A List of 27 Asymmetric Stocks

The SCRai Update - Five new positions added

To read our full disclaimer, click here.

The reality of concentrated investing is simple: you find far more exceptional opportunities than any single portfolio can hold.

The Schwar Capital Research Asymmetry Index (SCRai) captures these opportunities.

Each one reflects what I view as an asymmetric setup - though not necessarily suitable for my current portfolio at this moment.

Performance:

The SCRai is down -1.43% since inception, compared with the S&P 500’s 0.27% rise.

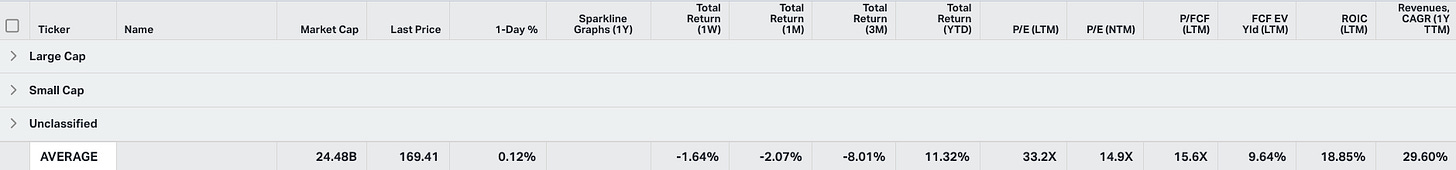

Here are the updated average statistics of the companies in the Index.

Forward PEs are compressing significantly as earnings growth accelerates, with returns on invested capital over 20% on average and nearly 20% revenue growth over the trailing twelve months.

These are averages, naturally. Individual companies may skew the figures.

But the premise holds: quality businesses, growing earnings and revenue at a strong clip, recently hammered.

All of which, we think, creates an asymmetric setup.

Updates:

We have added five positions to the index this week:

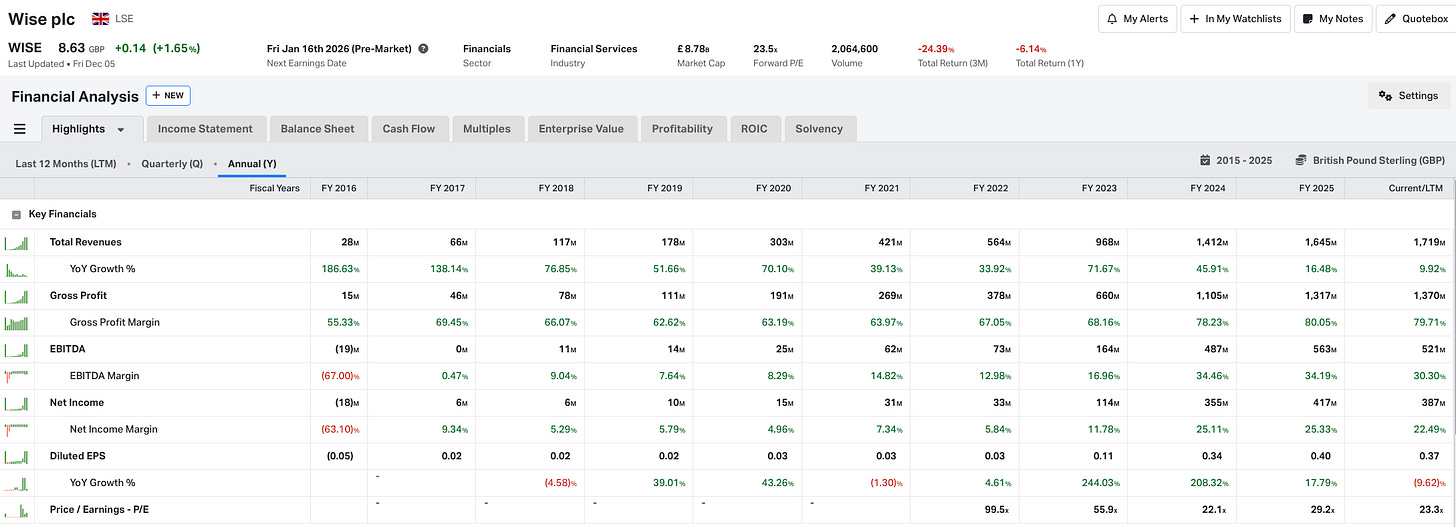

WISE

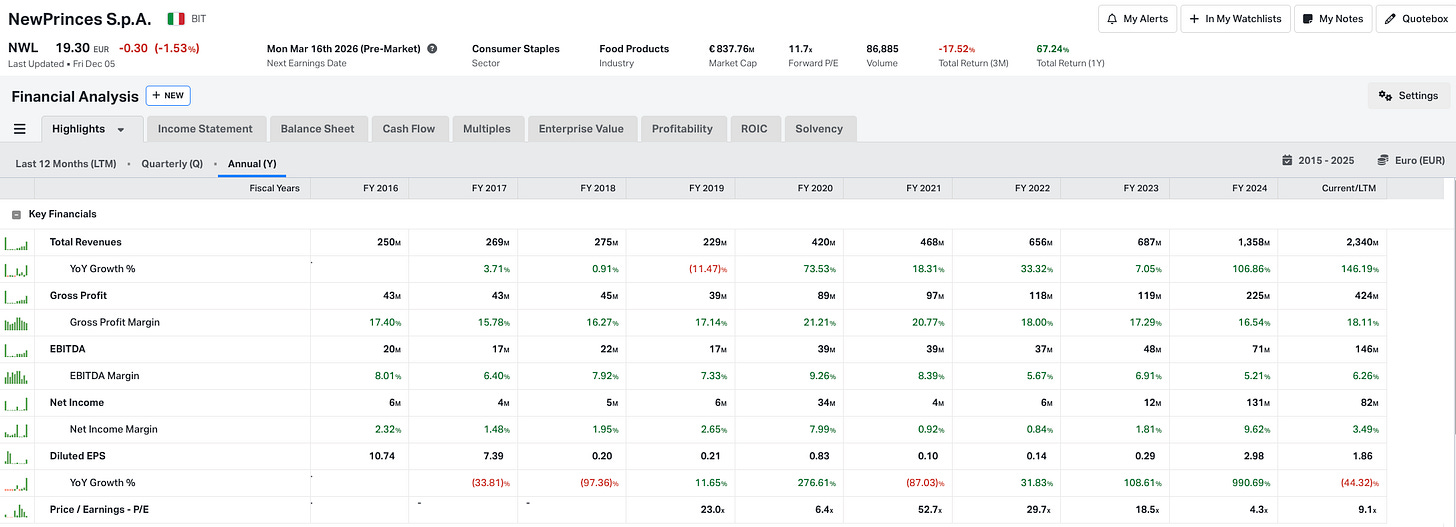

NWL

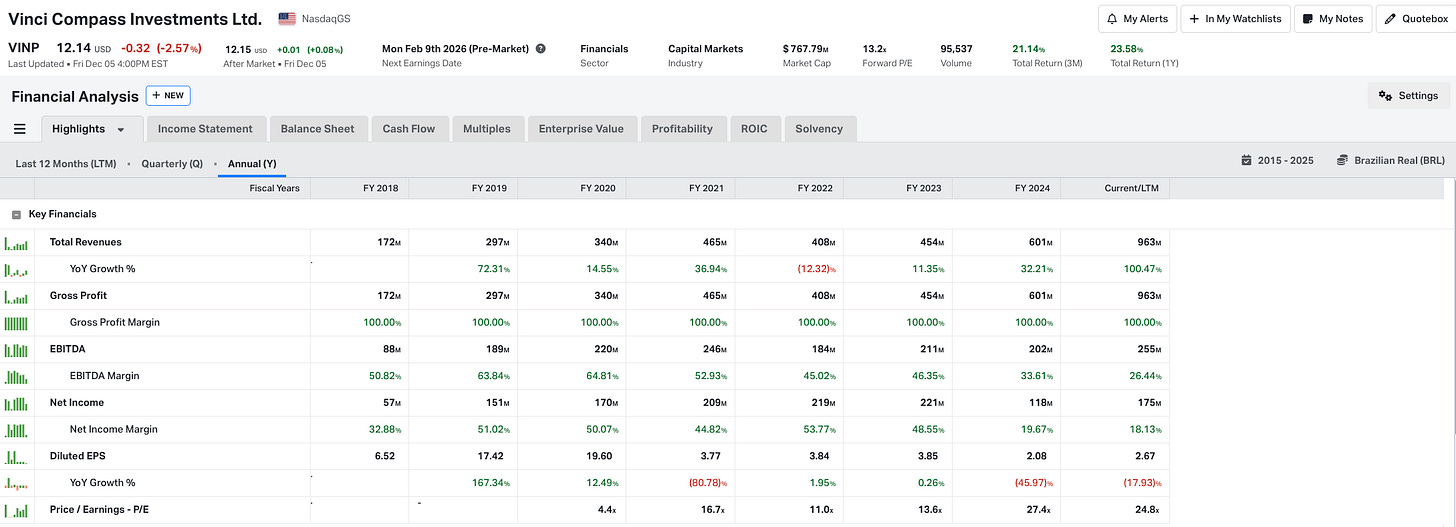

VINP

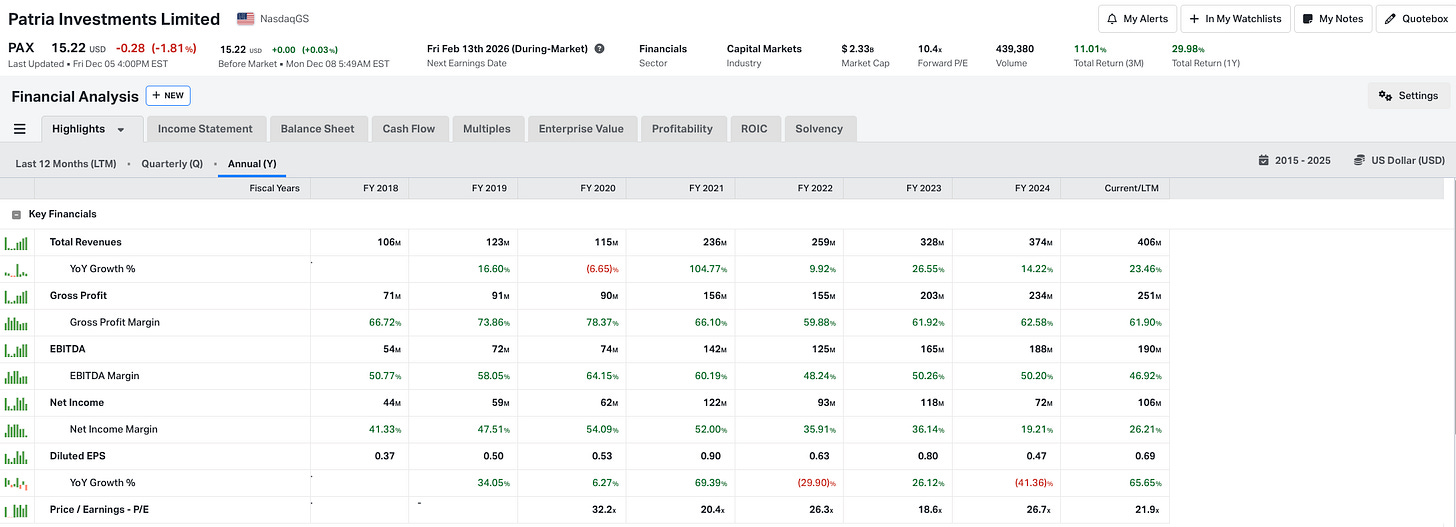

PAX

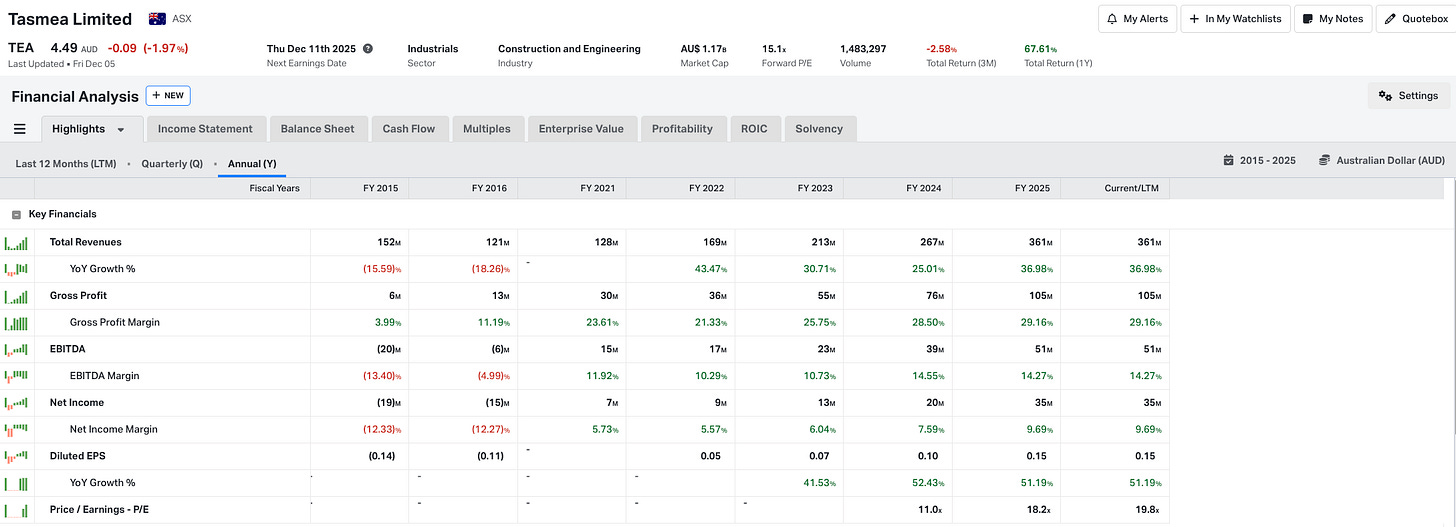

TEA

The Full Index - 27 Positions

The SCRai tracks businesses I believe exhibit asymmetric characteristics: quality companies with strong unit economics, growing earnings, and valuations that appear compressed relative to their fundamentals.

These aren’t recommendations - they’re ideas.

A research shortlist for investors who want to do their own work on businesses that meet a specific set of criteria.

Paid subscribers get access to the full index, updated weekly, with transparent tracking of each position.