The purpose of this article is to help you get the most out of your subscription to Schwar Capital.

Here is what I will cover in chronological order:

Our Goal

Key features of Schwar Capital (with quick links)

Stocks in our watchlist

Investment philosophy

Reviews

Special Gift…

1. Our Goal

Our goal here is simple.

To provide you with investment advice that is not only actionable but also generates alpha.

We assist money managers like you to optimise your returns while protecting against downside risk. Our proven investment strategies cut through market noise, freeing you to focus on what truly matters.

We hunt tirelessly for asymmetric investment opportunities - rare situations where potential upside significantly outweighs downside risk. We analyse countless opportunities, share our real portfolio decisions weekly, but only highlight the opportunities that meet our rigorous criteria.

Think of us as your investment research team, doing the heavy lifting to find special situations that can really move the needle, so you can focus on what matters to you.

By subscribing to our content, you will join a community of thousands of money managers, financial advisors, and perhaps most importantly likeminded investors who value our insights.

I want to personally thank you for being a subscriber and I hope you find value from our work. To show my appreciation, I've left a special gift for free subscribers at the end of this post.

2. Key features of Schwar Capital

These are all the exclusive features available to you today.

Paid subscribers have access to everything listed below, while free subscribers still receive select insights...

1. Complete access to Schwar Capital's Private Portfolio

Our Private Portfolio consists of a carefully curated selection of stocks representing what we believe are the most compelling opportunities in the market today.

We provide full transparency - you'll know exactly when we're buying and selling, allowing you to make informed decisions for your own portfolio.

The Private Portfolio’s performance can be found below:

Overall our annualised TWR now sits at 28.17%

Hundreds of professional investors and money managers rely on our Private Portfolio for market-beating returns. Full access to the portfolio and all trade alerts is available to paid subscribers. If you are interested, check out the special gift we have prepared for you at the end of this post…

2. Real-time trade alerts

Paid subscribers receive immediate notifications whenever we make moves in our Private Portfolio.

These timely alerts ensure you never miss an opportunity to act on our latest investment decisions, giving you the edge needed in today's fast-moving markets.

3. Bi-weekly deep dives / investment ideas

Twice monthly, we publish exhaustive company deep dives or our coveted investment thesis statements, outlining our reasoning for new portfolio positions.

Just look at our largest position, Nintendo, that we published as our first post that is up over 50% since, or Uber which we called out on the 20th of December and is now up 33% in a matter of months. Calls like these will pay for the subscription for life for many of you.

Here are FREE links to both of these statements so that you can see the quality of our work. We're giving these away so you can see exactly what you're getting when you become a paid subscriber.

4. Premium watchlist access

Our watchlist showcases opportunities we're monitoring closely before making portfolio decisions. This gives you advance notice of potential future moves and insights into our evaluation process.

You can see our full watchlist in the next section below.

5. Over 300 earnings summaries annually

We distill the noise of earnings seasons into actionable takeaways, focusing on what truly matters for long-term value creation.

Here’s an example of one of our earnings summaries:

6. Private community features

Connect with like-minded investors and investment professionals in our private community, where members share ideas, discuss market conditions, and help each other navigate challenging investment environments.

7. Memos

Our regular investment memos share time-tested investment teachings and principles that have created wealth for generations. We discuss unique, often overlooked perspectives on markets that you won't find in mainstream financial media, giving you an edge that few investors possess.

Here's what you can expect each week when you subscribe:

🧠 Monday – Memos: Exploring timeless investment principles.

📊 Friday – Research & Portfolio Updates: Detailed company analysis and investment updates on a bi-weekly basis.

Want to become a paid subscriber to Schwar Capital and access the full features of our investment service?

Keep reading to see the special gift we've prepared for you at the end of this post...

3. Stocks in our watchlist

Our watchlist consists of excellent and interesting companies that at the right price we would own.

With our paid plan, we disclose price targets for all these stocks, giving you clear entry points for potential investments.

Additionally, paid subscribers get access to comprehensive earnings summaries for all companies on the list.

These are the free and paid companies that are part of Schwar's Radar:

Free Stocks:

ADYEN – Adyen

GOOG – Alphabet

AMZN – Amazon

PYPL – PayPal

AAPL – Apple

UBER – Uber

NU – Nu Holdings

NVDA – NVIDIA

MELI – MercadoLibre

EVO – Evolution

BRKB – Berkshire Hathaway

META – Meta Platforms

MSFT – Microsoft

V – Visa

ABNB – Airbnb

Paid Stocks:

ADDT – Addtech

AMD – Advanced Micro Devices

ASML – ASML

AUTO – Auto Trader Group

BA – BAE Systems

6532 – BayCurrent Consulting

BLK – BlackRock

BKNG – Booking Holdings

BRO – Brown & Brown

CP – Canadian Pacific Kansas City

CMG – Computer Modelling Group

CSU – Constellation Software

CPRT – Copart

COST – Costco Wholesale

DHR – Danaher

DGE – Diageo

DNP – Dino Polska

6146 – Disco Corporation

EXPN – Experian

FICO – Fair Isaac Corporation

RACE – Ferrari

FNOX – Fortnox

GEBN – Geberit

GRG – Greggs

HGTY – Hagerty

HEI – HEICO

HIMS – Hims & Hers Health

IBKR – Interactive Brokers Group

ICE – Intercontinental Exchange

6055 – Japan Material

LIFCO – Lifco

LOGN – Logitech International

LSEG – London Stock Exchange Group

LMN – Lumine Group

MC – LVMH

MA – Mastercard

MCD – McDonald’s

MCO – Moody’s

MS – Morgan Stanley

MSCI – MSCI

NDAQ – Nasdaq

NKE – Nike

7974 – Nintendo

NOVO – Novo Nordisk

ODFL – Old Dominion Freight Line

PLTR – Palantir

PEP – PepsiCo

POOL – Pool Corp

RKT – Reckitt Benckiser Group

RMV – Rightmove

SPGI – S&P Global

SE – Sea Limited

SHOP – Shopify

TSM – Taiwan Semiconductor

TEQ – Teqnion

TVK – TerraVest Industries

KO – The Coca-Cola Company

TOI – Topicus

WCN – Waste Connections

WM – Waste Management

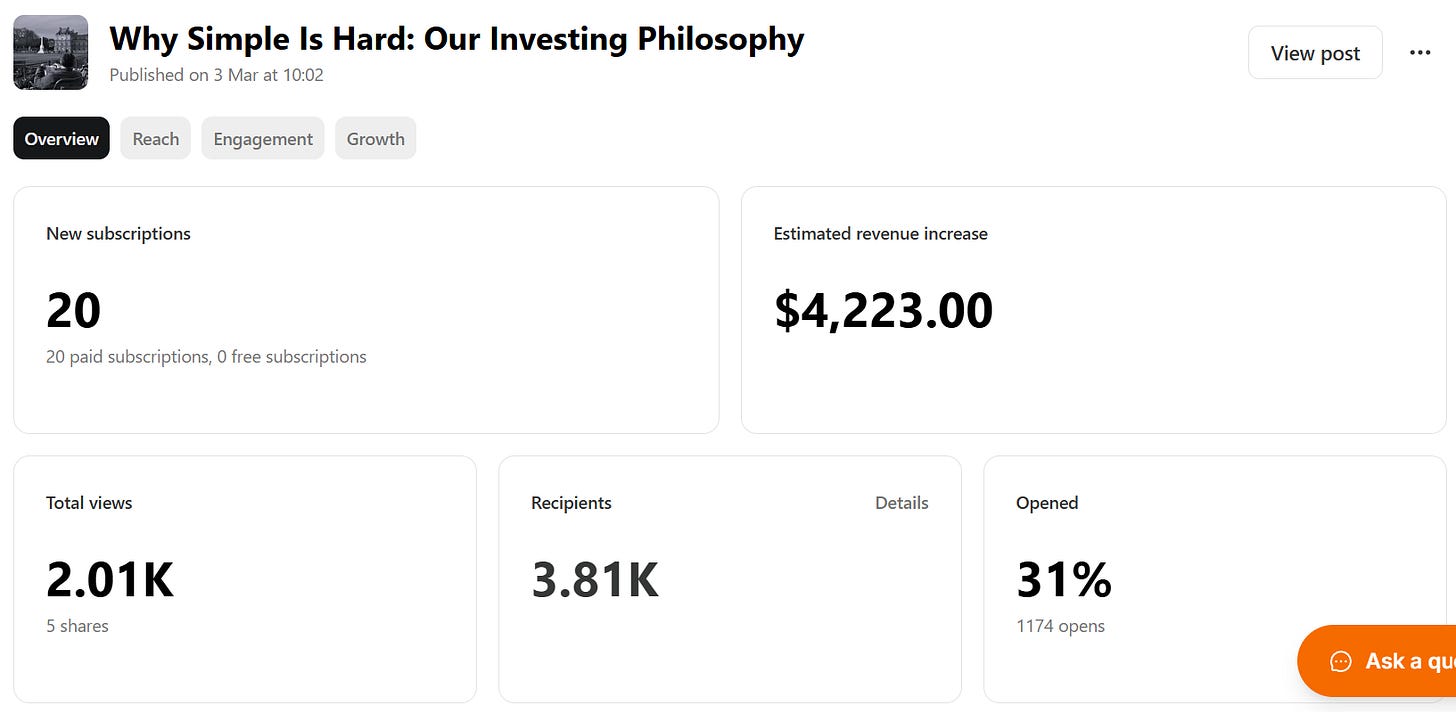

4. Investment Philosophy

Before we get to that special gift we promised you, we wanted to touch on what drives our approach. You can see our full investing philosophy here:

As you can see, this post struck a chord with our community - so we definitely think its worth a read.

5. Reviews

Schwar Capital announced going paid only a week ago as of writing, but has already received overwhelmingly positive feedback from our pledging subscribers. Here are some of our recent reviews:

6. That Gift We Promised You…

To welcome you to Schwar Capital, we wanted to give you an exclusive limited time offer!

20% lifetime discount on the annual plan

Complimentary access to Schwar's Radar included at no extra cost

This special promotion ends soon! Secure your membership today to lock in these benefits.

Not ready? No pressure - this founding rate is exclusive to this private window, but you can always wait until we go paid if you don't mind the higher price.

Thats It!

We hope you found this post useful and that it gives you a clear picture of what Schwar Capital offers.

Whether you choose to remain a free subscriber or upgrade to our premium service, we're committed to providing valuable insights that help you make better investment decisions.

Thank you for taking the time to read through this guide. If you have any questions about our service or investment approach, please don't hesitate to reach out.

We're excited to have you as part of our growing community of thoughtful investors.

Best,

Dom

Founder and Chief Investment Officer

Schwar Capital

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

![[FREE] Nintendo Investment Thesis Statement](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd50c679e-65ee-4b19-aa36-a922c5fbade2_4200x3000.png)

![[FREE] UBER Investment Thesis Statement](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1ff56970-7ef2-43fe-9331-e51e0984fd0a_660x660.jpeg)

TWR is the right way to calculate, good luck and congrats!

Hi, What do you recommend as an entry price below base IV? Sometimes I don’t have available capital at the time of a Schwar buy. Stock price may have moved up by the time capital is available but am cognisant of having a margin of safety and consideration of upside potential…