The Market Has Got Evolution Gaming All Wrong

Our Thoughts on Evolution Gaming's Q1 2025 Earnings

To read our full disclaimer, click here.

Evolution Gaming released their Q1 2025 earnings this morning, and the stock has plummeted nearly 20% as results missed consensus estimates across the board.

Here's what happened:

Net revenues increased by just 3.9% year-over-year to EUR 520.9 million (6.1% at constant currency)

EBITDA decreased by 1.1% to EUR 342.0 million, with margin compression to 65.6% (down from 69.0%)

Profit fell 5.4% year-over-year to EUR 254.7 million

EPS declined to EUR 1.24 from EUR 1.27 a year ago

Let's be clear: these results are disappointing. This isn't spin - the numbers speak for themselves.

The market reaction, however, presents an opportunity.

Long-term Evolution shareholders who once championed the stock are now calling it "garbage" and abandoning ship.

This capitulation is music to a contrarian's ears.

The market is missing several critical factors in its rush to judgment. Let me break down why this panic selling has created what might be an exceptional buying opportunity:

Valuation Has Become Compelling

After today's selloff, Evolution is now trading around a 10% free cash flow yield. Let that sink in.

This is a company that:

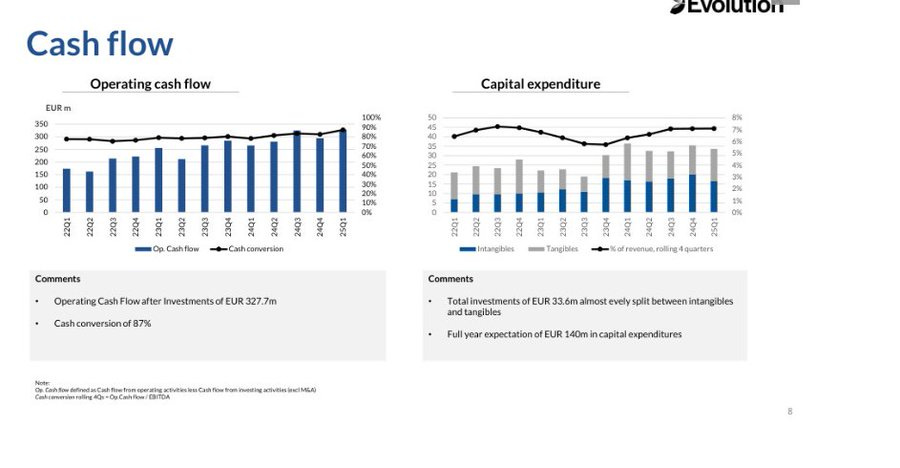

Is generating substantial and growing cash flow (up 25% from Q1 2024)

Has improved cash conversion to 87%

Initiated a share repurchase program with 2.1 million shares already acquired in the last quarter

Is increasing its dividend per share

Has significant insider ownership aligning management with shareholders

In other words, we have a capital-light business with industry-leading margins that's returning cash to shareholders while trading at a valuation typically reserved for no-growth or declining businesses.

The Risk/Reward Has Dramatically Improved

Investors should think in terms of asymmetry—the balance between potential reward and downside risk.

At its current valuation, Evolution doesn't need impressive growth to deliver satisfactory returns. The combination of:

10% free cash flow yield

Share repurchases shrinking the float

Growing dividends

...creates a scenario where shareholders could achieve double-digit returns even with minimal growth.

This provides a "margin of safety" that wasn't present at higher valuations.

And this doesn't account for any potential growth, which despite the current slowdown, remains likely over the medium to long term.

Looking Beyond Headline Growth Numbers

We prefer being roughly right over precisely wrong, so I won't present specific growth forecasts that offer false precision. Instead, let's analyse what's actually happening with Evolution's growth story.

First, we must acknowledge the challenging macro backdrop.

With trade wars intensifying and geopolitical instability rising, consumer discretionary spending faces natural headwinds.

This context matters.

But the headline 3.9% revenue growth figure masks a much more important story that the market is completely missing:

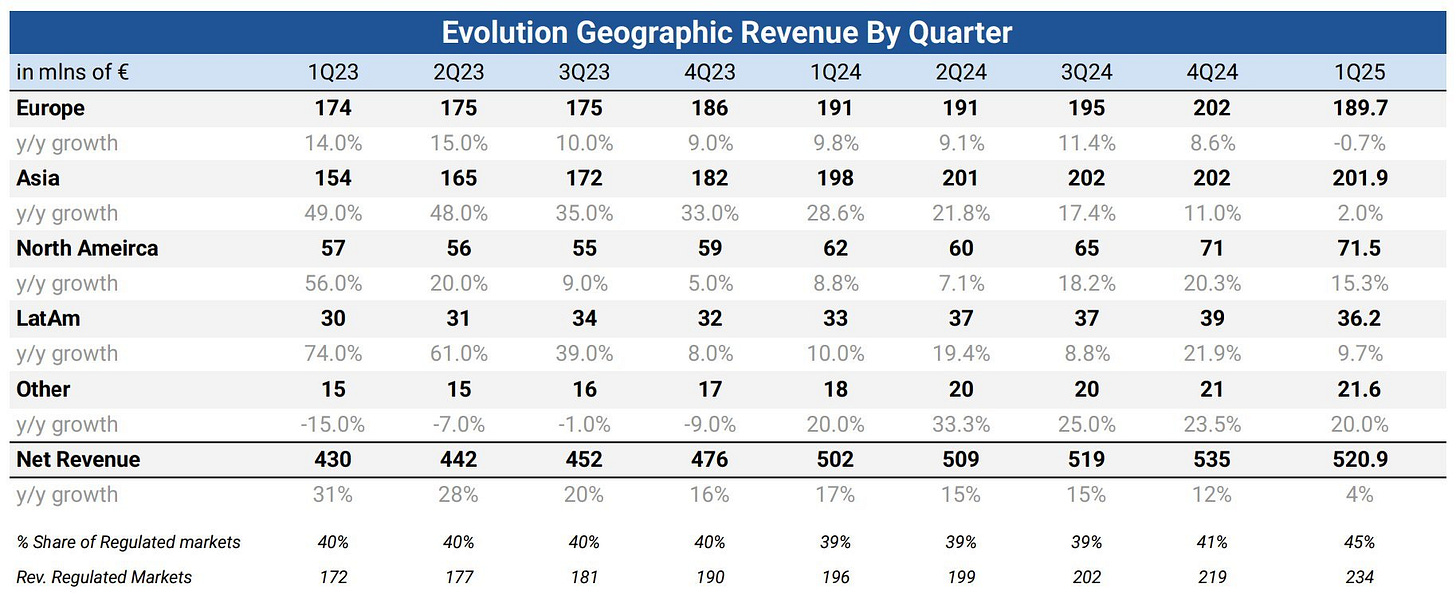

The company's share of revenue from regulated markets has jumped to 45% of total revenue, up from 39% in Q1 2024.

This shift toward regulated markets is deliberate and strategically sound.

Why does this matter? Because regulated revenue:

Is more stable and predictable

Carries less regulatory risk

Commands higher multiples from investors

Provides a foundation for sustainable long-term growth

Evolution's management team, which has significant skin in the game through high insider ownership, is clearly prioritizing building a sustainable business over maximizing short-term growth.

They're playing the long game.

The Temporary Headwinds Explained

The market is reacting to slowing growth without understanding the strategic reasons behind it. Evolution is deliberately sacrificing short-term growth for long-term sustainability:

1. Proactive Regulatory Compliance in Europe

Evolution has implemented what they call "ring-fencing" in European markets. This means:

They've voluntarily restricted access to their games to only properly licensed operators in each regulated jurisdiction

They're getting ahead of regulatory changes rather than waiting to be forced into compliance

They're building relationships with regulators as a trusted industry partner

This proactive approach has temporarily impacted European revenue (down 0.7% year-over-year), but positions the company as a compliant, low-risk partner for the long term.

2. Combating Cyber Threats in Asia

In Asia, Evolution has implemented technical countermeasures against cyber threats that were affecting their platform integrity. These security enhancements temporarily slowed Asian growth to just 2.0% year-over-year.

The company is essentially cleaning up its distribution channels, focusing on legitimate operators while excluding bad actors.

Both these initiatives represent investments in the future rather than problems with the business model.

Evolution is choosing to build proper foundations for sustainable growth rather than chasing short-term numbers at the expense of long-term value.

This is exactly the behavior long-term investors should want to see.

Conclusion: Short-Term Pain, Long-Term Gain

To summarize our contrarian view:

Poor Q1 Results: Yes, Evolution delivered disappointing headline numbers. We acknowledge this reality.

Compelling Valuation: At around a 10% FCF yield with strong cash conversion, the stock is now priced for zero growth or worse in our view.

Strategic Shift to Quality: The growth in regulated markets reveals management's focus on building sustainable, high-quality revenue streams.

Self-Imposed Headwinds: The company is deliberately sacrificing short-term growth by implementing regulatory compliance measures and cybersecurity enhancements.

Strong Capital Return: Evolution continues to reward shareholders through buybacks and dividends while building for the future.

This has transformed the investment case for Evolution Gaming.

What was once primarily a growth story now offers significant value characteristics with growth potential as a "free option."

This was well summed up in the earnings call:

"Needless to say, I am not happy with the financial development in the quarter, but one must take into account that the results are impacted by necessary steps that contribute to our mission to ever increase the gap to competition. The road cannot always be straight, but what is crucial is that we learn from the challenges we face and relentlessly adapt and strive to make Evolution a little bit better every day."

So, was this earnings report good?

No.

But does the stock deserve to trade at these depressed levels?

We think not.

Paid subscribers will receive our detailed analysis on exactly how we're positioning ourselves in Evolution Gaming, along with full access to our transparent portfolio.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions. To read our full disclaimer, click here.

How do we know the Chinese have not stolen / recreated all their IP and this is the reason for both the churn in asia revenue and cyber attacks?