Adding a New Position to My Portfolio

Portfolio Update #19 📊

To read our full disclaimer, click here.

Portfolio Strategy and Update

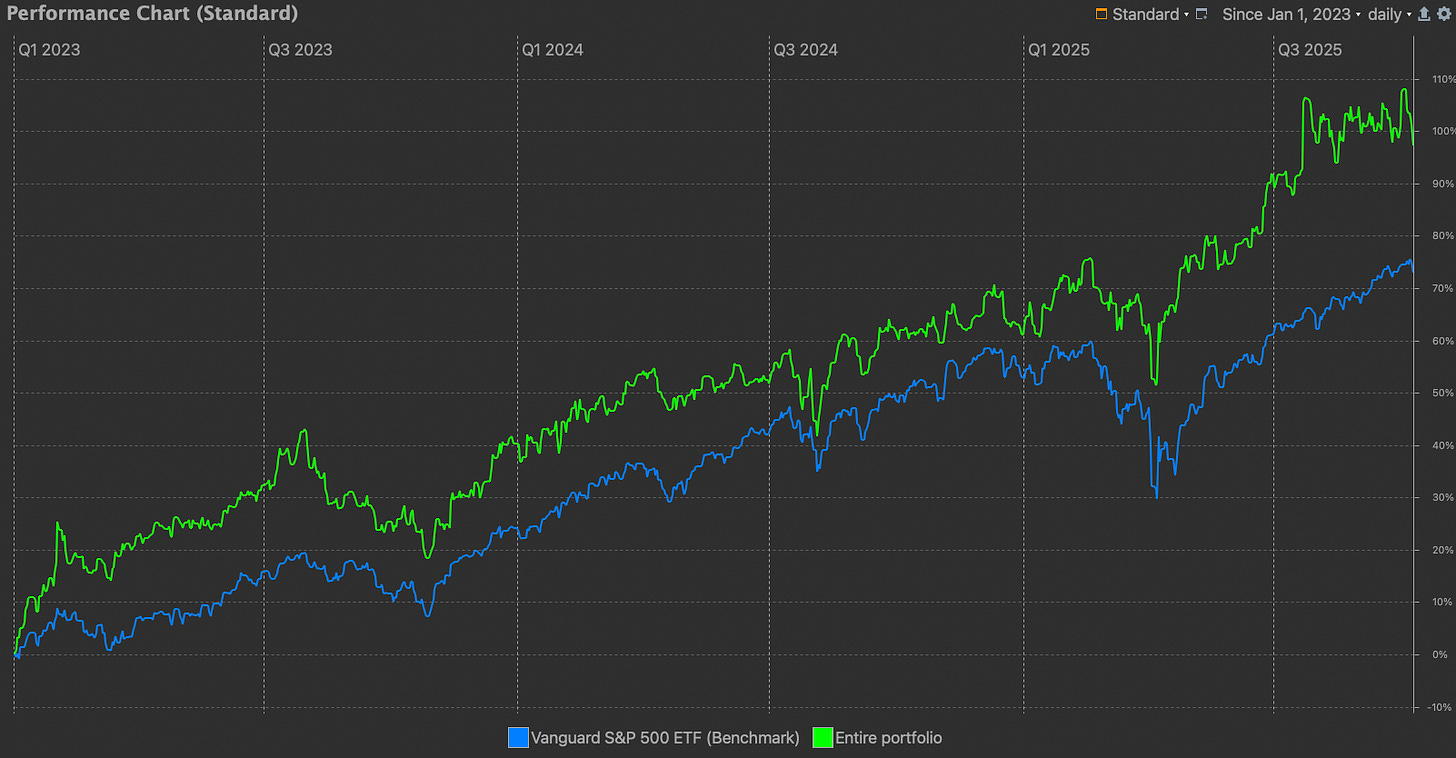

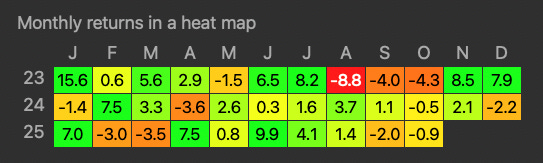

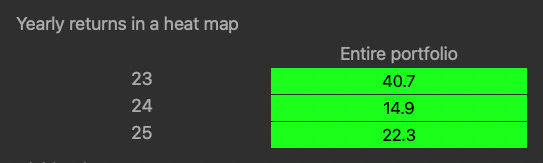

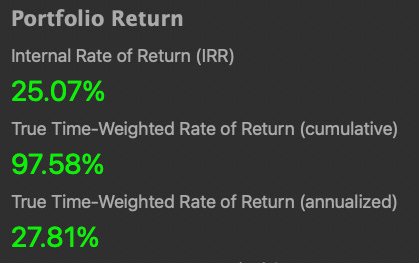

The portfolio continues to perform well this year, up 22.5% so far. The market, meanwhile, has returned 13%.

It’s been an active few weeks.

We’ve added two new positions: [Company A] and another purchase made just today.

Let me walk you through both.

[Company A] is a 40-year-old authentication business with what we see as monopoly-like customer lock-in. Gross margins sit at 47.8%, ROIC at 18%. The company is transitioning from materials sales to higher-margin sensor systems - a shift backed by $58M in contracted revenue. After a temporary timing-driven selloff, it trades at just 6.9x forward earnings.

You can read the full thesis here.

The position now represents 5.5% of the portfolio.

Today’s addition is [Company B], a 7.5% position.

The thesis: A proven roll-up CEO - who delivered 350% returns at his previous company - is transforming this business into a vertically integrated fire safety operation. He’s building what appears to be a razor-and-blade model with 60-70% margin recurring services. Fire Services revenue is up 113%, yet the company trades at just 7.5x forward EBITDA. We think there’s a multi-bagger runway ahead.

Beyond these two additions, we haven’t made adjustments elsewhere in the portfolio.

The one position we’re considering trimming is [Company C]. It’s approaching our fair value estimate, and we’d prefer to carry a larger cash buffer in general.

We’ll publish the full thesis for [Company B] next week.

Hope this post was useful and that you have a great weekend.

Dom

Schwar Capital

Statement of Assets

Become a paid subscriber here to see our full portfolio, complete with our personal reasoning behind each position and the uncensored version of the post above.