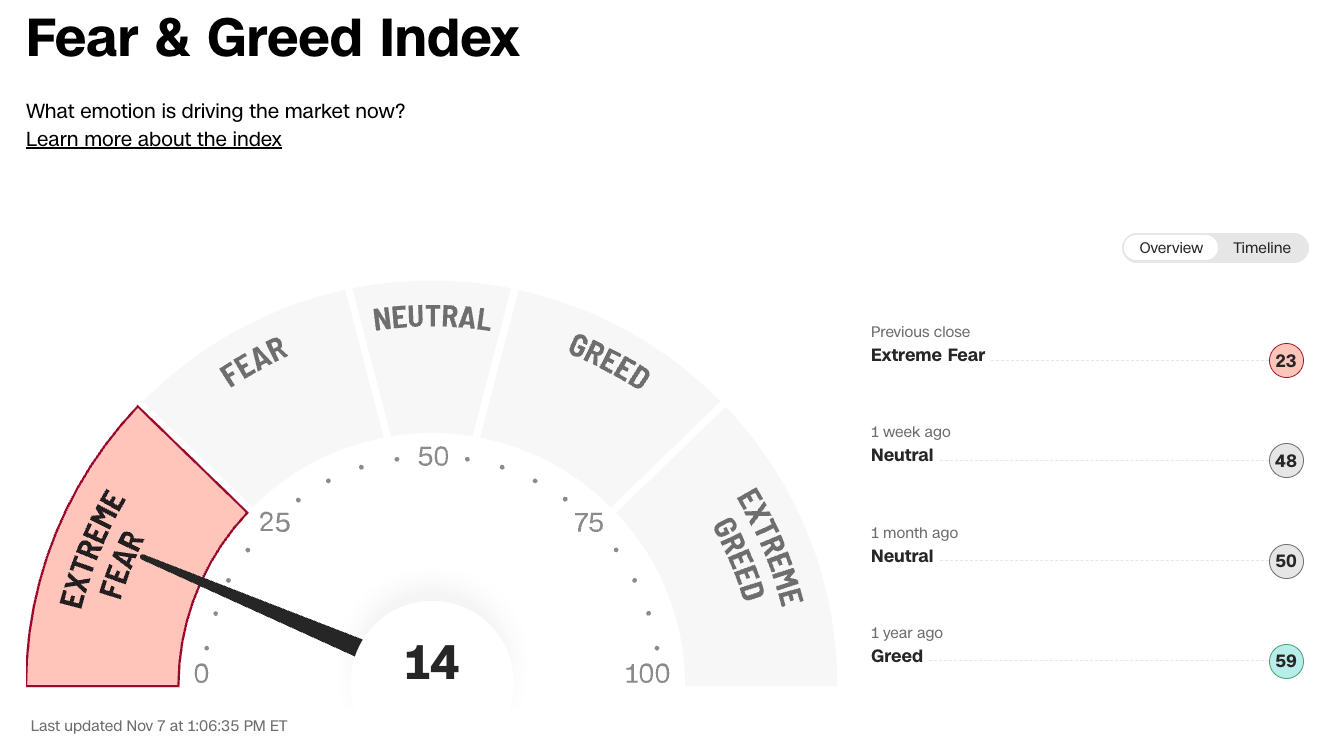

A quick reminder: we’re currently in extreme fear territory.

This is precisely why I’m buying.

Consider one example: [Company A].

PEG ratio: 0.47

PE: 6.75

Forward PE: 4.9

Dividend yield: 6%

Show me a well-known stock on Substack with metrics like that.

Yes, I may be underperforming a bit now. Yes, the decision on [Company B] has dented returns for the year.

But lessons have been learned.

The portfolio now features what I believe to be strong compounding potential from serial acquirers like [Company C], [Company D], and [Company E], alongside quality names such as [Company F] and [Company G].

Today, I added to four positions: [Company A], [Company C], [Company G], and [Company F].

You can see allocation percentages below.