Adding Five New Positions to the SCRai

Performance update, announcements, and upcoming write-ups.

To read our full disclaimer, click here.

The reality of concentrated investing is simple: you find far more exceptional opportunities than any single portfolio can hold.

The Schwar Capital Research Asymmetry Index (SCRai) captures these opportunities.

Each one reflects what I view as an asymmetric setup - though not necessarily suitable for my current portfolio at this moment.

Performance:

The SCRai is down 2.7% since inception, compared with the S&P 500’s 1.74% decline.

But, we’re not reading much into these performance figures yet.

The index is barely two weeks old, with just 15 positions - five of which were added this week.

That creates considerable distortion.

Until the index reaches its target size of around 50 names and has a few months under its belt, tracking performance will be difficult.

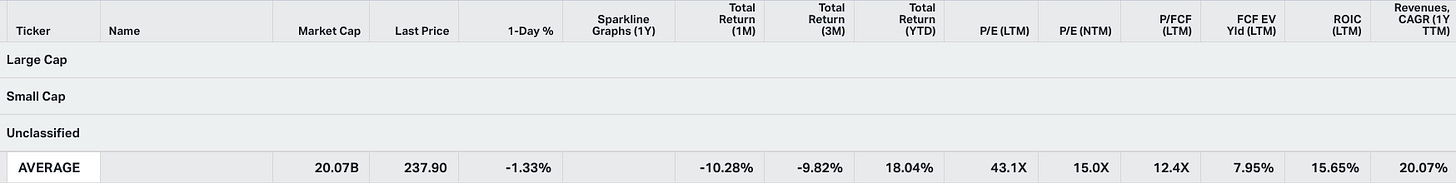

What might be more useful right now is looking at the average statistics of the companies in the Index.

As you can see, positions have been hit hard recently.

Yet the fundamentals suggest they may be undervalued: forward PEs are compressing significantly as earnings growth accelerates, with returns on invested capital over 15% on average and 20% revenue growth over the trailing twelve months.

These are averages, naturally. Individual companies may skew the figures.

But the premise holds: quality businesses, growing earnings and revenue at a strong clip, recently hammered.

All of which, we think, creates an asymmetric setup.

Updates:

We have added five positions to the index this week:

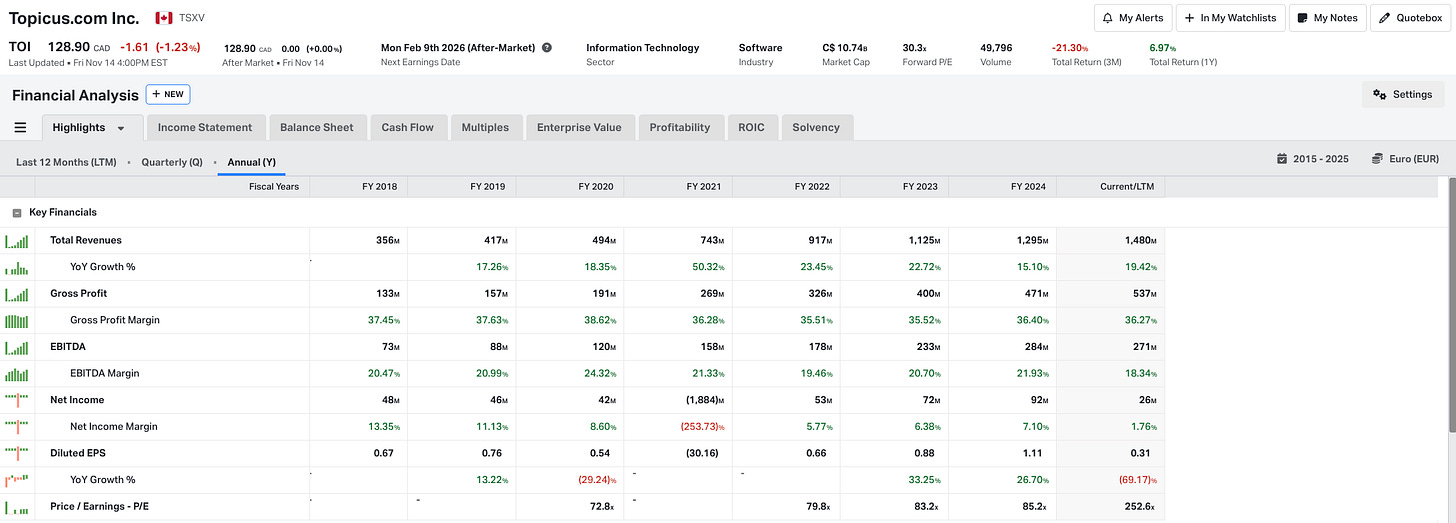

TOI.V

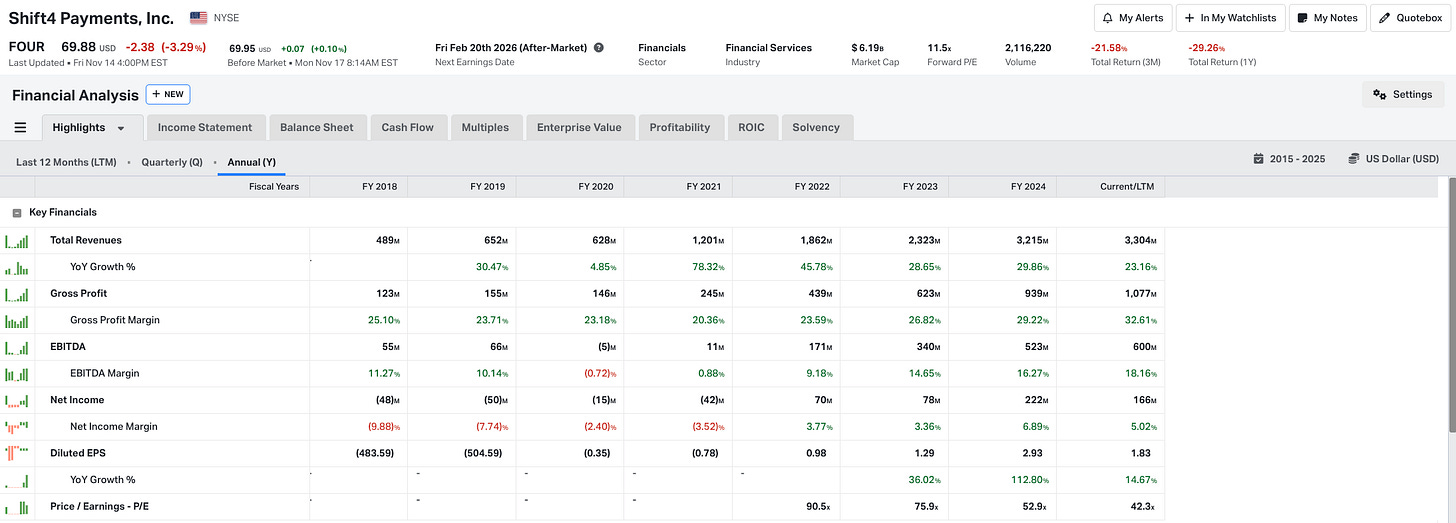

FOUR

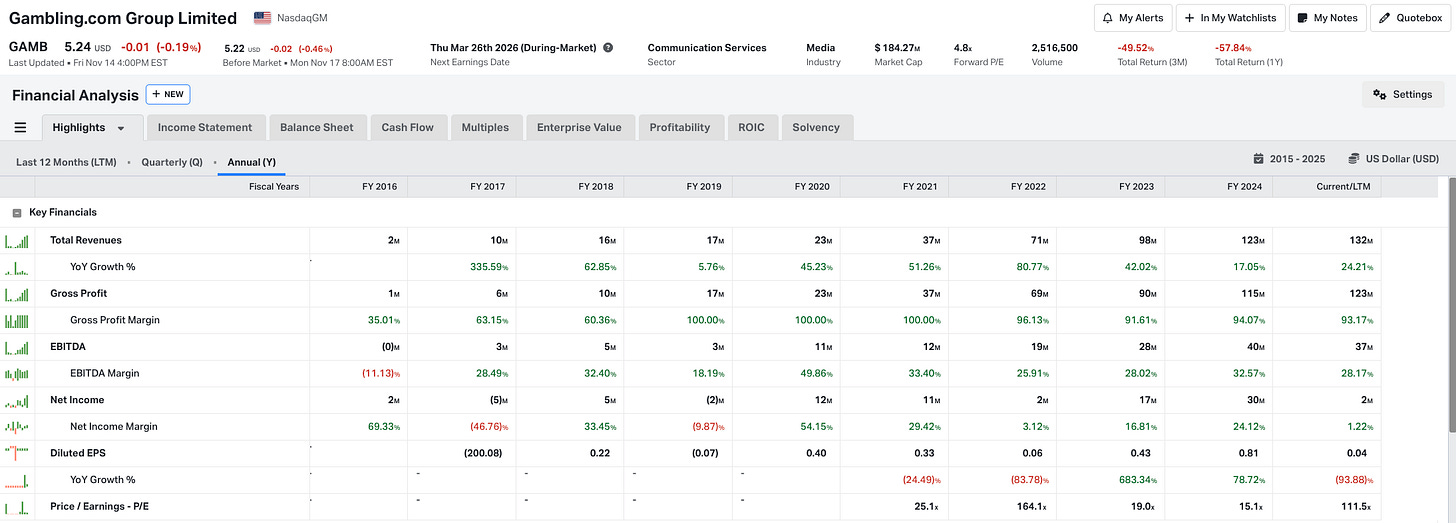

GAMB

LEAT

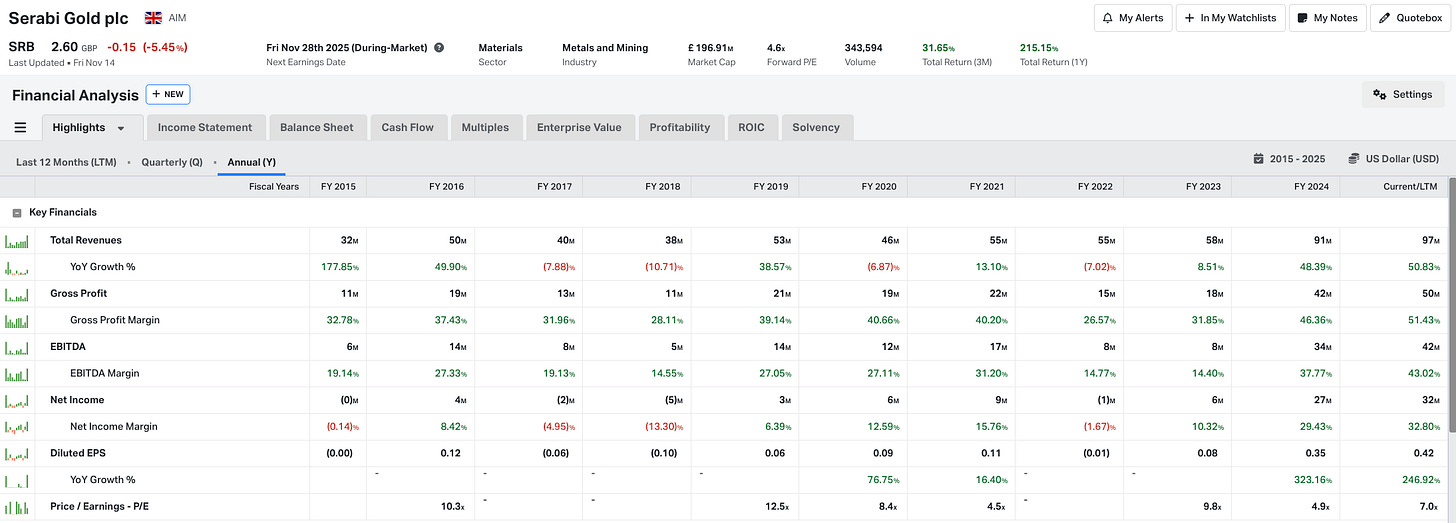

SRB

Coming this Week:

Wednesday: A full post on my valuation for CSU, TOI and LMN, following last week’s piece on the three companies. You can read that here if you missed it:

Friday: Portfolio Strategy and Update, with a deeper look at portfolio company metrics and how they stack up.