+35% Gain on UBER: The Ride Continues + Our Top Holding's Earnings Breakdown

Breaking down two critical earnings reports that tell very different stories

We're sharing part of this analysis for free to demonstrate the value you can expect as a paid Schwar Capital subscriber.

Two of our most significant positions just reported earnings, with dramatically different headline numbers but equally important implications for our portfolio. Let's dive into what these results tell us about our investment theses and where we go from here.

UBER: Our December Thesis Comes to Life

When we pitched Uber at $60.73 back in December 2024, we identified a highly asymmetric opportunity.

Five months and a ~35% gain later, Uber's Q1 earnings report has delivered exactly what we predicted: explosive growth in trips, revenue, and most importantly, free cash flow.

You can see our investment thesis here:

The Headline Numbers: Growth + Profitability

Uber's Q1 results tell a compelling story that validates our original thesis:

Trips up 18% YoY to 3.0 billion

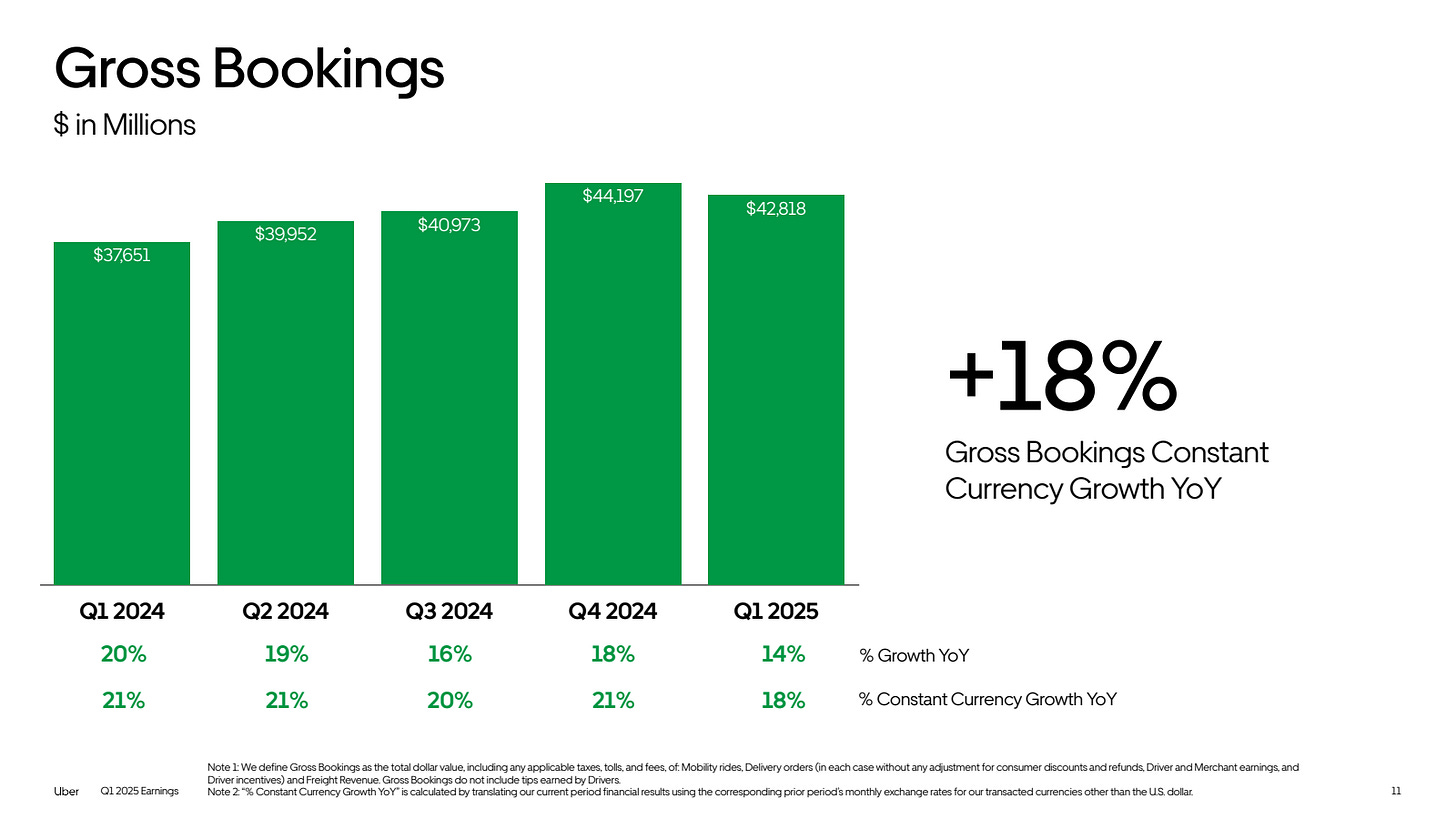

Gross Bookings grew 14% YoY (18% constant currency) to $42.8 billion

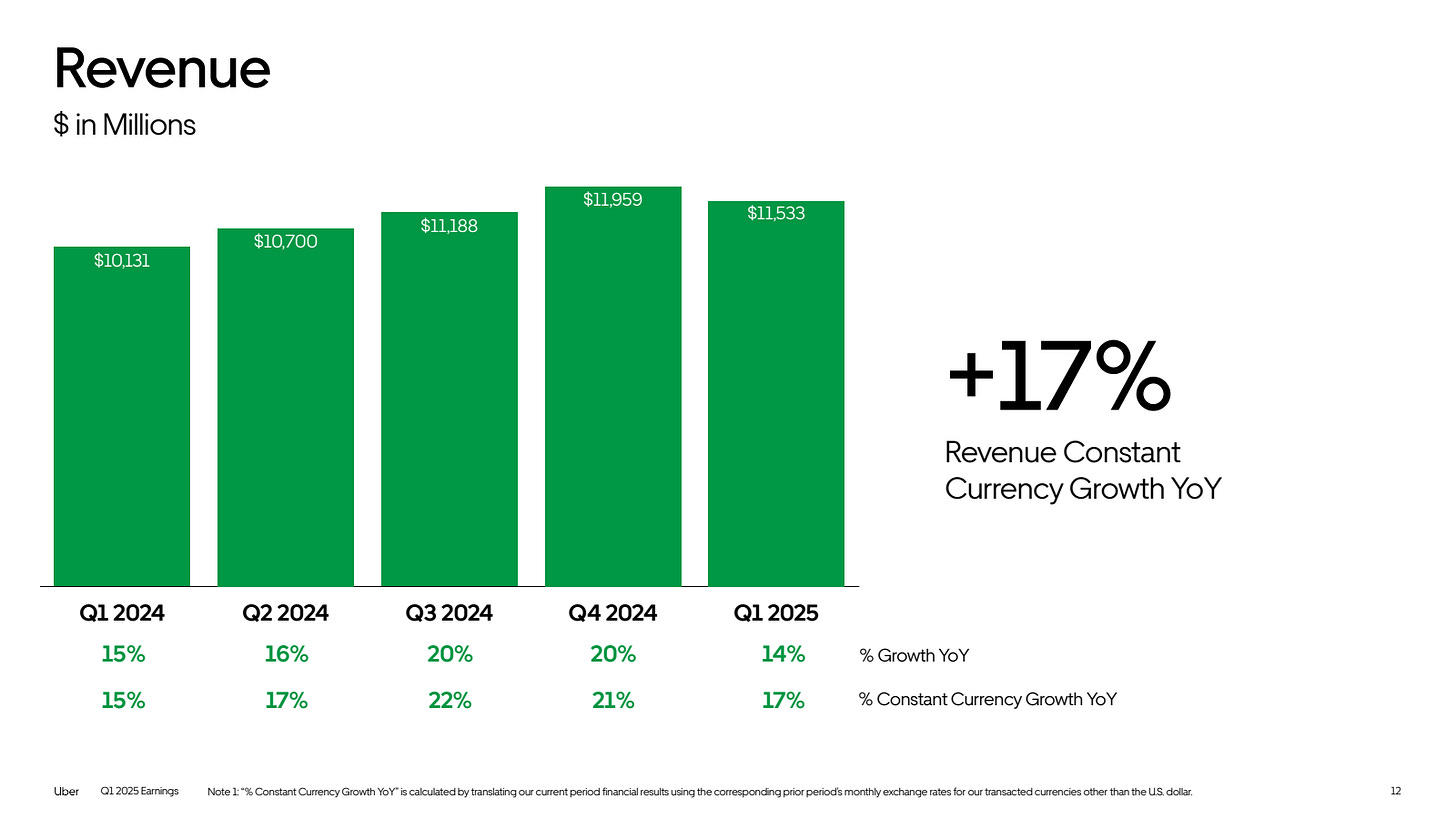

Revenue increased 14% YoY (17% constant currency) to $11.5 billion

Income from operations reached $1.2 billion, up $1.1 billion YoY

Free cash flow soared 66% YoY to $2.3 billion (annualizing to $9.2B)

These aren't just good numbers - they're exceptional for a company of Uber's size and market position.

Segment Analysis: Strength Across the Board

Looking deeper at segment performance reveals why Uber's business model is proving so resilient:

Mobility (Rides)

Gross Bookings up 13% YoY (20% constant currency) to $21.2 billion

Revenue up 15% YoY to $6.5 billion

Segment Adjusted EBITDA up 19% YoY to $1.75 billion

The core rides business continues to demonstrate pricing power and growing demand, even as it faces currency headwinds. The 20% constant currency growth rate is particularly impressive for a business of this scale.

Delivery

Gross Bookings up 15% YoY (18% constant currency) to $20.4 billion

Revenue up 18% YoY to $3.8 billion

Segment Adjusted EBITDA up 45% YoY to $763 million

Remember when critics claimed Uber Eats would never be profitable? The delivery segment is now generating substantial adjusted EBITDA with 45% year-over-year growth in profitability.

Freight

The only weak spot with Gross Bookings down 2% YoY to $1.26 billion

Segment Adjusted EBITDA loss improved to ($7) million from ($21) million YoY

While still experiencing challenges, even the Freight segment is moving in the right direction with significantly reduced losses.

You can see shorter earning summaries that cover all the stocks in our watchlist by Subscribing here to Schwar’s Radar

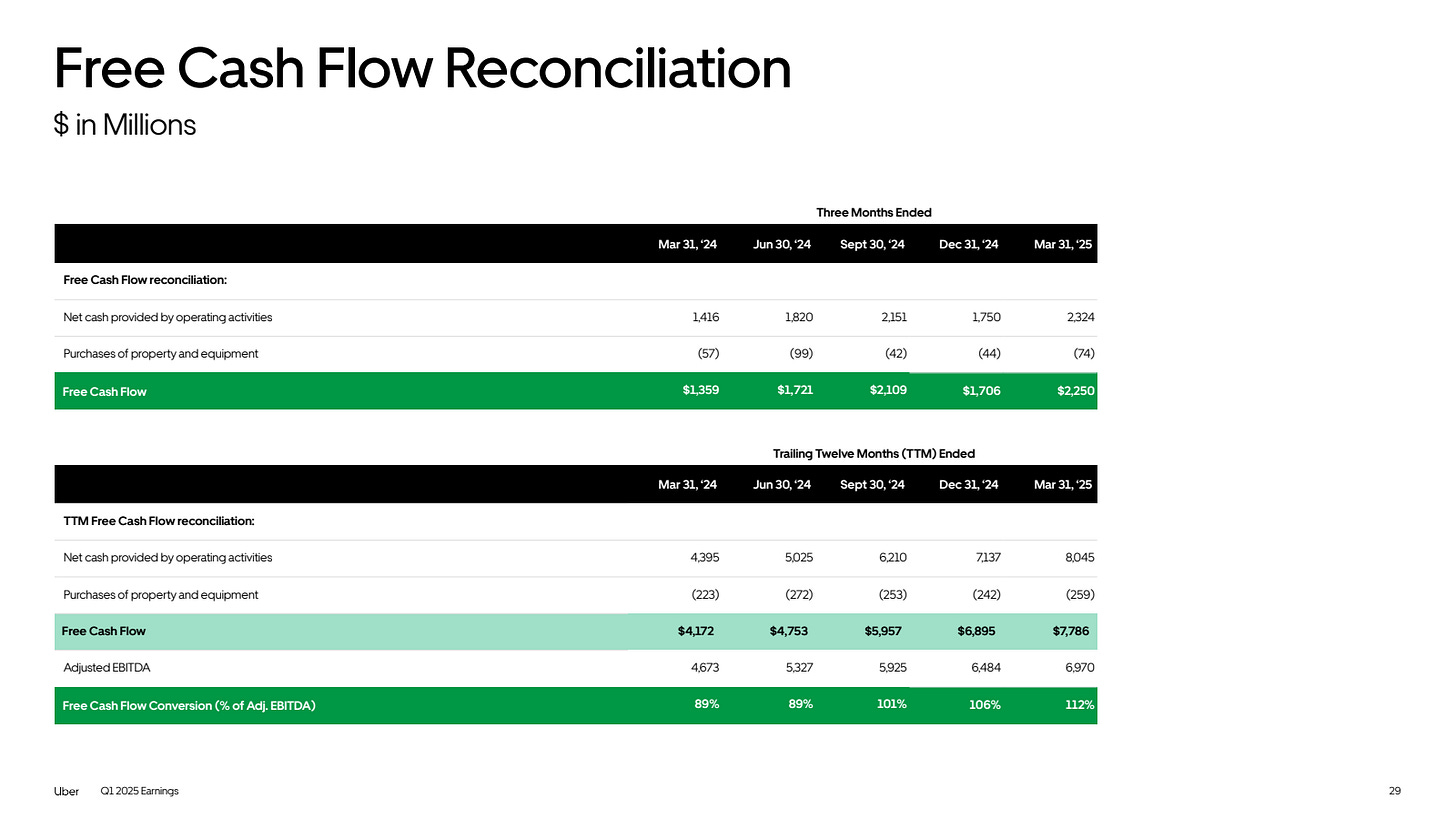

The Cash Flow Machine We Predicted

The most compelling part of this earnings report is the validation of our December investment thesis.

We predicted Uber would transform from a growth-at-all-costs company to a free cash flow powerhouse, and that's exactly what's happened:

Operating cash flow reached $2.3 billion, up 64% YoY

Free cash flow of $2.3 billion, up 66% YoY

Repurchased $1.8 billion of common stock during the quarter

Uber is now generating enough cash to fund growth initiatives, return capital to shareholders, and build financial flexibility - all simultaneously.

Management Guidance

Uber's guidance for Q2 2025 points to continued strong performance:

Gross Bookings expected between $45.75 billion and $47.25 billion (16% to 20% YoY growth on constant currency)

Adjusted EBITDA guidance of $2.02 billion to $2.12 billion (29% to 35% YoY growth)

This guidance comes despite an anticipated 1.5 percentage point currency headwind to total reported growth.

Our Take on UBER's Q1

The Q1 earnings report validates our investment thesis and reinforces our conviction in Uber as a long-term holding. The company is executing well across all key metrics: growth remains robust despite scale, margins are expanding, free cash flow is accelerating, and capital allocation is disciplined.

While the stock has appreciated ~35% since our December pitch at $60.73, we believe there's still upside based on the company's trajectory. Although the asymmetry isn't as large as when we first pitched the company, the combination of double-digit growth and expanding free cash flow margins creates a decent risk-reward at the current price.

Paid subscribers will see how we play the stock going forward.

Limited Time Offer: 20% Off New Subscriptions

Curious about our largest position and what we think of their recent earnings? Subscribe now to unlock all premium member benefits and complementary access to Schwar’s Radar.

![[FREE] UBER Investment Thesis Statement](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc93e528a-5f1f-4d8e-8347-947b0a251a62_4200x3000.png)