2025 Annual Letter - Schwar Capital Research

Year in Review: Lessons, Mistakes, and the Road Ahead

To read our full disclaimer, click here.

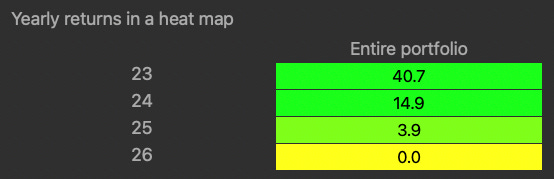

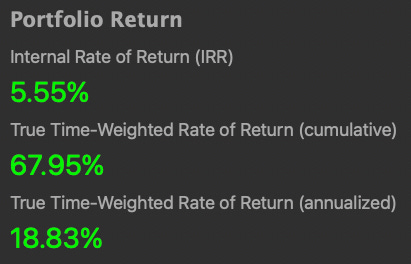

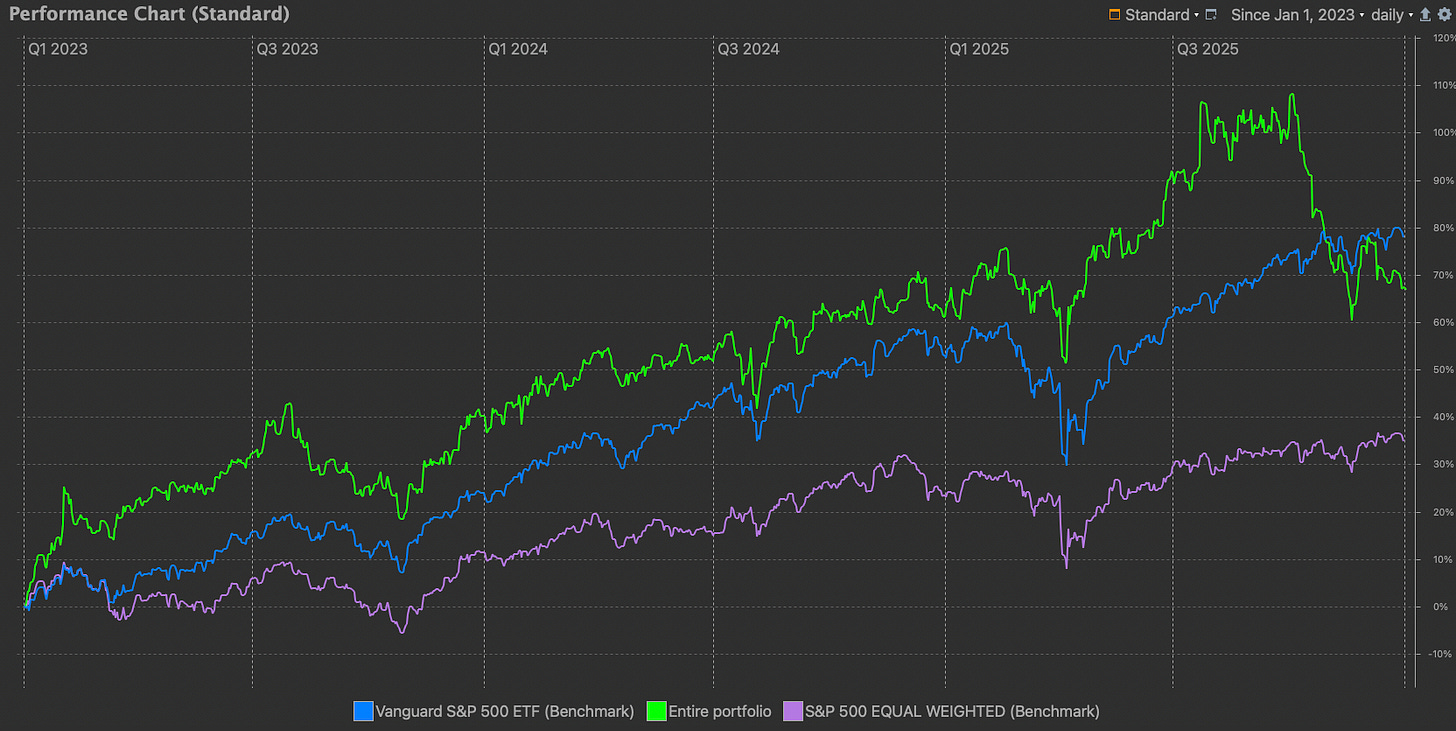

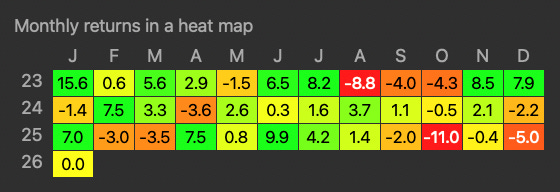

The Schwar Capital portfolio ended 2025 with a return of 3.9%. This underperformed both the regular S&P 500 at 16.4% and the equal-weight index at 9.3%.

This brings our focus metric of true time-weighted rate of return to 18.83%, which remains above our long-term target of compounding at 15% a year.

But these results don’t tell the full story of the portfolio’s year. This post is here to reflect on 2025 in more detail, then look forward to how I believe the portfolio is positioned heading into 2026 - along with some plans for this page.

At its peak, the portfolio was up nearly 30% this year in October. However, the combination of a few mistakes on my part and general underperformance from other positions led to a pretty brutal drawdown.

But before diving into that, let’s look a bit earlier in the year - to what I now see as the poisoned apple of 2025.

The Alpha Group Trade

Don’t get me wrong. This investment in ALPH.L was a great success.

30.11% in 25 days.

Here’s how it unfolded:

June 27th: Published the heads/tails thesis explaining the buyout mechanics and added more - now at 12.78% of the portfolio.

July 2nd: Increased further to about 20%. The catalyst deadline was July 7th.

July 11th: When the deadline extended, I explained why this actually increased conviction and predicted the final offer between 3,500–4,000 pence per share.

July 23rd: Corpay offered to buy Alpha Group for $2.2 billion.

Alpha shares jumped 25% on the news, delivering a total return of just over 30% in 25 days.

Not bad going.

What went right:

Found a highly asymmetric setup

Simple heads/tails thesis

Built conviction and concentrated heavily

Made it the largest position

And it paid off.

The Downfall

However, what happened after was the downfall of the portfolio this year. In fact, this was nearly the high-water mark for the entire year.

The confidence from this quick profit led me to make a few key mistakes.

Firstly, I sized the position in UHG - a special situation - larger than I should have.

In my opinion, I was unlucky on this investment. It failed on the people and egos involved, not the core economics of the thesis.

But my position sizing was too high for an event with a chance of permanent capital loss.

This was my major mistake. There was no luck involved in that decision.

In hindsight, I was in too much of a rush to deploy capital into a new idea after the portfolio was sitting in a high percentage of cash.

The second issue links to position sizing. This investment was too far a step from the usual companies I invest in.

ALPH.L worked as a high-percentage allocation special situation because it was, in my opinion, set up to be a quality compounder if it wasn’t bought out.

UHG clearly wasn’t. Hence why I exited the position as soon as I heard the news.

Oh well.

Live and learn.

And that’s what investing is all about.

I won’t be touching special situations for a while, that’s for sure.

The Lakeland Exit

Another major hit that added to the brutal drawdown was the roughly 40% fall in LAKE and the subsequent sale of the stock.

LAKE’s most recent earnings were, frankly, very poor.

A large part of the original thesis rested on management execution, and this quarter made it clear that execution has broken down.

Margins collapsed, inventory barely moved, tenders slipped again, and management appeared unwilling to take responsibility for their own decisions. Removing guidance after saying they “saw many of these issues coming” only highlighted the execution gap rather than building confidence.

It was a worst-case combination of outcomes, with little evidence of operational progress where it mattered.

I’ve lost confidence in management.

Don’t get me wrong the stock is now very cheap, but I frankly see more value in many of the other positions in my portfolio.

Where Things Stand Today

Most readers know I’m a big believer in decent cash allocation. It adds optionality and can be deployed during drawdowns.

Well, it’s fair to say the portfolio has experienced quite a drawdown recently - so a lot of capital has been deployed.

In fact, the portfolio currently sits nearly 100% in equities.

Ordinarily, I would prefer to hold more cash. But right now, I see immense value in all of my current positions.

I’m doing exactly what I preach: buying in the drawdowns and concentrating in my best ideas. When conviction is high across the board, sitting in cash feels like a waste of opportunity.

I’ve also spent a lot of effort this year moving away from tech, big US names, and the US economy in general. The portfolio has shifted towards microcaps.

This is causing more volatility, but I’m finding far more value - and I’m generally happier holding these names than some of the inflated, well-known stocks floating around Substack.

A significant portion of the portfolio is now also in UK stocks.

I believe the value here is exceptional, but overall they’ve done poorly this year. Patience is required with these ones.

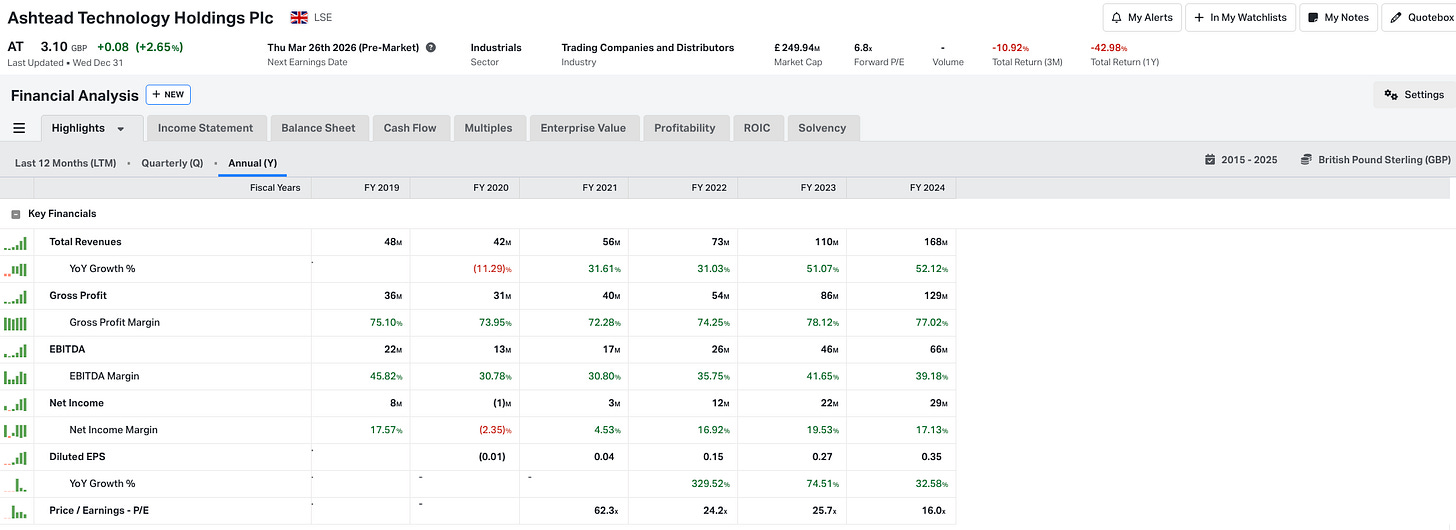

Top Position: Ashtead Technology

My current top position is Ashtead Technology, allocated at 20% of the portfolio. I may even add more on current weakness.

Here’s a company that’s never had a loss-making year in 40 years of operations:

25% returns on invested capital

76% gross margins

3-year revenue growth of 44%

Dominant market position with 50% market share in their core segment

And it’s trading at 8x earnings. Or 6.8x forward earnings.

Just look at these results.

I believe this serial acquirer deserves a P/E of 20+ for its quality. It’s less cyclical than people think because of its acquisitive nature. Management have a great track record to prove themselves. Once oil turns around and continued resilience in earnings and revenue becomes apparent, there should be a significant re-rating.

More on this company in the coming weeks for paid subscribers.

Portfolio Philosophy Going Forward

What I need to work on most this year is initial position sizing. The week after next, I’ll publish a post on how I plan to size positions going forward and will work from there.

Overall, I have a lot of confidence in my current holdings and there are plenty of catalysts lined up for them this year.

A Word on Patience and Transparency

It’s worth remembering that Buffett looked boring and underperformed during the dot-com bubble. The strategies that compound wealth over decades often look unremarkable in speculative bull markets.

I’ve noticed a lot of Substack pages recording big gains over the last few years.

My advice?

Check how transparent they are. Look at the types of names they’ve been holding.

Returns in a raging bull market don’t always reflect skill - and they rarely persist when conditions change.

The Rest of the Holdings

In the next couple of weeks, multiple posts will be coming out as I revisit and update the theses for each of the portfolio companies.

Also, next Monday, a full investment strategy and philosophy post will be released for all subscribers. I expect content cadence to increase this year as I have more time to dedicate to writing.

But before that, here is what the portfolio looks like going into 2026: