2024 Portfolio Review | Schwar Capital

We've hit 2500 subscribers!

To read our full disclaimer, click here.

Performance

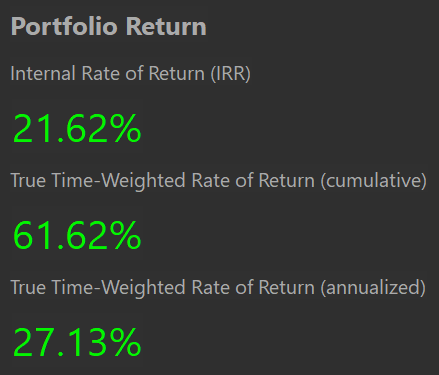

Our annualized Time-Weighted Return (TWR) since portfolio inception now stands at 27.13%.

Our 2024 return was 14.9%. While this represents an underperformance compared to the broader market, we believe it's important to understand the context:

Cash Position Strategy: As per our investment philosophy, we only deploy capital when we identify high-conviction opportunities. This disciplined approach meant maintaining significant cash positions throughout the year, averaging around 20%. While this created a performance drag, we're comfortable with this outcome as patience and waiting for the right opportunities are fundamental to our strategy.

Market Concentration Reality: The S&P 500's performance this year has created what we believe is an unsustainable benchmark. Over 50% of the index's gains came from just eight stocks. For a more balanced comparison, the iShares S&P 500 Equal Weight UCITS ETF returned 12.3% this year, meaning our 14.9% actually represents outperformance against a more diversified benchmark.

In our view, we're currently witnessing nearly unprecedented levels of market concentration, with performance largely driven by a handful of AI-focused stocks. In our view, these conditions suggest some strong bubble-like market characteristics. Just look at the graph below.