Brown & Brown (BRO) Business Breakdown

Boring Business, Beautiful Economics

To read our full disclaimer, click here.

Welcome to our new Business Breakdown series - complementing the Asymmetric Quality Index (AQI) I launched earlier this week.

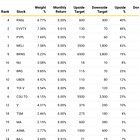

If you missed it, the AQI tracks 25 high-quality large-cap companies, weighted by my assessment of their asymmetric return potential rather than market cap or equal weights.

Each month, I analyze upside/downside scenarios to determine which quality companies offer the most compelling risk/reward in my opinion.

You can view that here if you want:

But rankings tell only part of the story.

Every other Wednesday, I’m breaking down one AQI company to show you exactly how I evaluate these businesses.

While I’m sharing my complete business analysis framework here, our actual investment theses, full portfolio positions, and the reasoning behind our buy/sell decisions remain exclusive to paid subscribers.

The difference? You’ll see how I think about the business. They’ll see how we apply that analysis in the context of our own portfolio.

You can upgrade here if you want:

No worries if not, here is the free breakdown of todays company, Brown & Brown (NYSE: BRO).

Understanding the Insurance Brokerage Model

Before diving into Brown & Brown specifically, it’s crucial to understand the fundamental difference between insurance brokers and insurance companies.

Insurance companies like State Farm, Progressive, or Chubb are the entities that actually underwrite risk - they collect premiums, maintain massive capital reserves, and pay out claims when losses occur. Their profitability depends on accurately pricing risk and managing catastrophe exposure, making their earnings inherently volatile based on weather events, litigation trends, and investment market performance.

Insurance brokers like Brown & Brown operate on an entirely different model.

They never take on insurance risk themselves but instead act as sophisticated intermediaries between businesses needing coverage and insurance companies providing it.

Brokers earn commissions typically ranging from 10-20% of premiums placed, creating a capital-light business model with predictable cash flows regardless of whether the underlying insurance companies profit or lose money on the policies.

When insurance rates rise due to increased claims - as we’ve seen with climate-related disasters and social inflation - brokers actually benefit as their percentage-based commissions translate to higher dollar amounts.

Brown & Brown’s Business Architecture

Brown & Brown has built one of the most formidable insurance distribution platforms in the United States, generating $4.8 billion in annual revenue through four carefully constructed segments that each serve distinct market needs while reinforcing the overall ecosystem.

Retail

The Retail segment, contributing approximately 60% of total revenue, operates through more than 300 locations nationwide and serves as the primary interface with American businesses. This division places commercial property and casualty insurance, employee benefits, and personal lines coverage for clients ranging from small local businesses to Fortune 500 corporations. The segment demonstrates remarkable stability with client retention rates exceeding 92% and average relationships spanning over seven years. The economics are particularly attractive as Brown & Brown earns not just standard commissions but also contingent commissions based on the profitability of business placed with carriers—these profit-sharing arrangements contributed $166 million in 2024 alone.

National Programs

The National Programs segment represents Brown & Brown’s highest-margin business, generating EBITDAC margins of 52.8% in Q2 2025 compared to 27.5% for Retail. This division develops and administers specialized insurance programs for niche markets—think architects and engineers through Arrowhead, flood insurance through Wright, or lenders through Peachtree. As program administrator, Brown & Brown earns override commissions of 5-15% on top of standard broker commissions while leveraging decades of accumulated underwriting data and regulatory expertise that would take competitors years to replicate.

Wholesale Brokerage

The Wholesale Brokerage segment, operating through platforms like RT Specialty, serves retail insurance agents who cannot place complex or high-risk coverage in standard markets. This division thrives during hard insurance markets when carriers tighten underwriting standards. With proprietary technology enabling instant quotes across 200+ carriers and specialized expertise in excess and surplus lines, this segment has grown at a 15% compound annual rate over the past five years.

Services

The Services segment provides fee-based revenue streams largely uncorrelated with insurance market cycles, including claims administration, captive insurance management, and Medicare advocacy services. While margins are lower than pure brokerage, this division provides crucial stability and deepens client relationships.

The Unit Economics That Drive Returns

Let’s walk through a rough example to understand why this model is so attractive.

When a mid-sized manufacturing company needs $10 million in property and casualty coverage, Brown & Brown might earn a 15% commission, or $1.5 million. Here’s what makes this compelling:

Revenue Recognition: That $1.5 million hits immediately upon binding coverage, even though the insurance company won’t know if the policy is profitable for years.

Cost Structure: To service this account, Brown & Brown needs:

1-2 account executives (total cost: ~$200-300k annually)

Office overhead allocation (~$50k)

Technology and support (~$50k)

This leaves roughly $1.1 million in gross profit - a 70%+ contribution margin.

The Multiplier Effect: But it gets better. That same client needs:

Workers compensation (another $500k commission)

Employee benefits ($300k)

Cyber liability ($100k)

Directors & Officers coverage ($75k)

Now we’re at $2.5 million in annual commissions from one relationship, with minimal incremental service costs since the same team handles all lines. The contribution margin on additional products approaches 85-90%.

Renewal Economics: Here’s the real magic. When policies renew (92%+ retention rate), Brown & Brown earns that commission again with almost zero incremental cost - no new sales effort, minimal service time. A book of business generating $100 million in commissions might require only $20-30 million in direct expenses to maintain.

Capital Requirements: Unlike insurance companies holding billions in reserves, Brown & Brown needs minimal capital:

No claims reserves required

Working capital actually negative (collect from clients before paying carriers)

Only real capital need is for acquisitions

This translates to returns on tangible capital exceeding 40% - impossible for capital-intensive insurers who target 10-15% ROE.

Scale Benefits: As the book grows, the economics improve further:

Technology costs spread over more revenue (dropping from 8% to 3.5% of revenue)

Carrier bonuses kick in at volume thresholds

Data advantages compound with every account processed

This is why EBITDAC margins can reach 52.8% in specialized programs - you’re essentially printing money on renewals while competitors struggle to replicate decades of accumulated advantages.

The Competitive Moat

Brown & Brown’s competitive advantages compound over time through several reinforcing mechanisms that create increasingly formidable barriers to competition. The company’s scale - placing over $20 billion in annual premiums - provides leverage with insurance carriers that smaller competitors cannot match.

This translates to exclusive program access, override commissions running 2-5% higher than industry averages, and preferential capacity access during hard markets when insurance becomes scarce.

The data advantage from processing 50,000+ commercial accounts annually enables superior risk selection and predictive analytics.

Brown & Brown’s loss ratios consistently outperform industry averages by 15-20%, while their proprietary benchmarking data has become so valuable that carriers pay $10,000-50,000 annually for access. This scale also provides significant operating leverage, with technology spending at 3.5% of revenue compared to 6-8% for subscale competitors.

Perhaps most underappreciated is Brown & Brown’s cultural competitive advantage.

Their “Good People Doing Good Things” philosophy drives measurable results—employee turnover runs at 8% annually versus 15-20% for the industry, while 95% of acquired firm principals remain three or more years post-transaction.

This cultural alignment enables successful integration of acquisitions and maintains the local relationships crucial to insurance distribution.

Management Excellence & Capital Allocation

Under Powell Brown’s leadership since 2009, the company has demonstrated exceptional capital allocation discipline while preserving the conservative culture established by his father, founder Hyatt Brown.

The management team’s decentralized structure empowers eleven segment leaders with P&L responsibility, enabling entrepreneurial decision-making while maintaining corporate oversight.

The capital allocation track record speaks volumes. Over the past decade, management has deployed $8.5 billion in capital with impressive returns - $6.2 billion toward acquisitions at average multiples of 8-10x EBITDA generating 15%+ internal rates of return, $1.5 billion in dividends growing at 9% annually, and $500 million in opportunistic share repurchases during market dislocations.

The pending $13 billion acquisition of RSC Topco (Accession) represents a transformational opportunity that will test management’s integration capabilities at unprecedented scale.

Q2 2025 Performance & Forward Outlook

The second quarter results demonstrate continued execution excellence despite a moderating rate environment.

Total revenues grew 9.1% to $1.3 billion, with organic revenue growth of 3.6% driven by strong retention and exposure growth partially offset by declining catastrophe property rates.

More importantly, EBITDAC Margin-Adjusted expanded 100 basis points to 36.7%, demonstrating the company’s ability to leverage its expense base even in a decelerating rate environment.

Each segment showed resilience despite varied market conditions.

Retail delivered 3.0% organic growth despite commercial property rates declining 15-30%, offset by continued strength in employee benefits with 7-9% rate increases. National Programs grew 4.6% organically while expanding margins 320 basis points through operational leverage. Wholesale Brokerage managed 3.9% organic growth despite significant rate pressure in professional lines, benefiting from continued strength in excess casualty placements.

Management’s commentary suggests the rate environment has largely stabilized, with admitted market rates expected to remain consistent through the second half of 2025.

Catastrophe property rates will likely continue declining through Q3 absent significant storm activity, though admitted carriers are beginning to write coverage again in California after years of withdrawal.

The company expects to close the Accession acquisition on August 1st and remain active acquirers of quality brokerages.

Conclusion

Brown & Brown exemplifies the type of quality compounder we seek - predictable economics, widening moats, and multiple growth drivers. The insurance brokerage model offers inherent advantages over underwriting risk, while BRO’s scale and culture create barriers competitors struggle to replicate.

Hopefully this post helped explain a bit more about Brown and Brown’s business and you’ve learnt something new.

Want to know if BRO is in our portfolio? Our actual positions, entry prices, and investment theses are exclusive to paid subscribers. They see not just what we think, but what we’re doing about it.

Dom

Schwar Capital